As trading in China resumed and investors anticipated a pause in Federal Reserve rate hikes following Friday's data showing a significant decline in the services sector, US stock index futures continued to rise on Monday morning.

The S&P 500 and Nasdaq 100 both increased by more than 2% on Friday, and they are currently trading slightly higher in premarket trade. The Dow Jones industrial average rose 0.2%. Amid confidence regarding China's demand for raw materials, the European Stoxx 600 index also increased, with mining and energy firms setting the pace. The MSCI Emerging Markets Index resumed growing as the nation modified its approach toward COVID and provided more governmental support to the economy. It has now increased by more than 20% since the October low of the previous year.

As mentioned above, traders are still betting that the Federal Reserve System will pause its rate hikes in February of this year. The likelihood that the American economy will avoid a recession this year has decreased significantly as a result of the news that the ISM Institute of Supply Management Services index has entered the contraction zone and wage growth will slow. Benchmark 10-year bond yields have increased.

Since last week's employment data did not provide a clear picture, everything will fall into place this week when the US inflation report for December is released. In addition, wage growth has slowed significantly, and unemployment has returned to its lowest level in decades.

On Friday, Esther George of the Kansas City Federal Reserve emphasized that rates will be higher and will be maintained at this level for longer than previously anticipated, while also cautioning that authorities have a difficult road ahead as they attempt to balance employment and inflation. We have observed a modest decline in wages, Esther noted, but if we compare them to what they were during the period of 2% inflation, it is clear that things are still far from ideal.

Investors currently anticipate the rate to peak at just below 5% in the swap market, compared to forecasts of 5.06% immediately before Friday's jobs report. Regarding the size of the February increase, traders continue to differ. It appears that a quarter-point change is regarded as more probable than an increase of half a point. The US stock market will have a far greater decline this year than many pessimists anticipate, according to Morgan Stanley strategists, as the threat of a recession will cause the largest yearly decline since the global financial crisis.

The price of oil increased after a Chinese Central Bank official predicted that the nation's economy will soon develop again as Beijing gives greater financial support to individuals and businesses. After the most recent US statistics showed additional indications that the Fed will become less hawkish this year, gold prices continued to rise.

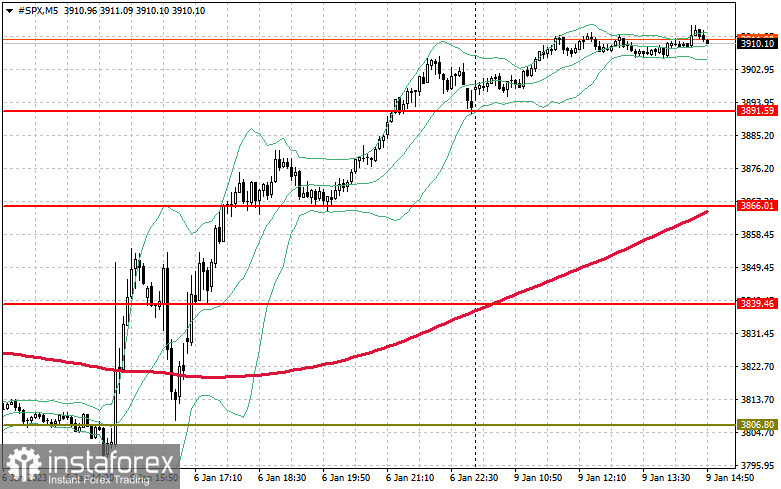

According to the S&P 500's technical picture, the index might keep expanding. The closest level, $3,920, must be reached to accomplish this, making it a priority for today. The trading instrument will need to strengthen to $3,961 before we can anticipate a more assured upward move, which will be a clear victory for the bulls at the start of the year. The level of $3,983 is a little higher and will be challenging to surpass. Purchasers just need to declare themselves in the vicinity of $3,891 in the event of a downward movement. The trading instrument's breakdown will swiftly send it to $3,866, and the $3,839 region will be the furthest goal.