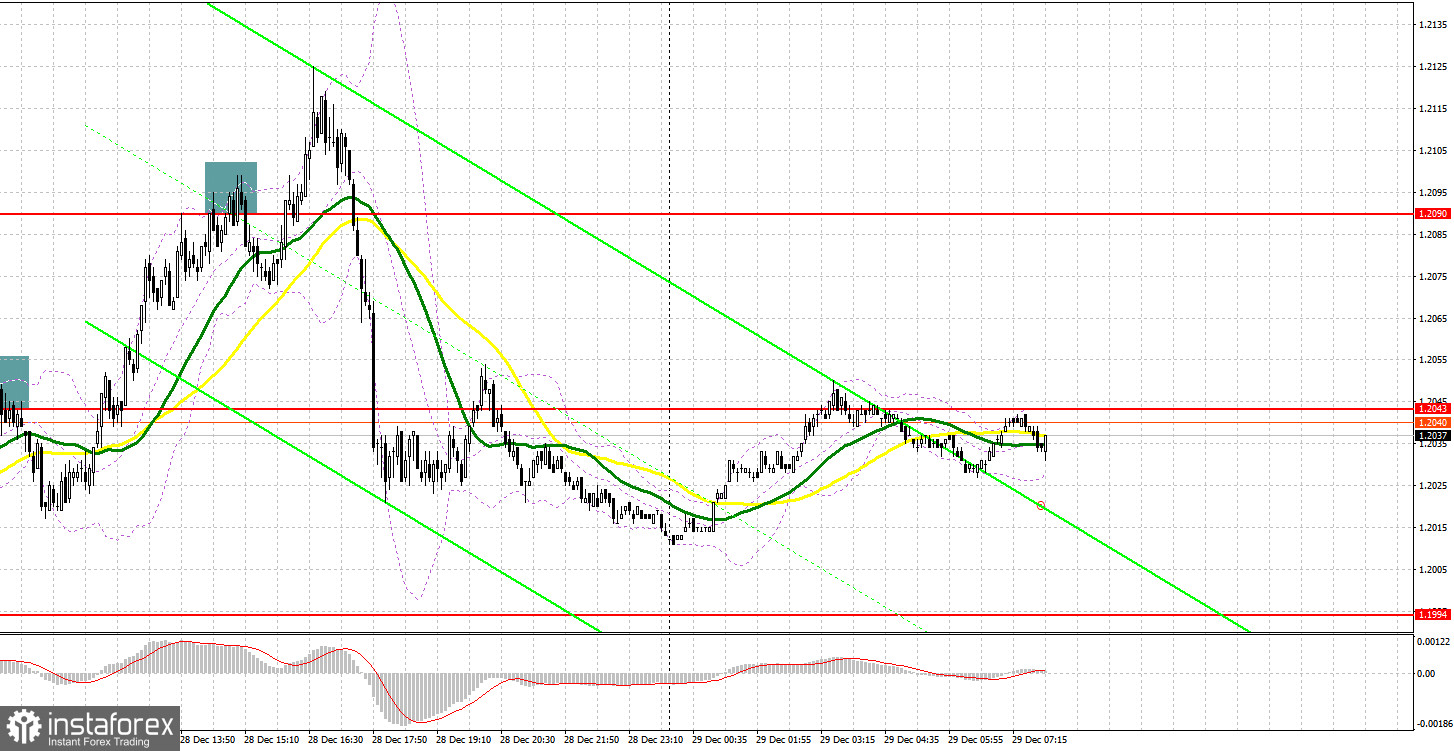

Yesterday there were several signals to enter the market but they didn't lead to good profit. Earlier, I asked you to pay attention to 1.2043 to decide when to enter the market. Let's look at the 5-minute chart and figure out what happened. Growth and a false breakout at 1.2043 gave an excellent sell signal. As a result, the downward movement was about 25 pips, and after that the pressure on the pound has eased. In the afternoon, amid disappointing US data, the pound rose to 1.2090, where there was another false breakout and bears had appeared. But the downward movement was only 15 pips, after which the pair rose and after that GBP fell. I wasn't present in the market by that time.

When to open long positions on GBP/USD:

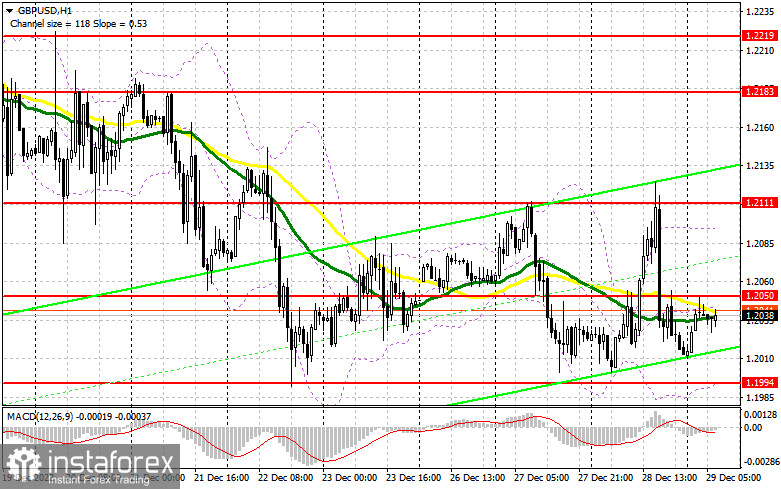

We will not receive any data that concerns the pound today and judging by how aggressive the bears were yesterday, most likely the pair will still be under pressure. The most we can expect is that the pair will remain in the horizontal channel and the bulls will defend the December lows. The bulls can try to continue the correction once the pair settles above 1.2050. At this level, the moving averages are benefiting the bears. But in the current situation, those who buy GBP/USD would like to see a false breakout near support at 1.1994, which coincides with the December low. That will produce a buy signal so that the price can rise above 1.2050 because it will show that there are strong bulls. A breakout and being able to settle above this range amid the lack of UK data allows us to expect a sharper rally and an update of 1.2111, from which the pound was actively sold yesterday. A breakout above 1.2111 with a similar test will help the pair approach 1.2183, where I recommend locking in profit. If the bulls miss 1.1994, the pressure on the pair will increase considerably and this will affect the bulls' stop orders. For this reason I wouldn't rush to buy: it would be wise to open longs on a decline and a false breakout around the low at 1.1949. It is also possible to buy the asset on the rebound from 1.1904, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

The bears made it clear that the pound has nothing to do above 1.2111. Now the main thing to do is to protect the nearest resistance at 1.2050, where the moving averages pass. While trade is carried out below this range, bears have the chance to break through the December lows. Of course in the current situation, while we don't know what will happen with the volatility and trading volume, only a false breakout around the new resistance at 1.2050 will be a good signal to sell, this will give hope for a bearish movement and a new fall to 1.1994. A breakout and upward test of this range will provide a sell signal with the prospect of a movement to 1.1949 and the possibility of returning to 1.1904, where I recommend locking in profit. If GBP rises and bears show no energy at 1.2050, nothing bad will happen, but the pressure on the pound will weaken. In this case, only a false breakout around 1.2111 will provide an entry point into short positions, with the goal of moving down. If bears are not active there either, you could sell GBP/USD right from the high and 1.2183, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

The COT report for December 20 logged a rise in long positions and a fall in short ones. After the key meetings of central banks, including the Bank of England, it became clear: central banks are going to continue to raise interest rates and tighten monetary policy, which by all rules, should lead to demand for national currencies, including the British pound. However, given that the UK's Q3 GDP data was revised downwards, and the onset of recession is not an expectation but a reality for next year, it is unlikely that traders will continue to buy the pound with the same fervor in January. According to the latest COT report, short non-commercial positions were down 16,860, to 40,887, while long non-commercials were up 3,276, to 35,284. Consequently, the non-commercial net position came down to -5,603 from -25,739 a week ago. The weekly closing price of GBP/USD was down to 1.2177 versus 1.2377.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages. It indicates that the pair is moving sideways.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD rises, the indicator's upper limit at 1.2100 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.