Analysis of trades and advice for trading the pound

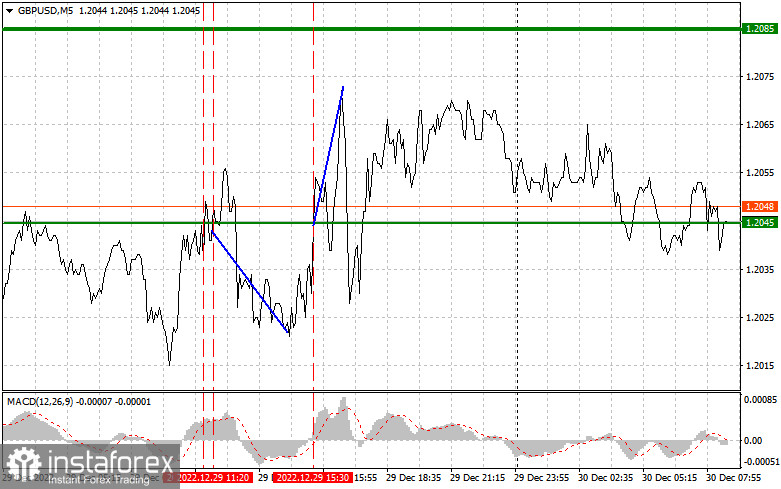

The pair's upward potential was constrained by the MACD, which was relatively far from zero at the time of the price test of 1.2045. After a short while, there was another test of 1.2045, and at that point, the MACD was already indicating a decrease from the overbought level. As a result, there was a roughly 20-point decline.

I don't anticipate much volatility in the first part of the day because, according to the data today, only a report on the nationwide house price index in the UK will be released. This news is unlikely to have a substantial impact on the market. Using case #2, it is advisable to trade in a side channel. A report on the PMI business activity index in Chicago is released in the afternoon; a strong reading could result in a strengthening of the dollar, which would also limit the pair's upside potential after the week.

Buy signal

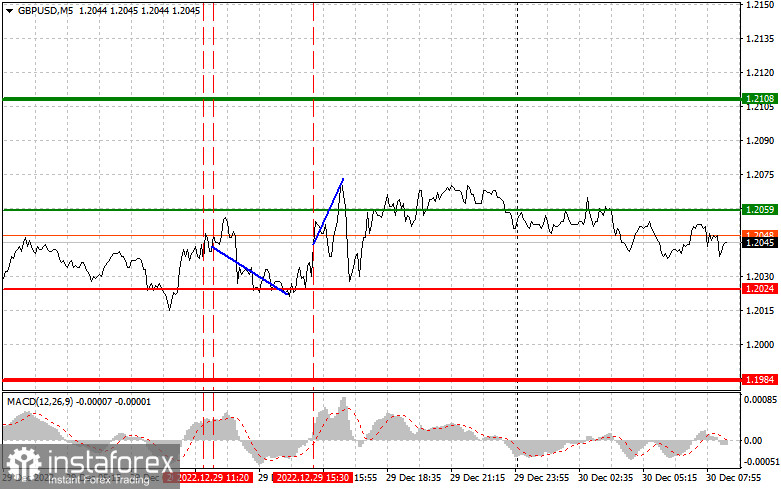

Scenario #1: The green line on the chart represents the entry point where you can purchase the pound today to increase it to the level of 1.2108. I advise closing purchases and starting sales in the other direction at 1.2108. Only if the annual lows are maintained is it conceivable to anticipate the pound's growth in the present. Make sure the MACD indicator is above zero and just starting to increase from it before making a purchase.

Scenario #2: It is also conceivable to buy the pound today if the price reaches 1.2024; however, at this time, the MACD indicator should be in the oversold region, limiting the pair's potential for further decline and causing a market upward turnaround. Growth to the polar levels of 1.2059 and 1.2108 is to be anticipated.

Sell signal

Scenario #1: Selling the pound today is only conceivable after updating the level of 1.2024 (the red line on the chart), which will cause the pair to drop quickly. The 1.1984 level will be the primary objective for sellers, and I advise quitting trades there and starting purchases right away in the opposite direction. In the absence of buyers over 1.2060, the pressure on the pound will increase again. Make sure the MACD indicator is below zero and just starting its descent from it before you decide to sell.

Scenario #2: It is also feasible to sell the pound today if the price reaches 1.2059; however, at this time, the MACD indicator should be in the overbought region, which will impede the pair's ability to rise and result in a downward market reversal. With the opposing levels of 1.2024 and 1.1984, we might anticipate a decrease.

Listed on the chart:

The price at which you can purchase a trading instrument is shown by the thin green line.

The expected price is indicated by the thick green line. Since further growth above this point is doubtful, take the profit or fix the earnings yourself.

The price at which a trading instrument may be sold is shown by the thin red line.

The price at which you can place an order is shown by the broad red line. Since additional decline is unlikely below this level, take a profit or make your profits.

The MACD signal. It's vital to follow overbought and oversold zones while entering the market.

Important. When deciding to enter the forex market, novice traders must be extremely cautious. To avoid being subjected to sudden variations in the exchange rate, it is recommended to avoid the market before the release of significant fundamental reports. Always use stop orders to limit losses if you choose to trade during the news announcement.