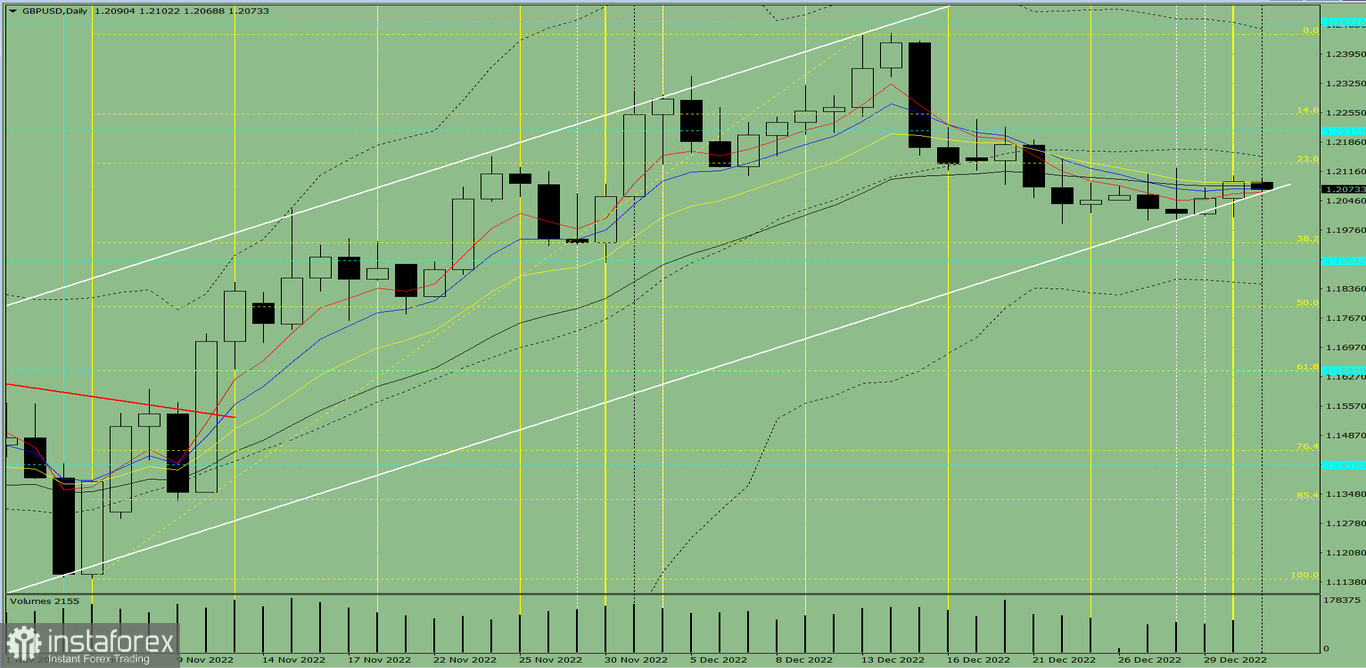

Trend analysis (Fig. 1)

GBP/USD may start moving down on Monday, starting from the closing of Friday's daily candle at 1.2092 to the lower fractal at 1.2008 (daily candle from 12/30/2022). If this level is tested, the pair will resume rising towards the historical resistance level of 1.2213 (blue dotted line), then fall down again.

Fig. 1 (daily chart)

Comprehensive analysis:

Indicator analysis - downtrend

Fibonacci levels - downtrend

Volumes - uptrend

Candlestick analysis - uptrend

Trend analysis - uptrend

Bollinger bands - uptrend

Weekly chart - uptrend

Conclusion: GBP/USD will fall from 1.2092 (closing of Friday's daily candle) to the lower fractal at 1.2008 (daily candle from 12/30/2022), rebound to the historical resistance level of 1.2213 (blue dotted line), then move down again.

Alternatively, the pair could rise from 1.2092 (closing of Friday's daily candle) to the upper fractal at 1.2124 (daily candle from 12/28/2022), then bounce down to the support line at 1.2065 (thick white line). Upward movement may resume after testing the level.