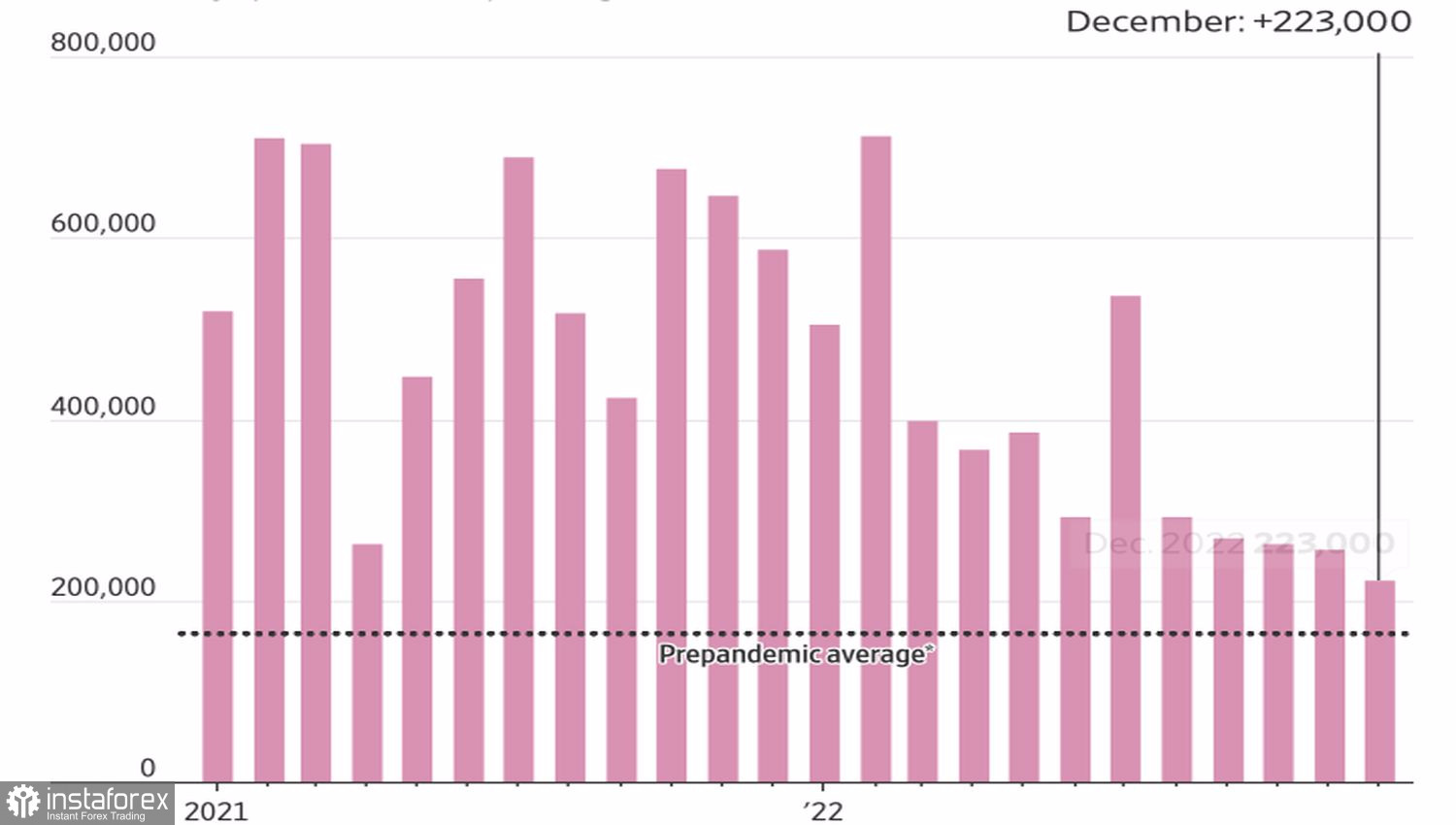

GBPUSD bulls launched a counterattack thanks to signs of slowing inflation in the United States. The growth rate of average wages declined from 5.1% to 4.6% y/y in December, which is good news for the Fed. The central bank had previously argued that a strong labor market and high service sector prices would allow inflation to consolidate at elevated levels, necessitating further increases in the federal funds rate. If not, the U.S. dollar will continue to be under pressure.

Although investor focus in 2023 may shift from inflation to the labor market as the U.S. economy nears recession, it is too early to tell. Investors are still fixated on consumer prices. And forecasts of them slowing from 7.1% to 6.6% in December, coupled with a drop in the growth rate of average wages, forced the bears on GBPUSD to retreat, which were not supported by strong employment and unemployment data.

Employment dynamics in the USA

Therefore the reasons for the pair's rise should be sought in North America, not Europe. The British economy is still breathing heavily—Bloomberg experts expect a shrink of 0.3% in October–November, which will be just another proof of recession. The only positive thing here is that inflation might slow down due to weak domestic demand.

In any case, the Bank of England found itself in an extremely unattractive position. It cannot afford to speed up the process of raising the repo rate, as this will further drive the UK economy into a hole. Conversely, too slow a tightening of monetary policy will not be able to suppress inflation, which is at its highest levels in decades. This alignment of forces allows us to talk about the weakness of the pound in 2023. In particular, Societe Generale predicts it will fall to 120 against the Japanese yen amid further weakening of control over the yield curve by the BoJ and a possible increase in the overnight rate.

Meanwhile, British Prime Minister Rishi Sunak promises to halve inflation and stimulate the UK economy. Hopefully, he will do the latter more slowly than his predecessor, Liz Truss. The enthusiasm of the previous head of the government turned out to be a total defeat for the GBPUSD bulls, with the pair falling to a record bottom.

Thus, the fate of the pound is largely influenced by external winds. And a further slowdown in U.S. inflation will be more significant for the GBPUSD than a reduction in British GDP.

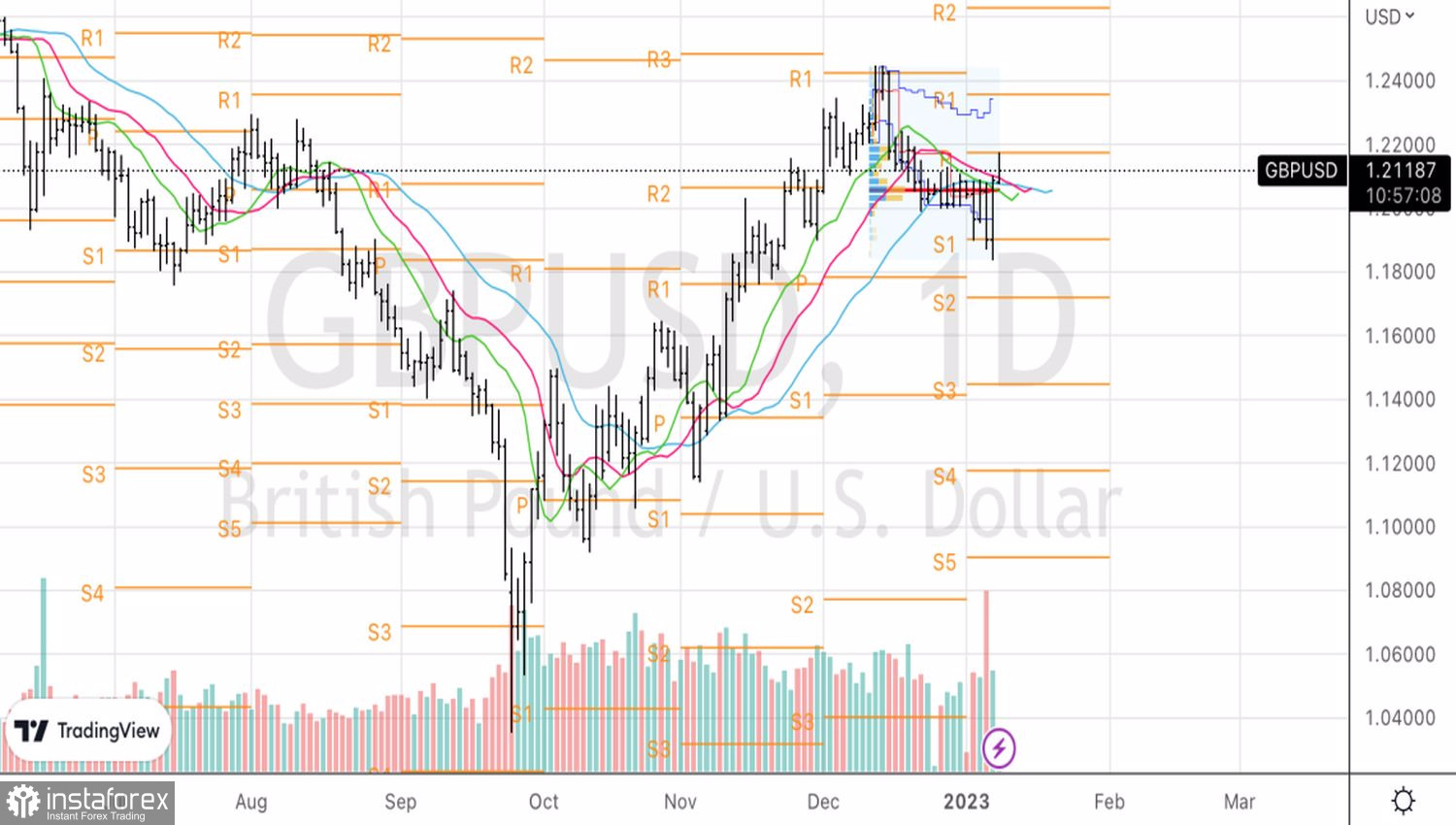

Technically, on the daily chart of the analyzed pair, there was a roller coaster with a fall below fair value and then a return above it. As a result, two of the three targets for shorts on GBPUSD, set in the previous article, were fulfilled. To continue the GBPUSD rally, a successful assault on the resistance at 1.217, where an important pivot point is located, is required. Its breakout will signal the formation of longs in the direction of 1.225 and 1.235.