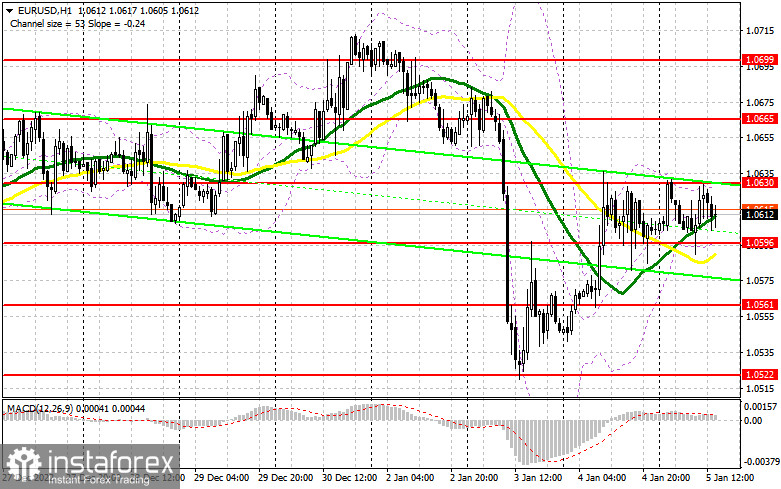

In my morning forecast I pointed out the level of 1.0596 and recommended making market entry decisions with this level in mind. Let us look at the 5-minute chart and see what happened. The euro created an excellent entry point for opening long positions after performing a false breakout of 1.0596. EUR moved up by more than 30 pips, but did not test 1.0630. The outlook for the second half of the day has not changed.

When to open long positions on EUR/USD:

This week's key events are the weekly labor market data, which will not be particularly interesting at the very beginning of the year, and the initial unemployment claims data by ADP. If the data are strong, it will push down EUR/USD. Because of this, traders are advised to make decisions based solely on technical analysis. As stated in the morning forecast, the best opportunity for opening long positions is a false breakout below 1.0596. The moving averages, which lie at this level, are currently favoring the bulls. This will create a buy signal and allow bullish traders to push the pair towards 1.0630. A breakout and a downward retest of this area will create an additional buy signal. From there, EUR/USD may surge to the high of 1.0665, and if it breaks through this level, it will trigger stop loss orders of bears and begin a new uptrend. Traders are recommended to take profits at this level. If EUR/USD slides down in the second half of the day with no buyers being present at 1.0596, it may drop to 1.0561 under renewed pressure. A false breakout of this level will create another buy signal. You can also buy EUR immediately if it bounces off the monthly low of 1.0522 or 1.0482, targeting an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bears have definitely managed to hold on to 1.0630, even though one pip separated the pair from testing that level. If EUR/USD moves up, short positions can be opened if the pair fails to settle above 1.0630. From there, it may move towards 1.0596, the level which was already tested today. The moving averages in this area favor the bulls. A breakout and an upward retest of this level will create another sell signal and send the pair towards 1.0561, where the correction will likely end. However, if EUR/USD breaks below this level as well, it will likely drop to 1.0522, making a bigger EUR downtrend possible. The most distant target is 1.0485, where I recommend taking profit. If EUR/USD moves up during the American session and bearish traders are inactive at 1.0630, short positions should be opened only if the pair fails to settle above 1.0665. You can sell EUR/USD immediately if it bounces off the high at 1.0699, taking into account a downward correction of 30-35 pips.

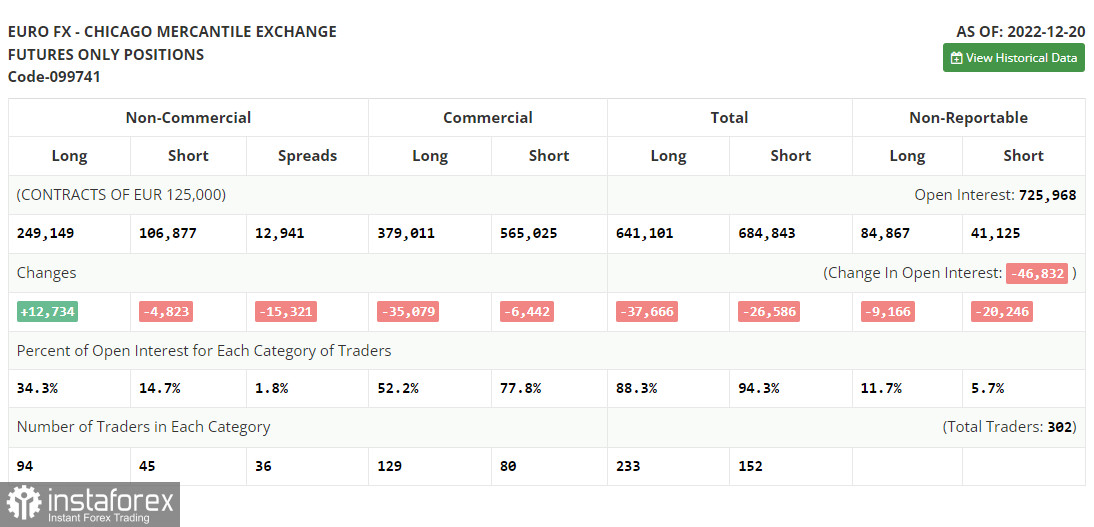

Commitment of Traders (COT) report:

According to the COT report for December 20, speculators opened more long positions, while the number of opened short positions decreased. Traders increased their net long positioning following policy meetings of central banks, as well as positive eurozone and German data. However, it did not affect the overall situation significantly, and the pair remained within last week's trading channel. Strong US Q3 GDP and labor market data have given support to the US dollar, as traders expect the Fed to tighten its policy further due to high inflationary risks in 2023. The looming recession has also made risky assets undesirable for traders. The COT report indicates that long non-commercial positions rose by 12,734 to 249,149, while short non-commercial positions fell by 4,823 to 106,877. At the end of the week, total net positioning of non-commercial traders increased sharply to 142,279 from 122,247. This indicates that investors, despite existing concerns, continue to buy the euro anticipating a sharper rate hike by the ECB in 2023. However, further upside movement of the euro requires a new fundamental trigger. The weekly closing price rose to 1.0690 vs. 1.0342 in the previous week.

Indicators' signals:

Moving averages

Trading is carried out right above the 30-day and 50-day moving averages, which indicates that the euro is trading flat.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD moves up, the indicator's upper border at 1.0630 will serve as resistance.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders.