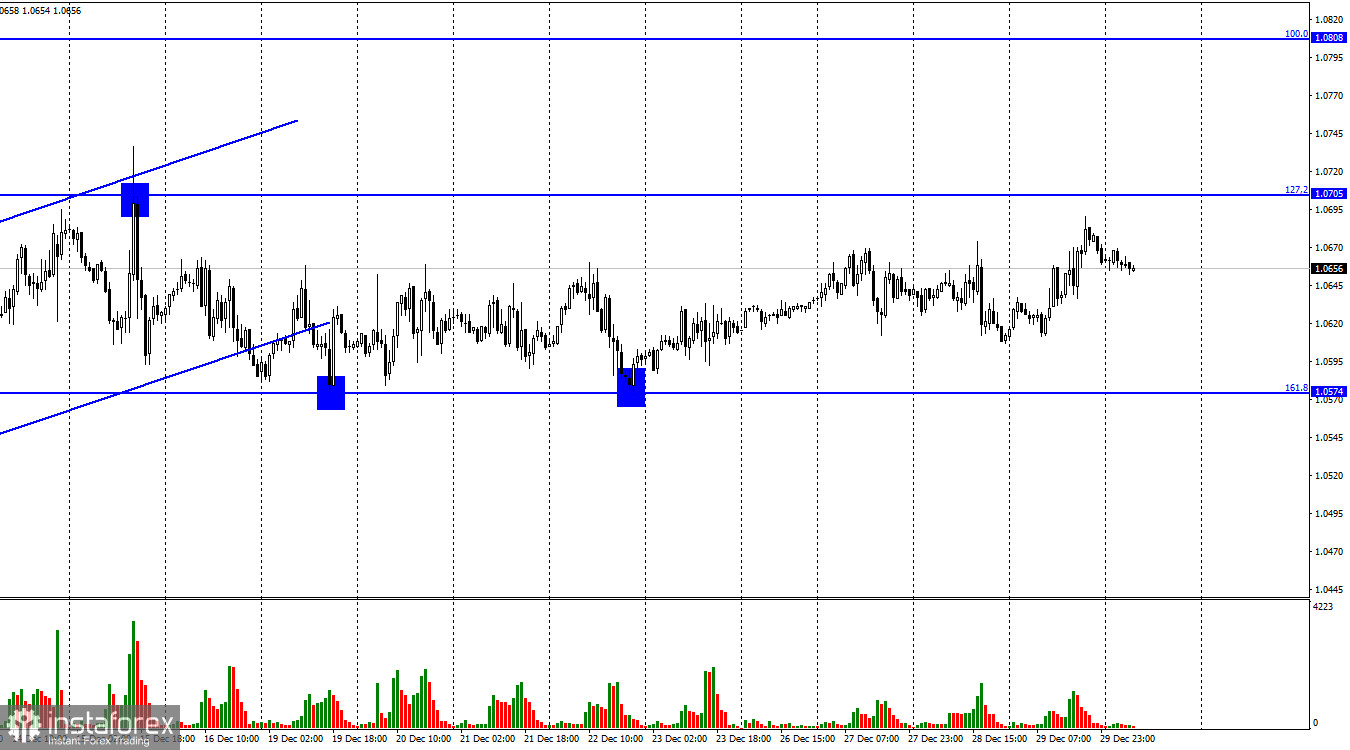

Hi everyone! The EUR/USD pair was hovering between 1.0574 and 1.0705 levels on Thursday. As it failed to reach these levels, there were no entry points. Nevertheless, the euro is located quite close to its previous high, the Fibonacci correction level of 127.2%. Thus, bulls remain in control.

The economic calendar was empty yesterday as usual. Traders are looking forward to the next week as there will hardly be any crucial events this year. Besides, the NonFarm Payrolls report, average hourly wages. and unemployment figures are on tap next week. Of course, traders will be largely awaiting the NFP report. The figure is expected to be low. Unemployment is likely to remain unchanged. The labor market has been quite resilient. I do not think that this indicator will suddenly decline or, on the contrary, grow significantly. So, the market reaction could be weak. The unemployment rate is projected to amount to 3.7%, unchanged from the previous month. If the forecast is correct, no good entry points are likely to appear.

I believe that next week the pair may move in the sideways range of 1.0574 - 1.0705. I think that it is necessary to pay attention to the breakout level but not to the fundamental background. On Friday, trading volumes may be high. However, it does not mean that the pair could break through one or the second level of the sideways range.

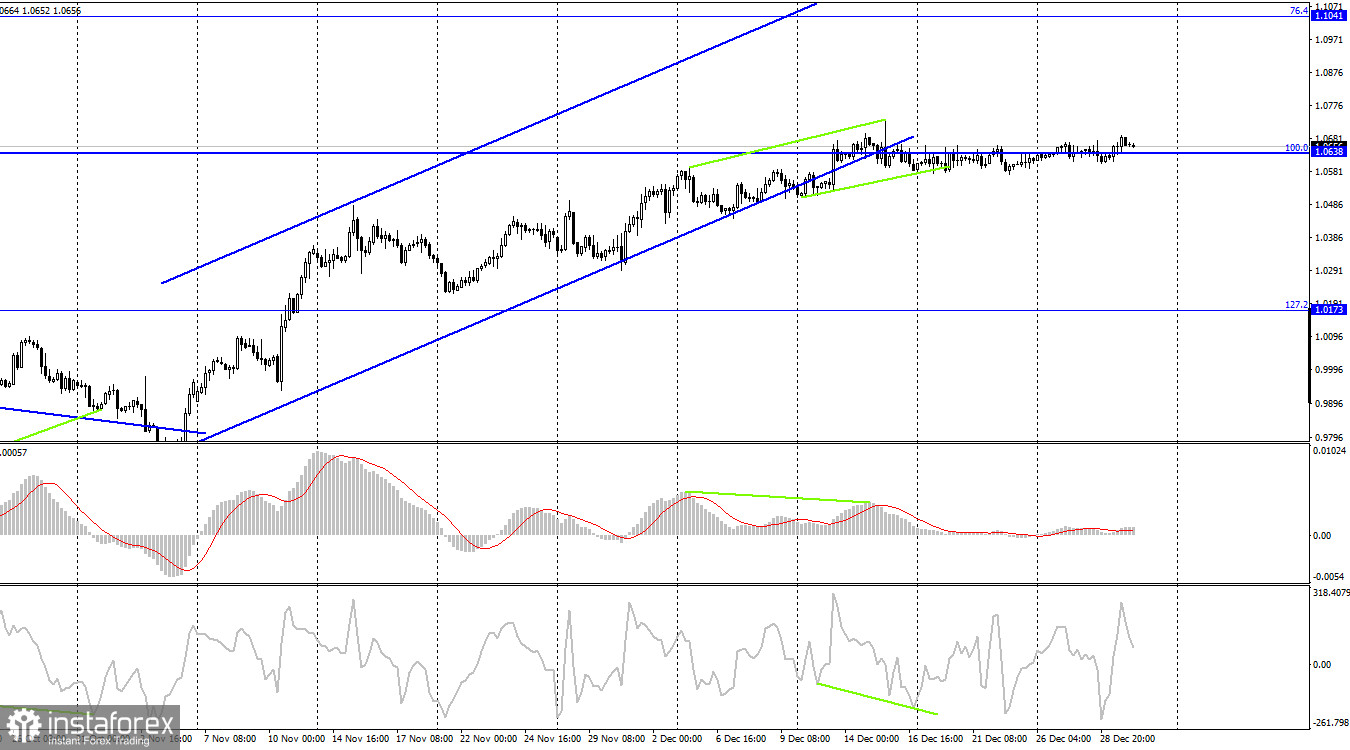

On the 4-hour chart, the pair is moving horizontally. Thus, if it settles above or below 1.0638, the Fibonacci correction level of 100.0%, there will hardly be any signals. Divergences that form from time to time also have no impact.

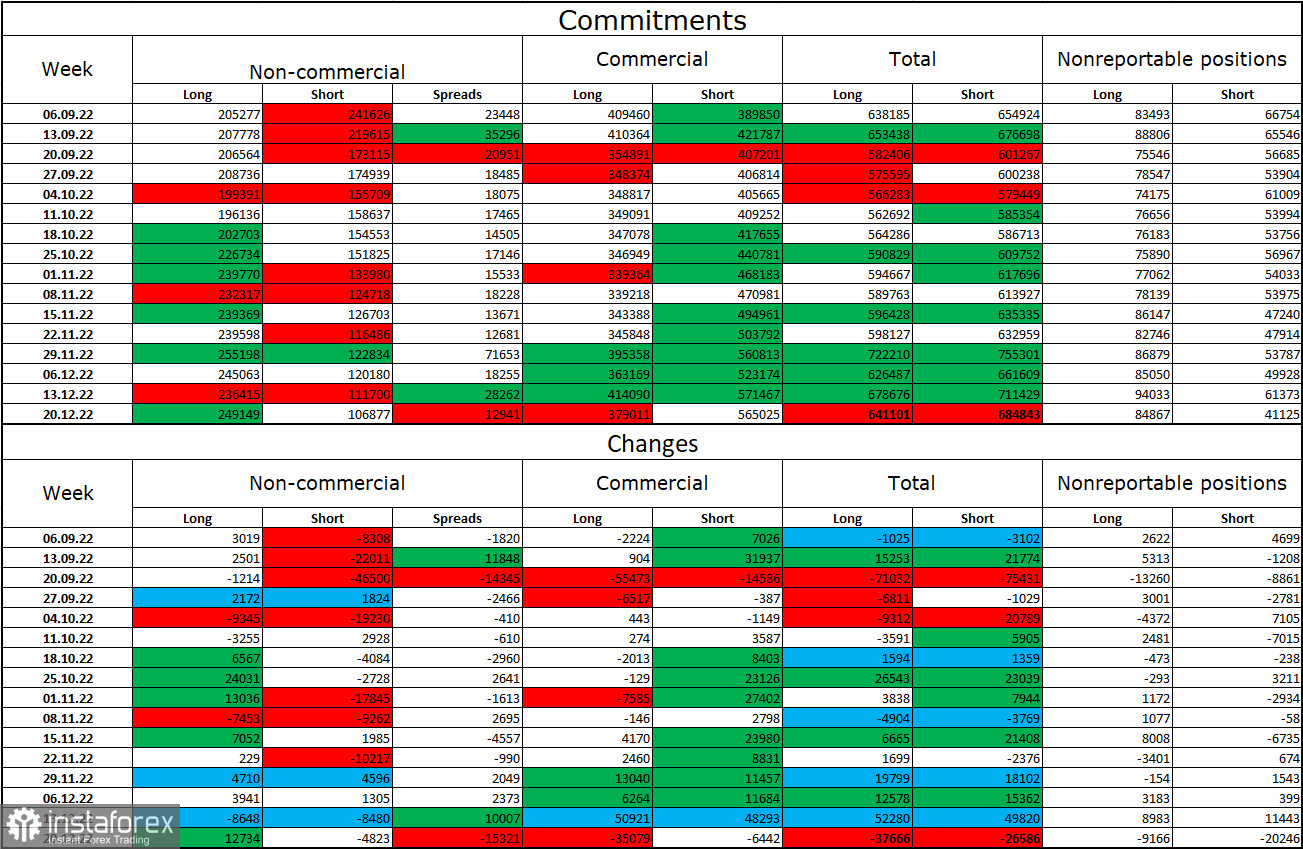

Commitments of Traders (COT):

Last week, speculators opened 12,734 long positions and closed 4,823 short ones. The mood of large traders remains bullish. The total number of long positions amounts to 249,000, and short ones -106,000. The euro is currently growing, which is in line with the COT reports. The number of long positions is already significantly higher than the number of short ones. In the last few weeks, the bullish momentum has been strengthening. However, analysts are wary of its rapid rise. Fundamental factors are now favoring the euro. So, it is steadily increasing after a prolonged decline. The outlook remains bullish. However, if it breaks through the ascending channel on the hourly and 4-hour charts, bears may regain momentum in the near future.

Economic calendar for US and EU:

On December 30, the economic calendar for the US and the EU is uneventful. The impact of fundamental factors on the market sentiment will be weak.

Outlook for EUR/USD and trading recommendations:

It is better to sell the euro if it drops below 1.0574 on the hourly chart with a target of 1.0430. It is also recommended to sell the euro if it retreats from 1.0705 with a target of 1.0574. It would be wise to open long positions if the pair rebounds from 1.0574 on the hourly chart with a target of 1.0705.