EUR/USD

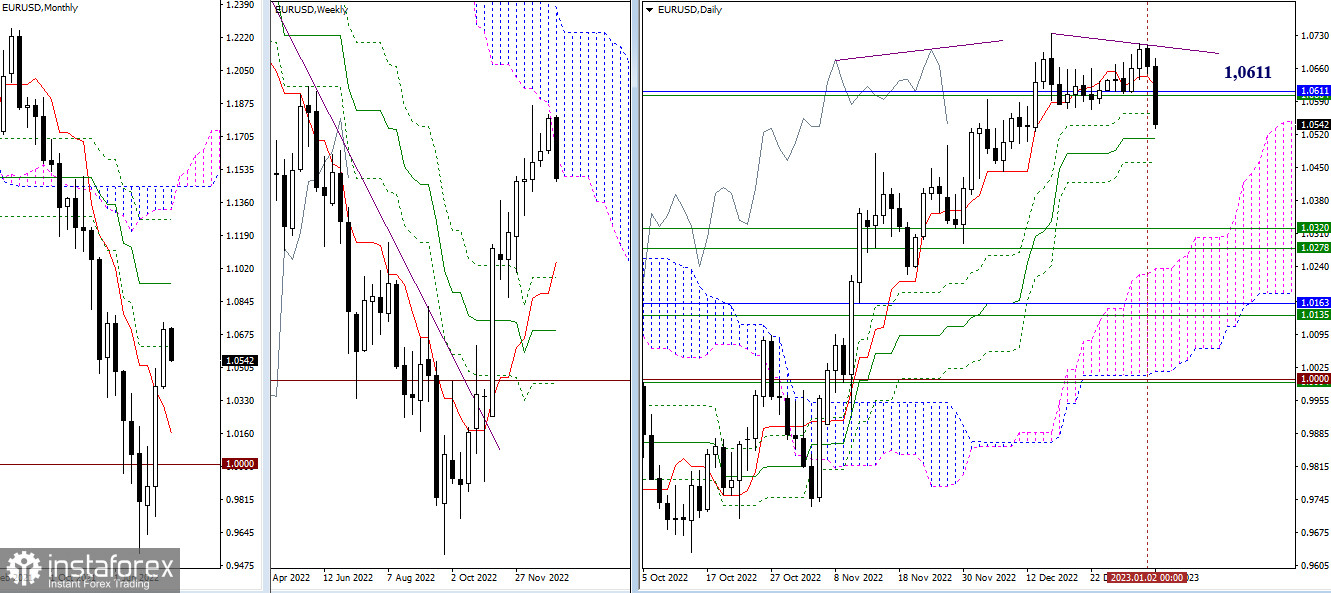

Larger timeframes

The bulls managed to close the 2022 year on an optimistic note. Let's figure out what scenario lies ahead based on the ongoing upward correction in the one-month timeframe. In the one-week timeframe, the resistance of the cloud's lower border evolved into support and merged with the one-month support at 1.0611. As a result, if the instrument updates a one-month high of 1.0736, this will open the door to a one-month short-lived uptrend (1.0943) and the upper border of the weekly cloud (1.0930). If, despite the technical background and some preconditions, the bulls don't insist on a further uptrend, the bears could take over for EUR/USD. This scenario was discovered yesterday on the daily chart in the form of a hidden bearish divergence according to the Chinkou Span. Today the bears started testing support levels. Their main task for today is a breakout and removal of the daily gold Ishimoku cross whose final levels are seen at 1.0513 and 1.0460.

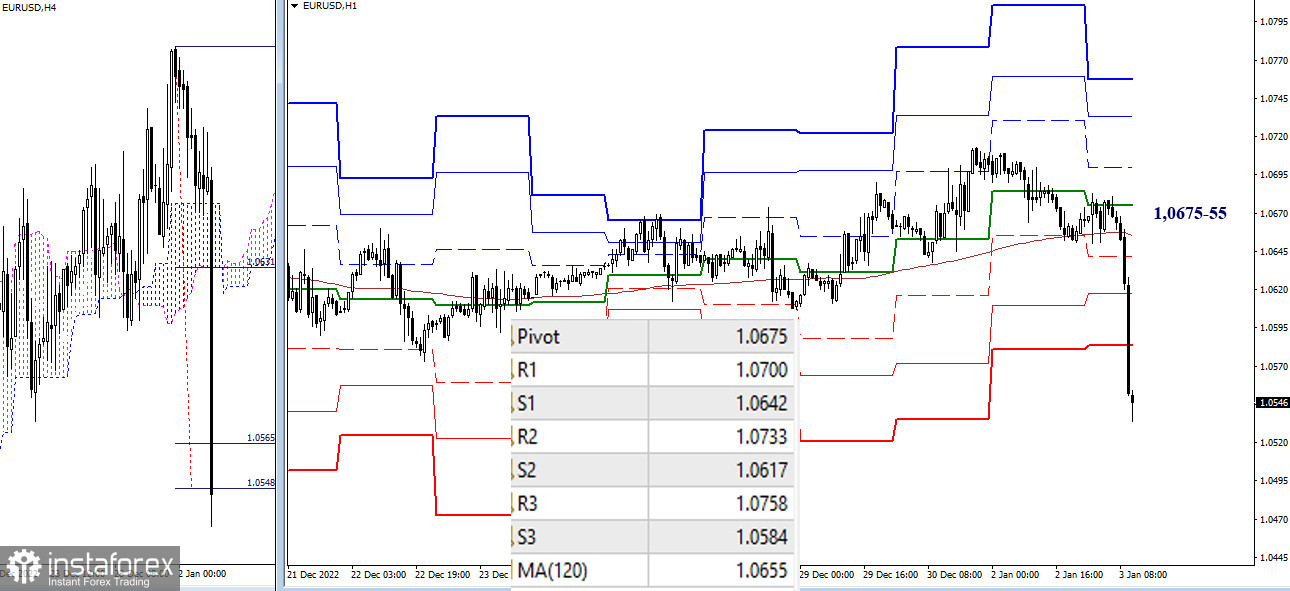

H4 – H1

On smaller timeframes, the bears pushed EUR/USD sharply down. Meanwhile, the price passed the targets at smaller timeframes: the target of a cloud's breakout on the 4-hour timeframe and support of classical pivot levels. The levels which have been passed (1.0565 – 1.0584 – 1.0617) can now serve as resistance in case the bulls take control over the pair. The downward targets are now seen at 1.0513 and 1.0460, support levels on larger timeframes.

***

GBP/USD

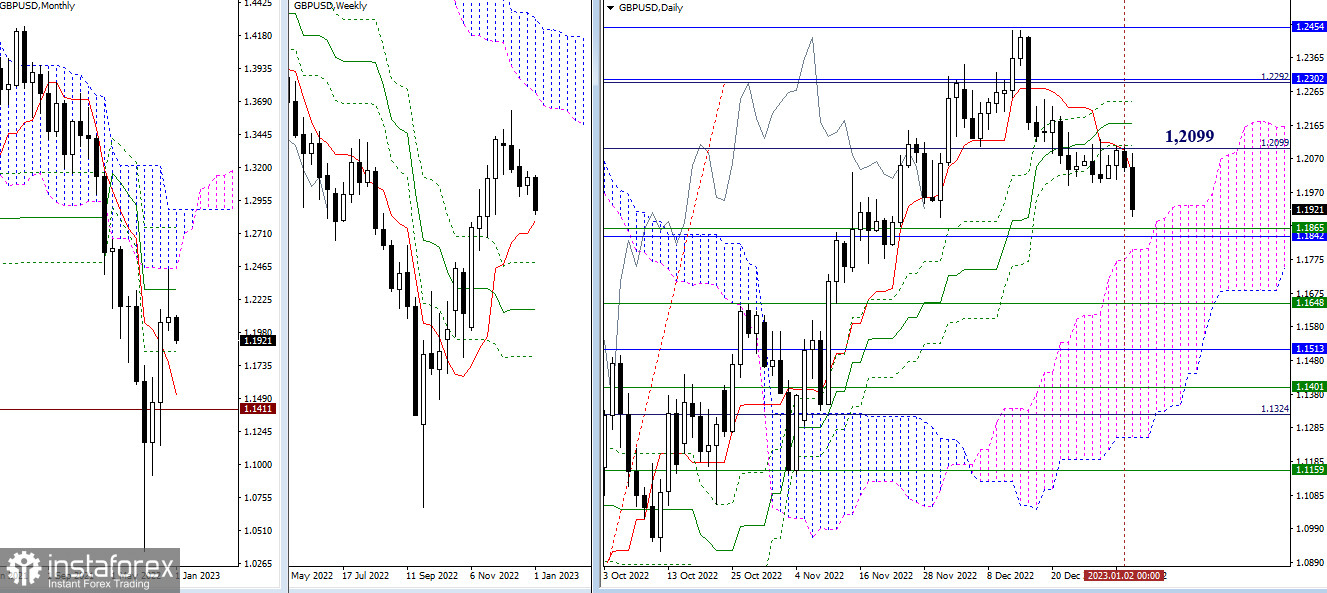

Larger timeframes

GBP/USD completed last year with a drop from the tested one-month resistance levels of 1.2302 and 1.2154. These levels are still acting as major resistance on the current section. Once they are broken, this will clear up new prospects. Today the pond sterling updated a low of December, trying to develop a decline. The bears are now focused at support of the daily Ishimoku cloud which is reinforced by the one-month support at 1.0842 and one-week support at 1.1865.

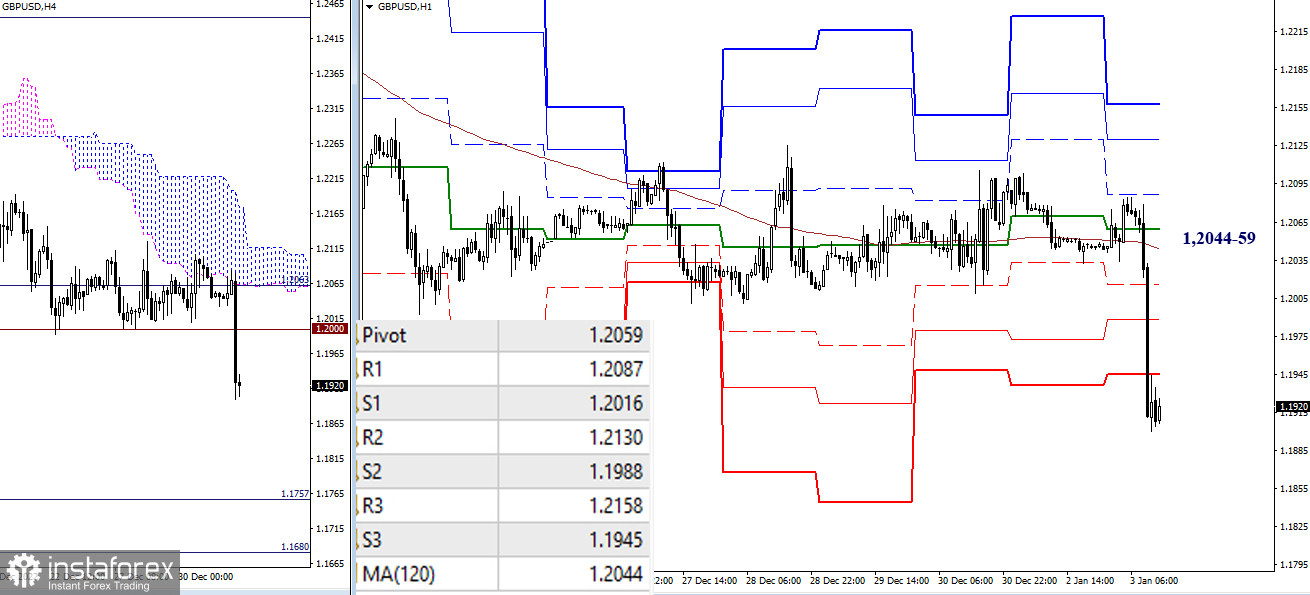

H4 – H1

The bears decided to intrude sharply into the situation and insist on a decline. So, the piece has passed all support levels of classical pivot points. Therefore, support levels of larger timeframes such as 1.1842 and 1.1865 now serve as the nearest downward targets. Resistance could be retested during the intraday climb in case the area embracing classical pivot levels 1.1945 – 1.1988 – 1.2016 is passed.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Average (weekly long-term trendline)