The last time we saw the upward movement of Bitcoin was in mid-December. The cryptocurrency was systematically gaining volumes near the $16.8k level, after which it made a bullish breakdown of this level and consolidated above $17k.

Subsequently, the upward movement continued to the $18k, where there was a false break of the round mark and the price headed to its usual habitat near the level of $16.4k.

Nearly a month later, Bitcoin resumes its timid attempts to move upward to the psychological level of $17k. The other day, the cryptocurrency took advantage of bullish momentum and conoslidated near the $16.8k level.

A combination of factors indicate a high probability of an upward movement closer to mid-January. Representatives of the American investment company Bernstein believe that now is the best time to buy BTC, as cryptocurrencies begin the path to updating price highs.

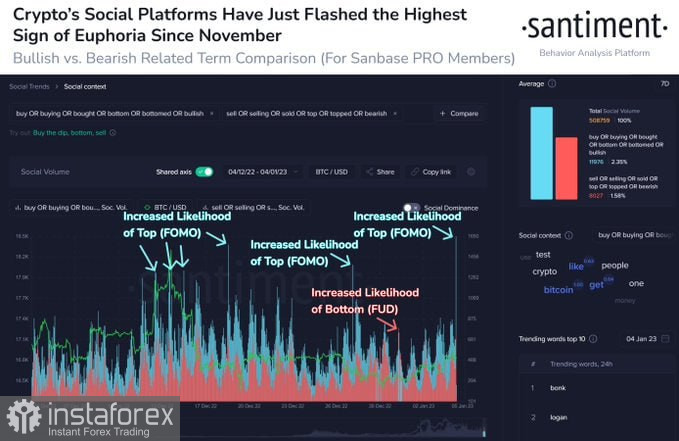

Investors with balances from 0.1 BTC to 100 BTC, who have embarked on an aggressive accumulation stage, agree with this. For six months, these categories of investors have accumulated more than 9% of the free BTC supply on the market. Santiment experts also observe a growing demand for the purchase of cryptocurrencies on social networks.

Institutional investors have also stepped up their work in the crypto direction. BlackRock Capital and Fidelity have begun bulk buying BTC for their large clients for long-term storage. According to analysts, 0.32% of managed volumes will be enough for BRC to buy back all BTC on crypto exchanges.

Historically, January has always been a favorable month for digital assets, and therefore we can't rule out an upward move towards the $18k–$18.4k area. The long period of accumulation is coming to its end, which can be seen both by the fundamental background and technical signals of the cryptocurrency.

BTC/USD Analysis

For the first time in three weeks, the cryptocurrency has approached the retest of the $16.9k level, where the 30 EMA takes place. In the last attempt, buyers did not have enough volumes to implement the bullish idea, as a result of which the price went to retest the $16.4k support level.

Also near the $16.9k level is the 0.236 Fibonacci level, which failed to be broken in early December. If Bitcoin gains a foothold above this indicator following the results of several trading days, the asset will further move towards the $17k–$17.4k area.

The key task of Bitcoin following the results of the current trading week will be an upward breakdown of the $16.4k–$16.9k fluctuation channel. Despite the growing buying sentiment, local technical signals indicate the weakness of buyers.

On the daily chart, the RSI has turned sideways and the stochastic oscillator is preparing to form a bearish crossover. At the same time, the 7-day EMA may soon break through the 30 EMA from the bottom up, which will become a strong signal of a trend reversal.

Results

Bitcoin is beginning to acquire fundamental and partly technical reasons to start an upward trend. Given the current state of the market, it is important to understand that we mean a price movement to local highs. It is not necessary to expect the price change of more than 5%.

In addition, there is still the possibility of a downward price movement if BTC fails to gain a foothold above $16.9k. SPX continues to decline, and miners still bear losses and sell BTC. Therefore, the chance of a failed retest of $16.9k remains, and in this case, the asset will resume its downward movement to the $16k–$16.4k level.