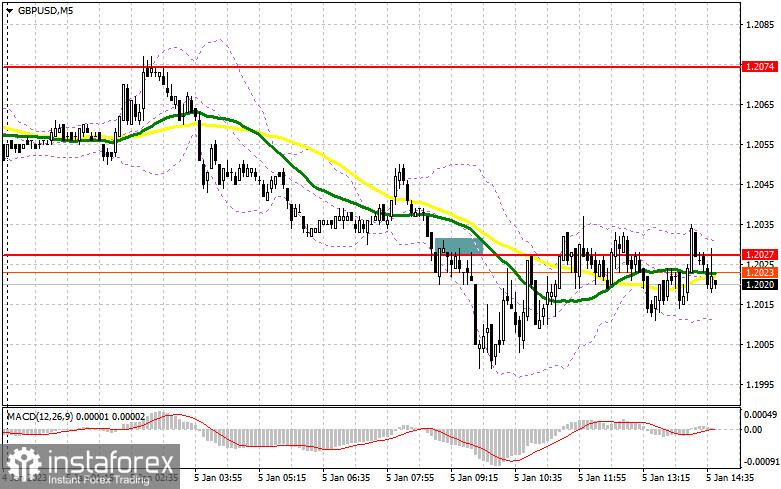

I focused on the 1.2027 level in my morning forecast and suggested making considerations about joining the market there. Let's analyze the 5-minute chart to see what transpired there. Following the release of dismal PMI index data, the 1.2027 breakthrough and reversal test from the bottom up in the first half of the day provided the entry point for the sale of the pound, which culminated in its subsequent sell-off. The pair decreased by around 30 points as a result, although it never tested the nearest support level of 1.1986. I didn't change the technical picture or the plan itself for the second half of the day.

To open long positions on GBP/USD, you need:

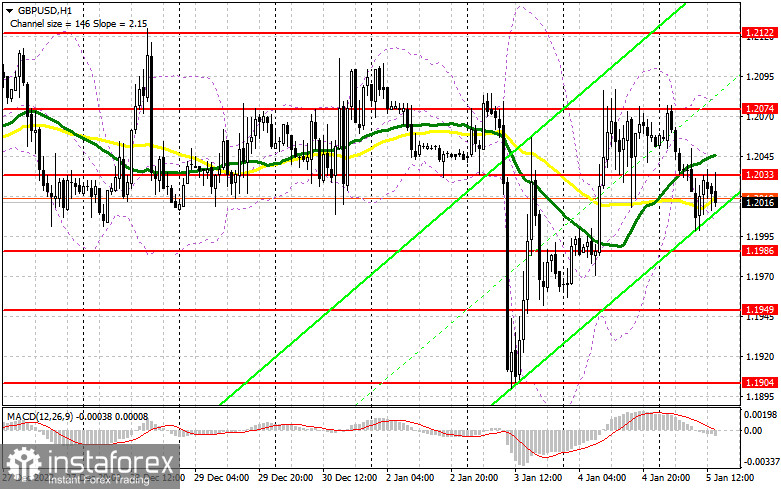

In addition to a report on changes in the number of employed from ADP and the balance of international trade, figures on applications for unemployment benefits in the United States are also made public during the American session. Positive results could result in an even bigger strengthening of the US dollar relative to the US dollar as these indications are extremely significant for the market. With positive news, it is preferable to watch for the pair to fall and the development of a false breakdown in the support level of 1.1986. As a result, you will receive a purchase signal and be able to move over 1.2033, where the moving averages are already favoring sellers. We can anticipate a sharper upward surge and an upgrade to 1.2074, from where the pound aggressively declined throughout the Asian session, if there is a breakthrough and consolidation above this level. The growth chances above 1.2122, where I advise fixing profits, will be opened up by an exit above 1.2074 with a comparable test. The bulls' pressure on the pair will intensify dramatically if they are unable to complete the duties assigned to them and miss 1.1986 in the afternoon. This will cause the demolition of the stop orders put below by purchasers. Because of this, I suggest that you hold off on making any purchases and instead begin long positions on a downturn and a fake breakdown close to the minimum of 1.1949. I advise purchasing GBP/USD right away in anticipation of recovery from 1.1904 to gain 30-35 points in a single day.

To open short positions on GBP/USD, you need:

The bears made it obvious that they intend to bring the pound back to a monthly minimum, but much will depend on data related to the US labor situation, which has a direct impact on inflation and future Federal Reserve System policies. Now that the pair is below 1.2033, the sellers' primary goal is to keep it there. While trade will continue below this area, sellers have a good probability of updating yesterday's lows. Waiting for a false breakdown to occur in the region of 1.2033, which will also be a good signal to begin short positions in anticipation of a return of the bear market and a down to a minimum of 1.1986, would be preferable for new sales in the current circumstances. With a rise to 1.1949 and the potential for updating 1.1904, where I advise fixing profits, only a breakthrough and a reversal test from the bottom up of this range will provide an entry opportunity to sell. Nothing bad will occur with the possibility of GBP/USD growth and the lack of bears around 1.2033, but the pound will see less pressure. In this instance, the sole entry opportunity into short positions to continue down is a false breakdown in the vicinity of 1.2074. If there is no activity there, I urge you to sell GBP/USD right away at the highest price of 1.2122, but only if you are counting on the pair to fall back by 30-35 points over the day.

Signals from indicators

Moving Averages

Trading is taking place just below the 30 and 50-day moving averages, which suggests that the pair is likely to continue falling.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2075, will serve as resistance in the event of growth.

An explanation of the indicators

• Moving average (moving average, determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the graph.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

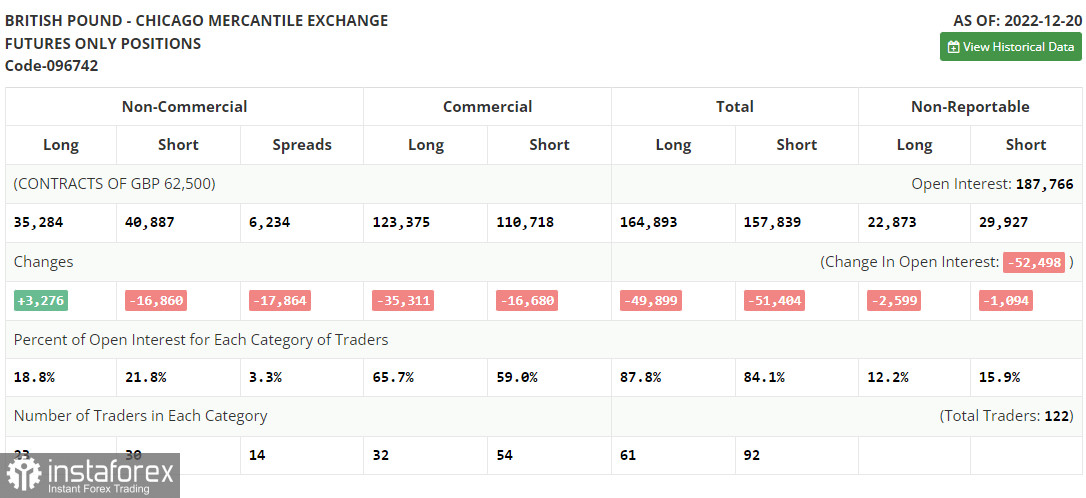

• Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.