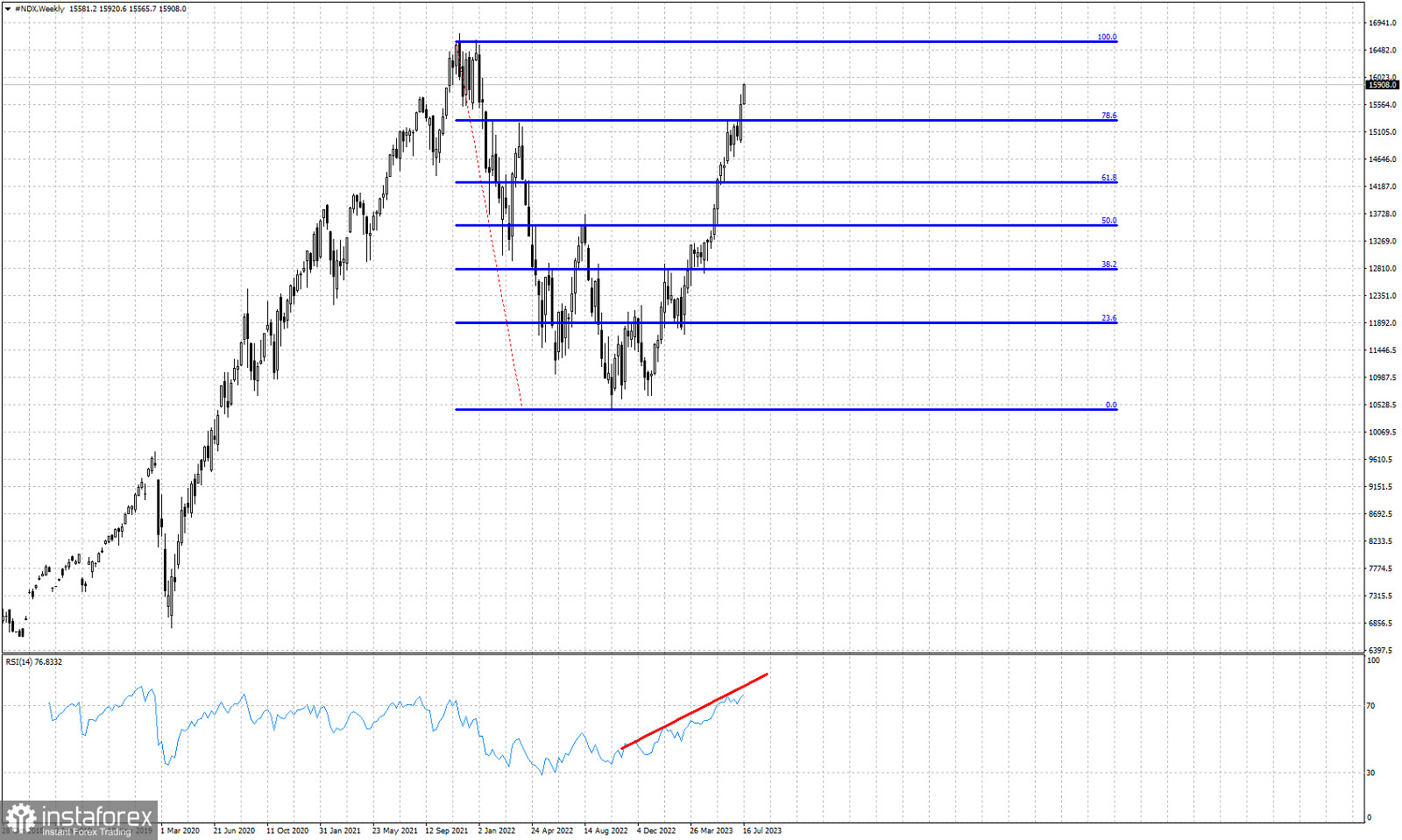

Blue lines- Fibonacci retracements

Red line- higher highs

Unstoppable NASDAQ continues it's vertical bull run making higher highs and higher lows. Recent price action suggests that over the coming weeks we should expect to see higher levels and most probably new all time highs. Breaking above the 78.6% Fibonacci retracement usually leads to new higher highs. The RSI has just entered overbought levels above 70 as it continues to make higher highs. There is no sign of a weakening up trend or major top formation. Yes we could see a pull back towards 15,300 or even lower, yes a pull back is justified, but the most probable scenario would be that this pull back will form a higher low and the up trend will eventually resume.