Yesterday, the euro rose significantly after a good PMI, and today it may continue to recover, but we need quite controversial statistics on the US.

When to open long positions on EUR/USD:

The minutes of the Federal Reserve meeting did not change investors' expectations, so let's see how traders react to data on Germany's trade balance and the eurozone producer price index that will be released this morning. Higher inflation in the eurozone may boost the euro in the morning. The best scenario for long positions would be a false breakout near 1.0596. This is where the bullish MAs are also located, and that would give a signal to enter the market, allowing the bulls to go back to 1.0630. A breakout and test of that range will be another entry point to go long, to test the high at 1.0665. A breakout through the level will hit bearish stop orders and generate another buy signal, targeting 1.0699. If the pair tests it, an uptrend will start at the beginning of the year. This is where it is wiser to lock in profits. Should EUR/USD go down when there is no bullish activity at 1.0596, the pressure on the pair will increase, so the emphasis will be placed on the US data, which will be discussed in the afternoon. You could open longs when the pair falls towards 1.0561 after a false breakout. It will become possible to buy EUR/USD on a rebound from this month's low at 1.0522 or even lower at 1.0485, allowing a bullish correction of 30 to 35 pips intraday.

When to open short positions on EUR/USD:

Yesterday, the bears retreated while the market received good data, but they also managed to keep the pair below 1.0630, so they could hope that the euro moves down this morning. In case the pair rises during the European session, it is important that the bears do not lose control over 1.0630. That's why the best scenario for short positions would be if the pair does not settle above 1.0630, which would take the pair to 1.0596, where the MAs are. This level was tested yesterday, so do not be surprised if the bulls are dealing with it today. A breakout and a retest of this barrier will put pressure on the euro, generating an additional sell signal. The quote may then retrace down to 1.0561 where the bears are likely to loosen their grip on the market. The pair will fall to 1.0522 if it consolidates below this mark. That would also bring back hopes of a bearish market for the euro at the beginning of the year. The most distant target is seen at 1.0485 where it is wiser to lock in profits. If EUR/USD goes up during the European session when there is no bearish activity at 1.0630, I recommend to postpone shorts to 1.0665. It would be best to only sell there after failure to consolidate. Also, it will be possible to sell EUR/USD on a rebound from the high of 1.0699, allowing a bearish correction of 30 to 35 pips.

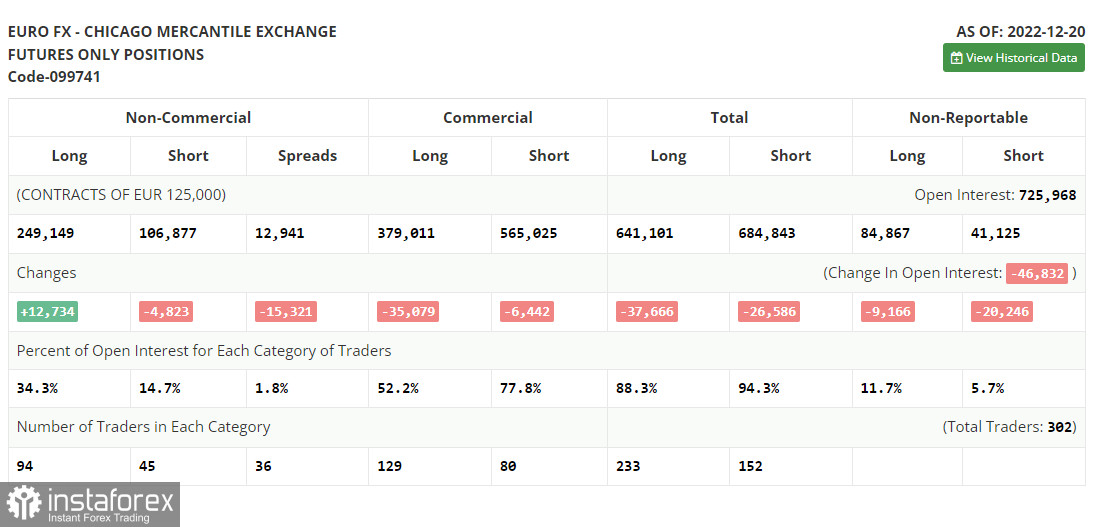

COT report:

The COT report for December 20 revealed an increase in long positions and a drop in short ones. Traders preferred to increase longs on the euro after the central banks' meetings by the end of the year, and also amid good data on the eurozone and Germany, which were released last week. However it didn't affect the balance of forces to a great extent and we continue trading within the channel formed last week. Strong data on U.S. GDP growth in Q3 this year and the labor market are also keeping the U.S. dollar in demand, as traders expect further monetary tightening due to risks of continued high inflationary pressures next year. Add to all this a recession and you are unlikely to have much appetite for buying risky assets. According to the COT report, long non-commercial positions were up 12,734 to 249,149, while short non-commercials positions were down 4,823 to 106,877, and the total non-profit net positioning was up sharply to 142,279 versus 122,247. This indicates that investors, despite all fears, continue to buy euros in hopes of a sharper rate hike by the European Central Bank next year. But a new fundamental reason is needed in order for the euro to rise further. The weekly closing price rose to 1.0690 versus 1.0342.

Indicators' signals:

Trading is carried out slightly above the 30 and 50 moving averages. It indicates that the bulls are trying to seize the initiative.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper limit at 1.0630 will serve as resistance. If it falls, the indicator's lower limit around 1.0596 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.