Key data on the US labor market was released at the beginning of Friday's US session. This report is usually important, but in the light of recent events it has become particularly significant for dollar bulls. It should be considered through the prism of the last FOMC meeting, the results of which were quite contradictory. In fact, Federal Reserve Chairman Jerome Powell tied the pace (and scale) of monetary tightening to key macroeconomic indicators, primarily labor market and inflation. Therefore, Friday's report was significant not just for the day, but also for the long term, in particular, in the context of the first Fed meeting of 2023.

Looking ahead, take note that current price fluctuations should be treated with a certain degree of skepticism - the notorious "Friday factor" blurs the overall picture. Right after the release, the US dollar index nearly renewed a peak by hitting 105.400. But literally within an hour, the index turned south and returned to the initial positions. The EUR/USD pair behaved similarly: after a sharp decline to 1.0485 (four-week low), it returned to the area of the fifth figure. In other words, Friday's Nonfarm did not provoke a dollar rally despite it being in the green zone.

In the foreign exchange market, unfortunately, it is relatively rare for traders to get unambiguous signals of a fundamental nature. As a rule, one of the components of the release is out of the ordinary, thereby sowing doubts about a particular trading decision. Therefore, the market's initial reaction is often false: traders evaluate the importance of a particular indicator in the context of other indicators, and eventually they make their verdict. For instance, at one end of the scale there is a decrease in unemployment, a stronger increase in the number of people employed in the non-farm and private sectors, and a slight, albeit growing share of the economically active population. At the other end of the scale are wage indicators, which fell well short of projections.

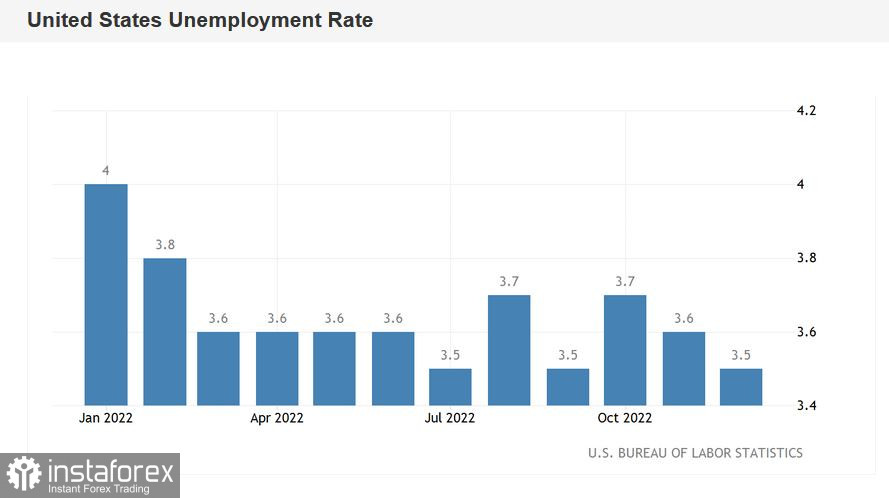

Thus, the number of employed in the nonfarm payrolls sector increased by 223,000 in December, while projections were somewhat lower, at the level of 200,000. A month ago, this indicator was at 202,000 (according to the data specified on Friday). The December indicator of growth of the number of employed in the private sector did not disappoint either, as 220,000 jobs were created in this sphere (while the growth forecast was 180,000). The share of the economically active population increased as well. In this case we are talking about a slight decrease (by 0.1% relative to the November figure) - but being in the green zone added to the overall picture. Moreover, the majority of experts forecasted a slight, but still a decline (down to 62.0%). Meanwhile, the unemployment rate fell to 3.5% (this figure has not dropped to this value since last September).

This is one side of the coin. On the other side are wages, which turned out to be worse than forecasted. Monthly average hourly earnings rose to 0.3% (a downtrend for the second straight month while traders expected it to be 0.4%. On an annualized basis, the index also showed a negative trend, hitting 4.6% (the weakest result since September 2021).

Weak wage data (wage growth is still lagging behind even higher inflation) and the impact of Friday's factor prevented the bears from consolidating their success - at least on Friday, the pair returned to the 5 figure area.

Such values were not only caused by the contradictory data on the US labor market. Another data, which isn't less important for the pair, was also released on Friday. This was the main data on inflation growth in the eurozone. The overall consumer price index declined to 9.2% (forecast - 9.6%, a downtrend for the second month). In contrast, the core CPI rose to 5.2%.

In my opinion, the pair will trade in the area of the 5th figure in the medium term, and bears and bulls will pull the rope again, taking advantage of contradictory data. The bulls must defend the 5th figure (because otherwise the price will return to the 1.0250-1.0450 range). But it is also important for the bears to consolidate around the 5th price level, not allowing the bulls to return to the 1.0600-1.0680 range.

From a technical perspective, the pair tried to cross the support level of 1.0510 (bottom line of the Bollinger Bands indicator on the daily chart). Impulsively breaking through this target, traders failed to consolidate their positions and eventually lost the initiative. As a result, the price was trading between the bottom and the middle lines of the Bollinger Bands on the D1 chart, that is, in the range of 1.0510-1.0600.

Given the contradictory signals of the latest reports, traders need to assess the situation even more. Now they will focus on the comments of the European Central Bank and Fed representatives, who will assess the dynamics of European inflation and the Nonfarm in the context of their further possible actions. It would be wise to make trading decisions as early as next week, as in the run-up to the weekend traders will lock in profits, thus distorting the overall picture.