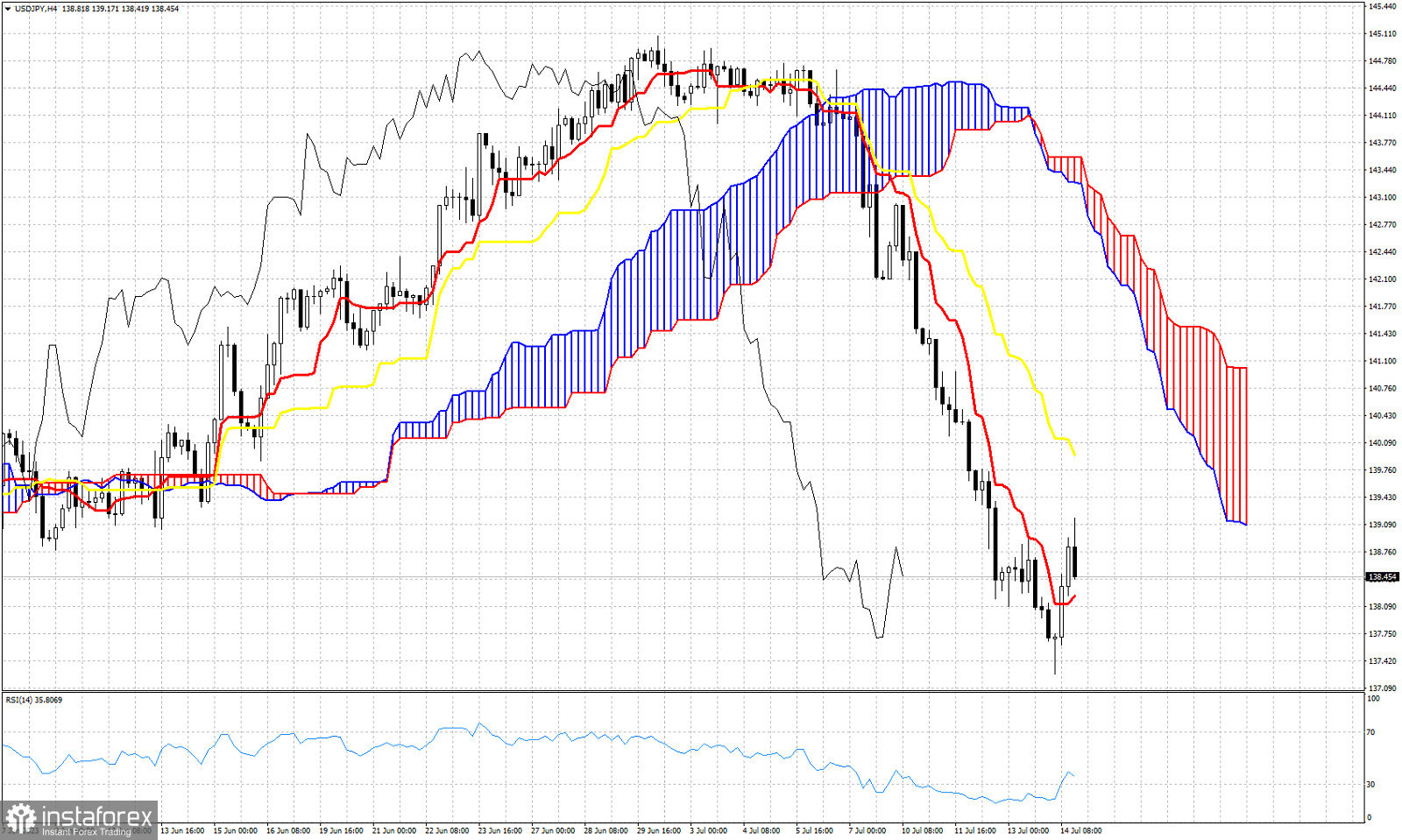

USDJPY is trading around 138.55. Short-term trend in the 4 hour chart according to the Ichimoku cloud indicator remains bearish since the break down below the Kumo (cloud) at 143.15. Price has made a low around 137.26 and is now bouncing. Price is trading above the tenkan-sen (red line indicator). The kijun-sen (yellow line indicator) provides resistance at 140.13. This is the first important resistance bulls need to break above in order to hope for a trend change. According to the Ichimoku cloud indicator, in order for trend to change to bullish we need to see price break above the cloud. The cloud resistance is at 142.70-143.20. The Chikou span (black line indicator) remains below the candlestick pattern (bearish). For this indicator to turn bullish we need to see price above 141.50. As one can see bulls have a lot of work to do in order to reclaim control of the trend. For now trend remains controlled by bears. The RSI is turning higher from oversold levels but this only justifies a short-term bounce. The bounce in the RSI can not suggest a trend change.