This week, bulls and bears of the EUR/USD pair alternately intercept the initiative. For instance, on Tuesday, bears organized quite a powerful breakthrough, going down from 1.0685 to 1.0520. On Wednesday, the bulls regained some of the lost positions, returning to the area of the 6th figure. But they failed to hold on to it so on Thursday, the price fell sharply to the base of the 5th figure again.

Such price "swings" indicate that both bulls and bears are not confident in their abilities. After all, despite the relatively high volatility, it is of little use since the pair is actually marking time, revolving around the 1.0600 mark. The parties alternately win the rounds, but at the same time they cannot develop a stable trend. In order to develop an upward movement, bulls need to cross the resistance level of 1.0700 and gain a foothold within the 7th figure. On the other hand, in order to build a downward movement, bears need not to push through the support level of 1.0500, but also to identify their positions in the area of the 4th price level. In this case, it will be possible to talk about a new price level at 1.0250-1.0450, which may pave the way to a parity level in the future.

However, this is still very far away. The "downward wind" emerges spontaneously, and also suddenly fades away. But for a stable price movement, an equally stable "weather" is needed – that is, an appropriate fundamental background.

The minutes of the December Federal Reserve meeting failed to cope with this task, although many experts were betting on this report, suggesting that it would strengthen or weaken the greenback. The document actually turned out to be hawkish (the Fed members actually ruled out the option of a rate cut in 2023), but the dollar was passive towards it. Firstly, the Fed's minutes did not answer the main questions for dollar bulls: whether the central bank is ready to pause rate hikes and whether it is ready to revise the final point of the current tightening cycle (if inflation continues to decelerate) to the downside. The Fed has carefully sidestepped these "uncomfortable questions", preserving a certain intrigue here. On top of that, the dollar came under pressure from the ISM manufacturing index, which was released hours before the minutes were released. The index keeps sliding down consistently, making new lows (December's reading was at 48.4, the weakest result since May 2020).

However, as mentioned above, on Thursday, the bears turned the situation in their favor. During the US session, the pair rapidly declined to the support at 1.0520: in this price point, the bottom line of the Bollinger Bands indicator coincides with the Kijun-sen line on the daily chart.

This trend was due to several fundamental factors. First, the political crisis in the lower house of Congress is getting worse in America. This fact, due to its uniqueness, provides indirect support to the safe dollar. Secondly, the greenback reacted positively to the ADP report on the US labor market, which came out in the green zone. Finally, the dollar strengthened on Thursday on the back of the US stock market decline. The stock market closed lower on Thursday amid negative dynamics from the technology, utilities and industrial sectors. In particular, the Dow Jones fell 1.02%, the S&P 500 fell 1.16% and the NASDAQ Composite fell 1.47%.

As for the political crisis in America, it is a unique situation: on Thursday, the House of Representatives is casting its tenth vote to name a speaker. This beats the record of a century ago, when they still managed to elect a speaker in the ninth round. The tenth round will be the longest "contest" in the lower chamber in 164 years.

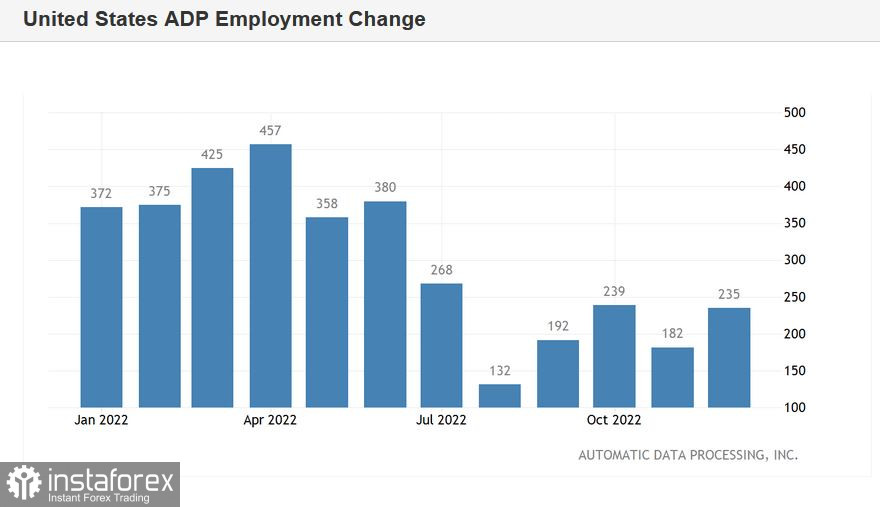

However, the political factor played a very indirect role in strengthening the greenback. In my opinion, the bulls were first of all inspired by the ADP report, which is a kind of "storm chaser" in the run-up to the release of the Nonfarm data. According to the agency, the number of US non-farm employment increased by 235,000 in December (while the preliminary forecast was at the level of 150,000).

If the official numbers on Friday repeat the trajectory of that release, the dollar will strengthen its position across the board. But we have to remember that the ADP numbers do not always correlate with Nonfarm payrolls, so it is risky to "bet" in favor of the greenback.

The general outlook for Friday's report is for the job growth rate to rise by 200,000 in December. The unemployment rate is likely to remain flat at 3.7%. The annualized growth rate of average hourly earnings may slow to a low of 5.0% (down from 5.1% in November).

Thus, the dollar appears to be appreciating "up front" after being inspired by a very good report from the ADP. However if the official figures fail the USD bulls, the pair could finish the trading week around 1.0650-1.0680, rushing from one extreme to the other, so to say. Therefore it is still advisable to take a wait-and-see attitude due to the high uncertainty.