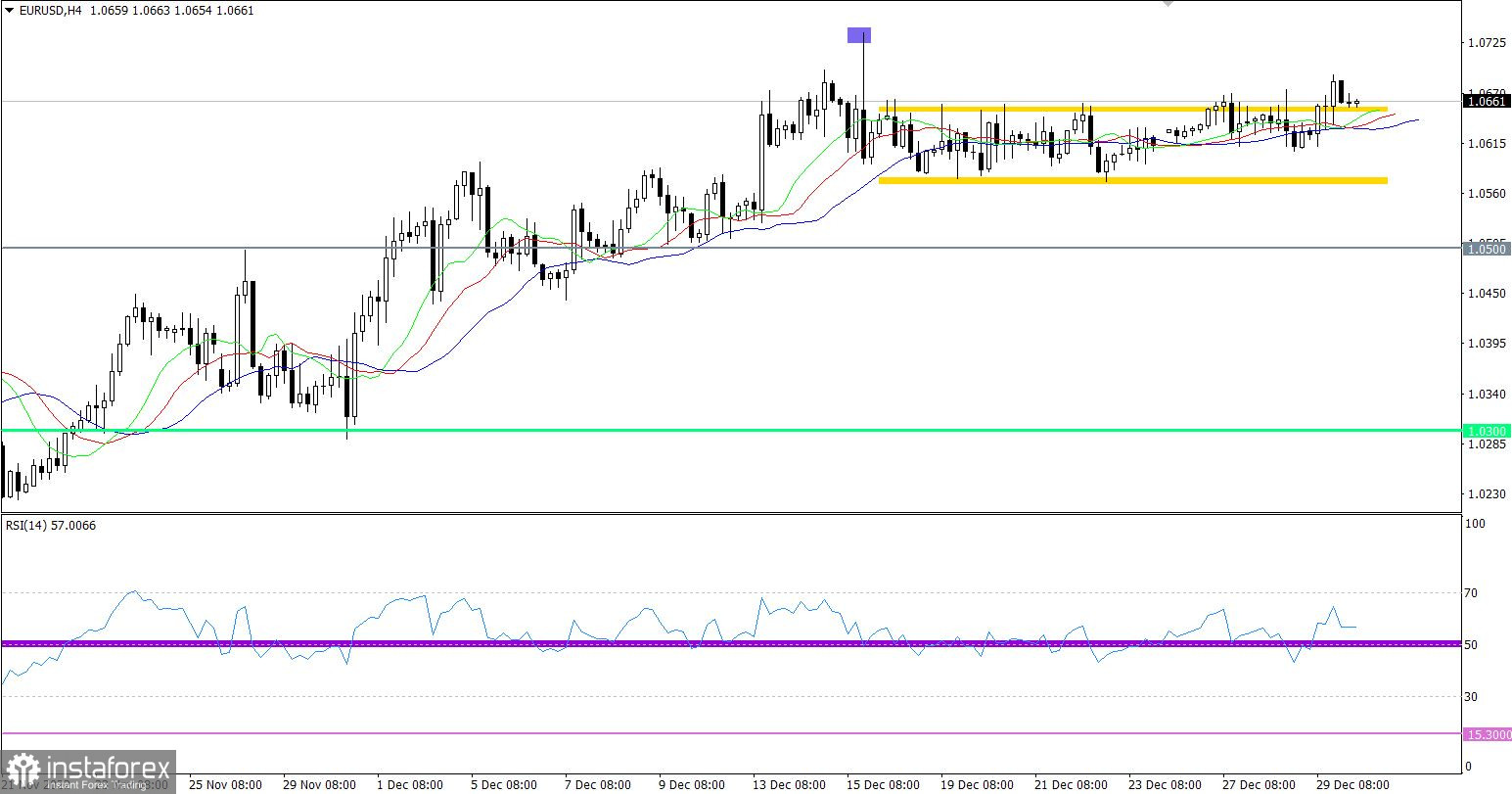

The single European currency showed noticeable growth in the run-up to the New Year. It even jumped beyond the upper limit of the range, in which it has been trading in for almost two weeks straight. However, it failed to settle and eventually rolled back exactly to the upper limit of the range.

The reason for that was the extremely weak data on the unemployment benefits applications in the United States. The number of initial claims grew by 9,000 instead of the expected 4,000. The continuing claims, which was supposed to fall by 1,000, had increased by 11,000. Although the previous data was revised upward, it was only by 2,000. So, generally speaking, it is not surprising that the single currency strengthened its positions a bit. But we should pay attention to the fact that it did not go beyond the limit. Therefore, its growth potential is very limited. And it's not just because it's the end of the year and most traders and investors are absent in the market. The thing is that investors gradually come to realize the results of the past meetings of the European Central Bank and the Federal Reserve. And the holidays are just used to revise expectations and plans for the next year. Apparently, no one will speak about any interest rate disparity in favor of the euro next year. And it is quite possible that before the summer we will see parity with the dollar again.

The number of unemployment claims (United States):

EURUSD managed to show local activity on Thursday, and as a result, the euro crossed the 1.0570/1.0670 horizontal channel with its upward movement. But the bulls' joy did not last long, immediately after the breakthrough it suddenly pulled back, thereby returning the quote behind the corresponding limit. In this case, there is a clear uptrend, but trading volumes in the market are clearly not enough for a full movement.

On the four-hour chart, The RSI technical indicator is moving in the upper area of the 50/70 indicator. This indicates a bullish mood.

On the four-hour chart, Alligator's MAs are directed upward, but given that the quotes are still within the flat, the signal may be unstable.

Outlook

Stable presence of the price above 1.0670 may strengthen long positions in the future, which will lead to the prolongation of the upward cycle. In this case, you can see the current price fluctuation as a "breakout pullback" pattern, which strengthens the position towards the breakout.

As for the bearish scenario, it is considered in terms of continuing the fluctuation within the previously passed flat.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical signals are showing buy opportunities due to the local breakthrough of the upper limit of the flat.