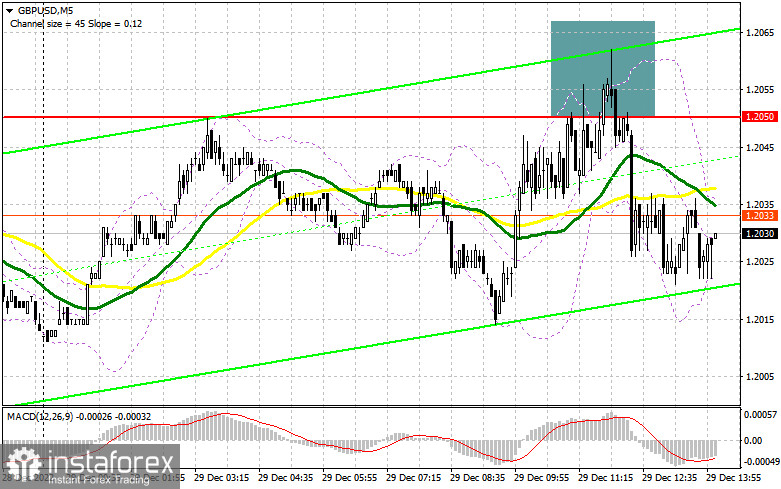

I focused on the 1.2050 level in my morning forecast and suggested making decisions about entering the market there. Let's analyze the 5-minute chart to determine what transpired there. A false breakdown that developed at 1.2050 grew and formed, producing a strong sell signal. The downward movement, as a result, was about 25 points, and the pressure on the pair is still present. Technically speaking, the second half of the day has not seen any changes.

You require the following to open long positions on the GBP/USD:

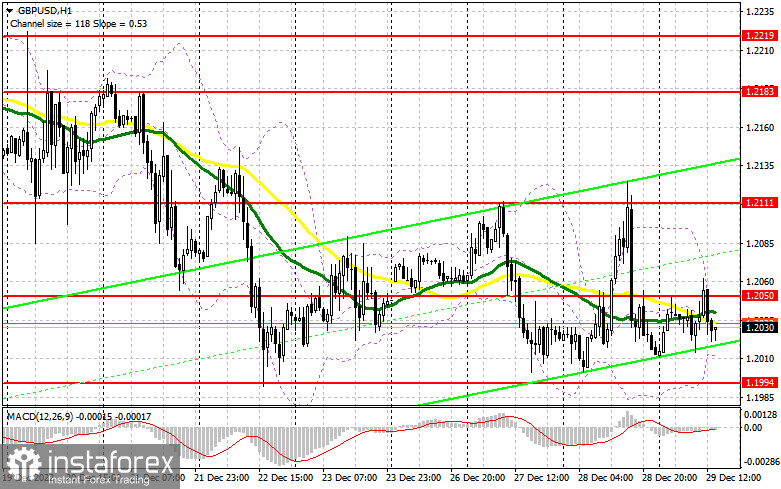

Data on unemployment benefit applications in the US are released during the US session, which could cause a brief increase in market volatility - particularly if the data come in worse than expected, which would weaken the US dollar's position, but only temporarily. With favorable news, it is best to watch for a decline in the pair and a potential false breakdown in the 1.1994 support level, which corresponds to the December low. This will result in a buy signal and enable you to return above 1.2050 because it will show that there are significant buyers in the market. We can anticipate a sharper upward jerk and an update to the level of 1.2111, from where the pound was actively sold yesterday, if there is a breakthrough and consolidation above this range. The growth prospects at 1.2183, where I advise fixing profits, will be opened up by an exit above 1.2111 with a comparable test. The bulls' pressure on the pair will increase significantly if they are unable to complete the tasks assigned to them and miss 1.1994 in the afternoon. This will cause the demolition of the stop orders placed below by buyers. Because of this, I suggest that you hold off on making any purchases and instead open long positions on a decline and a false breakdown close to the minimum of 1.1949. I advise purchasing GBP/USD right away in anticipation of a recovery from 1.1904 to gain 30-35 points in a single day.

For opening short positions on the GBP/USD, you will need:

The bears clearly stated that they are nearby at 1.2050 and that they expect to continue guarding this area. While trading will take place below this range, the main objective is to keep the pair below 1.2050. However, sellers have a good chance of breaking through the December lows. In the present scenario, it would be best to hold off on making any new sales until a false breakdown forms in the region of 1.2050, which will be another strong sell signal in anticipation of a resumption of the bear market and a sustained decline to a minimum of 1.1994. Only a breakout and a reverse test of this range from the bottom up will provide an entry point to sell with a move to 1.1949 and the potential for updating 1.1904, where I advise fixing profits. Nothing terrible will occur, but the pressure on the pound will lessen due to the possibility of GBP/USD growth and the lack of bears at 1.2050. In this case, the only entry point into short positions to move down is a false breakout in the vicinity of 1.2111. If there is no activity there, I advise you to sell GBP/USD right away at the highest price of 1.2183, but only if you are counting on the pair to fall back by 30-35 points during the day.

Signals from indicators

Moveable Averages

The fact that trading occurs around the 30 and 50-day moving averages suggests that the market is lateral.

Notably, the author considers the period and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located around 1.010, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.