On Tuesday, the information background was quite calm and weak at first glance. However, traders were very active during the day. The information background may have become the reason for such increased activity. The only report was the manufacturing activity index in the US. It decreased to 46.2 from 47.7 in December, which is a negative trend. However, this report could not have triggered bearish activity in the market as the US dollar rose on Tuesday. Some analysts also mentioned the German inflation report, which showed a noticeable decline. Meanwhile, this report is not connected with the decline of the European currency, at least because the decline started several hours before its release. Thus, the informational background did not have any effect on traders' sentiment.

The reason for the strong moves is more simple and more obvious. The holidays are over, traders are coming back to the market, and we see stronger moves outside the sideways channel. The market has simply returned to its non-holiday state. There are more important reports ahead this week, so the movements by the end of the week may be quite strong. I recommend paying attention to EU inflation and US labor market reports, which will be released on Friday.

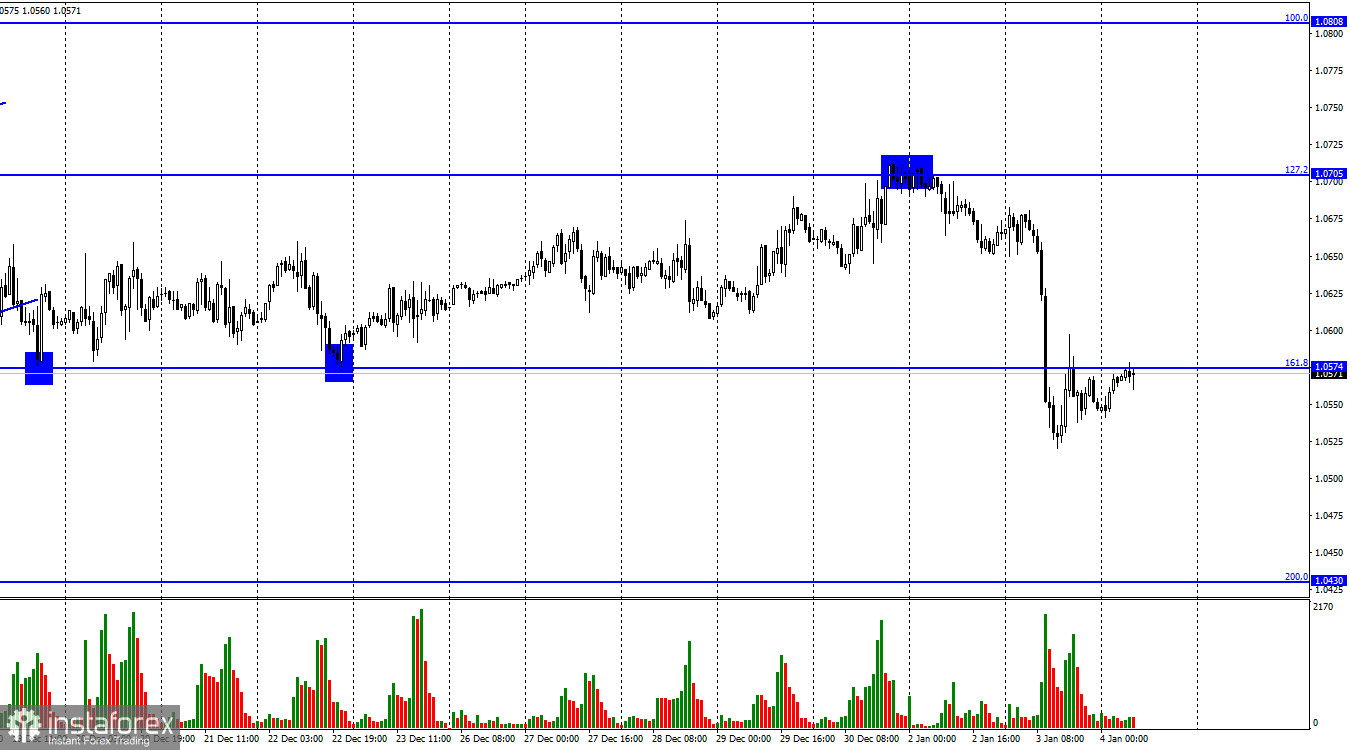

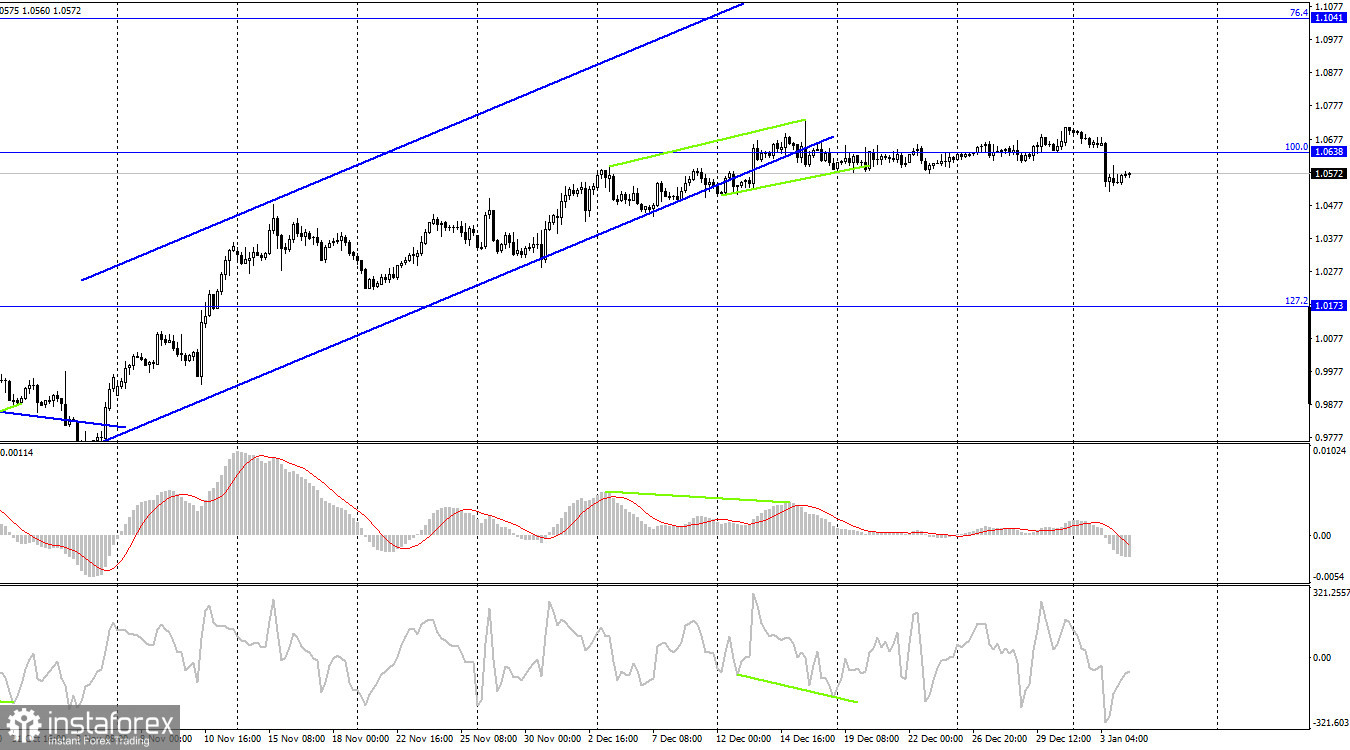

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the 100.0% Fibo level - 1.0638. The fixation below this level gave no signals. On the hourly chart, the pair closed below the sideways corridor, so the downtrend may continue toward the next correction level of 127.2% - 1.0173.

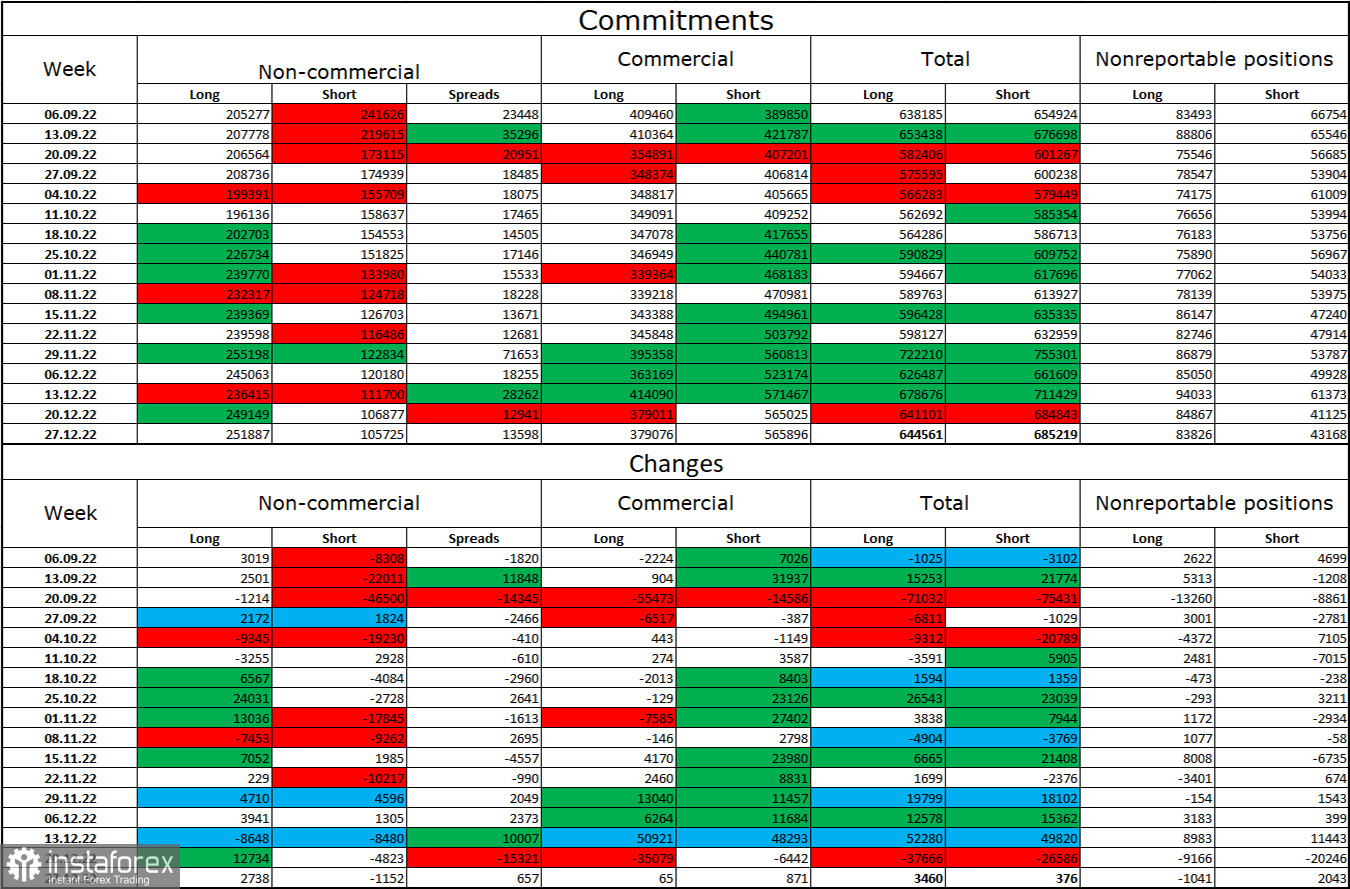

COT report:

Last week, speculators opened 2,738 long contracts and closed 1,152 short contracts. The sentiment of large traders remains bullish and continues to strengthen. The total number of long contracts, which are in the hands of speculators, now stands at 252,000, and short contracts are at 106,000. The European currency is growing at the moment, which corresponds to the data of COT reports. At the same time, I draw your attention that the number of longs is already two and a half times higher than the number of shorts. In the last few weeks, the euro has been rising steadily. Meanwhile, it may seem that the euro has grown too fast. The situation continues to become more favorable for the euro after a period of decline, so its prospects remain positive. However, going beyond the ascending channel on the hourly and 4-hour charts may mean a strengthening of the bearish positions in the nearest future.

US and EU economic calendars:

EU - Services PMI (09-00 UTC).

US - ISM Manufacturing PMI (15-00 UTC).

US - FOMC Meeting Minutes (19-00 UTC).

On January 4, the economic calendars in the US and the EU are mostly empty. Only business activity indices will be released. The influence of the information background on traders' sentiment may be weak today.

EUR/USD forecast and recommendations for traders:

One may sell the euro on a rebound from 1.0705 with the target of 1.0574. The target has been reached. New short positions can be opened on a rebound from 1.0574 with the target of 1.0430. It is better to buy the euro after the price closes above 1.0574 on the hourly chart with the target of 1.0705.