Problems of tech companies in the US appeared again, causing the local market to fall. Similarly, the European market fell because right after a significant increase, shares of TESLA and APPLE collapsed by more than 14% and 4% respectively, resulting in a negative closing of stock indices. This shattered all hopes of a rise in demand for equities, which had been expected at the start of the new year.

The forex market could not stay away from the situation of the stock market either as dollar began to rise before the opening of the US trading session. The driver was the growing expectations of lower inflation in Europe, which was influenced by the CPI data from Germany. This increased the likelihood that other global central banks will follow the Fed in taking a pause in raising interest rates.

The oil market also came under pressure, showing a strong local drop in prices.

Most likely, the negative sentiment will continue if the minutes of the December Fed meeting, which is due out today, do not hint at a pause in rate hikes in the 1st quarter of the new fiscal year. The labor market data not showing a slowdown in growth will give a similar effect.

The turning point could be the upcoming US consumer inflation figures as markets will surely shift from bearish to bullish once the data shows a slowdown. This could be accompanied by a marked weakening of dollar.

Many remain optimistic on a global reversal in markets.

Forecasts for today:

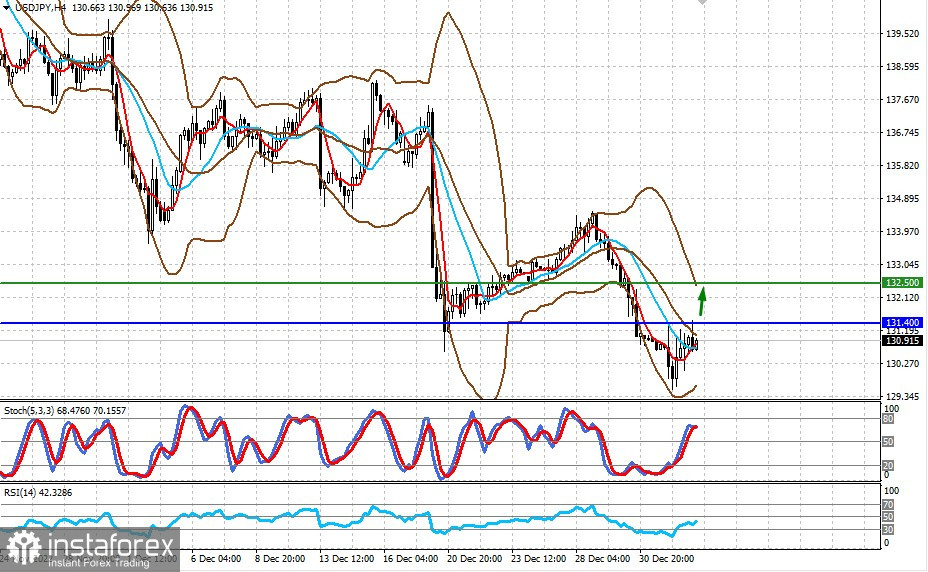

USD/JPY

The pair is trading below 131.40. If market sentiment improves today, there will be a local recovery towards 132.50.

AUD/USD

The pair is trading below 0.6825. Again, if the situation in the markets stabilizes and investor sentiment improves, the pair will rise above 0.6825 and surge to 0.6900.