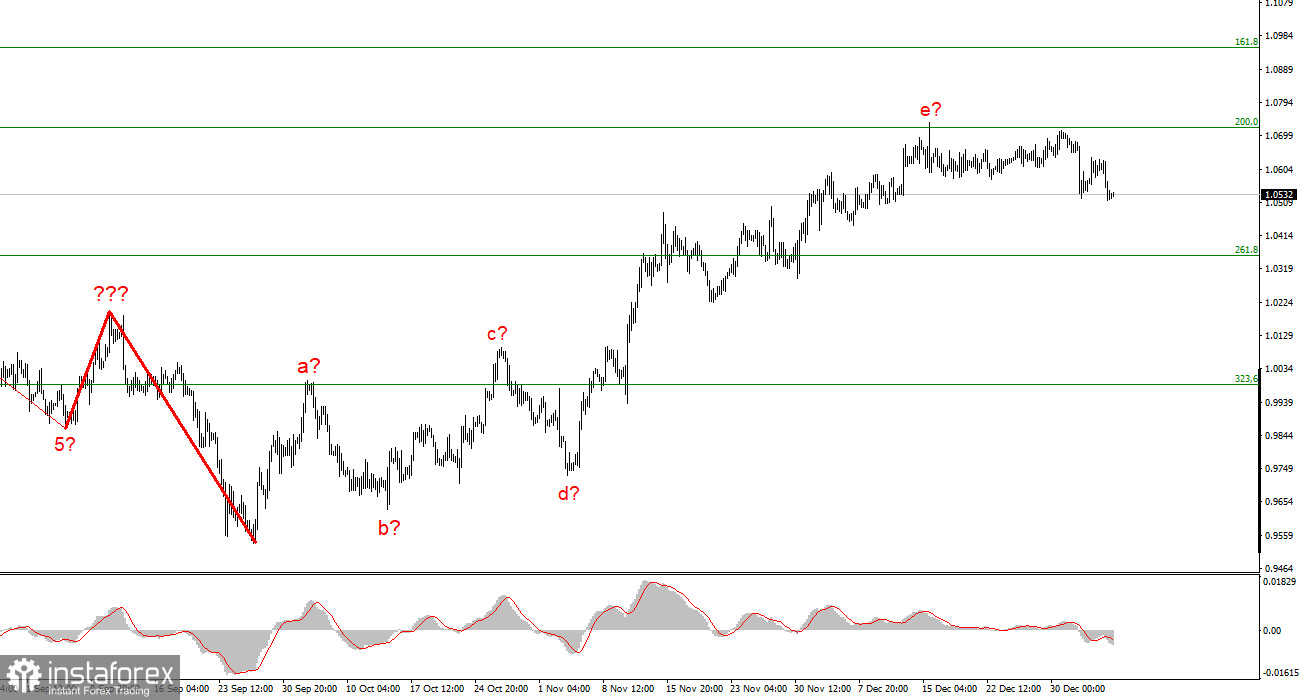

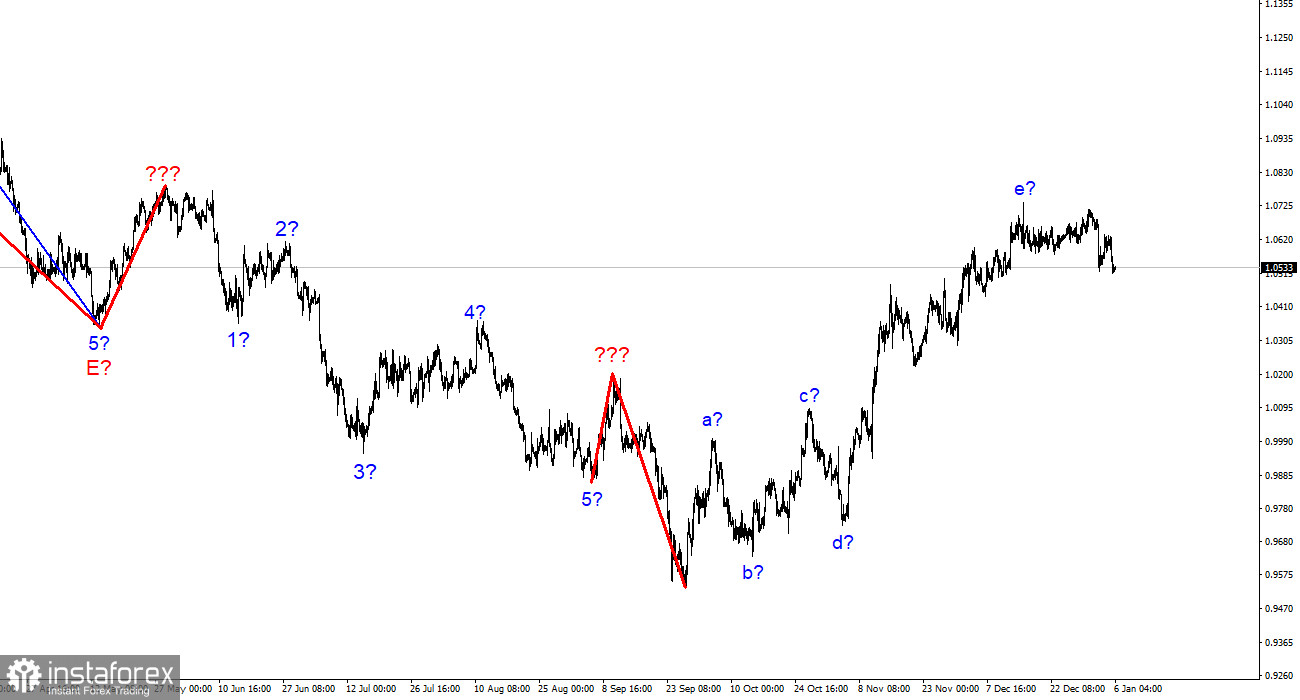

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be fairly accurate, and the entire upward phase of the trend is still highly complex. It now has a clear corrected and lengthened form. Waves a-b-c-d-e have been combined into a complicated corrective structure, with wave e having a form that is far more complex than the other waves. Since the peak of wave e is substantially higher than the peak of wave C, if the existing wave arrangement is accurate, construction on this structure may be nearly finished or may already be finished. I'm getting ready for a decrease in the instrument because, in this scenario, we are predicted to build at least three waves down. The demand for the euro currency is decreasing this week, and the currency is moving away from its recent heights. These two marks, along with a failed attempt to surpass the Fibonacci 200.0% level at 1.0726, could indicate the end of the development of the upward trend section. Now, nevertheless, US dollar demand must increase further. The context of the news this week enables us to anticipate such a result.

The state of business in the EU is still disappointing.

On Thursday, the euro/dollar instrument decreased by 80 basis points. Active movements didn't start until noon, and in the morning, there wasn't much news in the United States or the European Union. Nevertheless, I must tell out that the European Union's construction sector business activity index dropped to 42.6 points, while it was 41.7 points in Germany. The construction industry is less significant than the manufacturing or service sectors, yet as this week's news revealed, not everything is in order. While several indices increased, they all ultimately stayed below the critical value of 50.0. Thus, all three areas continue to see declining business activity. Even though the reports themselves are of little market significance, this aspect alone is enough to lower demand for the euro.

Additionally, this week saw the release of the FOMC protocol, something the market does not always welcome. Typically, this is only the Fed board of directors' summaries of economic theses, which reflect their perspective. The FOMC's stance is still considered to be "hawkish" as of Wednesday, and as of right now, I have no questions for the Fed. There is no break in the process of tightening monetary policy, therefore it is obvious that the US rate will climb in the near future. The rate itself may increase to 5.5% or even a bit higher. This, in my opinion, is the second element supporting this week's strengthening of the US dollar. Wave analysis is the third and most significant factor. The market cannot ignore it because it has been indicating for several weeks running that a downward set of waves must be built. The wave e might have lasted even longer if the European currency had been supported by the news background. However, current news does not help the euro.

Conclusions in general

Based on the analysis, I conclude that the construction of the upward trend section has become more complicated to the five-wave and is nearing its completion or completed. As a result, I suggest making sales with objectives close to the predicted 0.9994 level, or 323.6% Fibonacci. We have a signal for a drop and a departure of quotes from the recent highs, while there is a chance that the rising phase of the trend will become even more lengthy and complicated. The likelihood of this scenario is still pretty high.

The wave marking of the descending trend segment notably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this portion is complete, work on a downward trend segment can start.