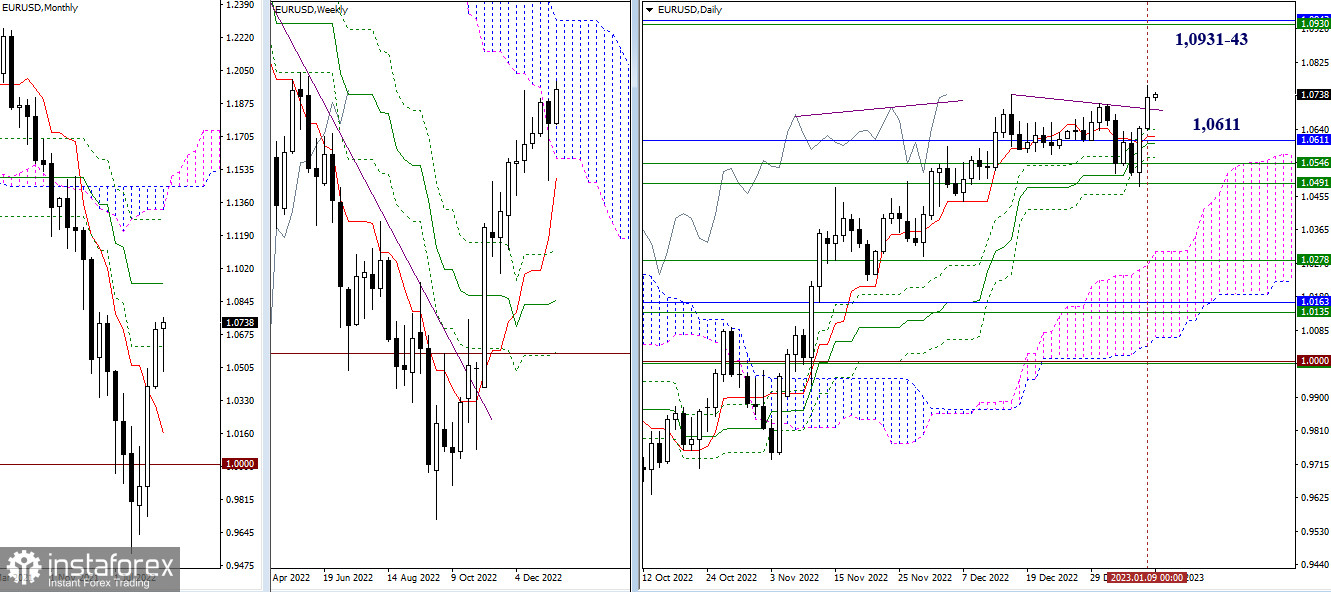

EUR/USD

Higher time frames

Bulls retested the December high of 1.0736 and completed a correction. If they maintain control over the market and develop the uptrend on the daily and weekly chart, their next upward target will be the area of 1.0931-43 (upper boundary of the weekly Ichimoku cloud + monthly medium-term trend). A break above 1.0931-43 will allow the pair to head for new upward targets. The support zone has expanded by now and is found at the levels of 1.0611 – 1.0546 – 1.0491. These are the levels of different time frames and they form the daily cross pattern, the lower boundary of the weekly Ichimoku cloud, the weekly short-term trend, and the monthly Fibo Kijun line.

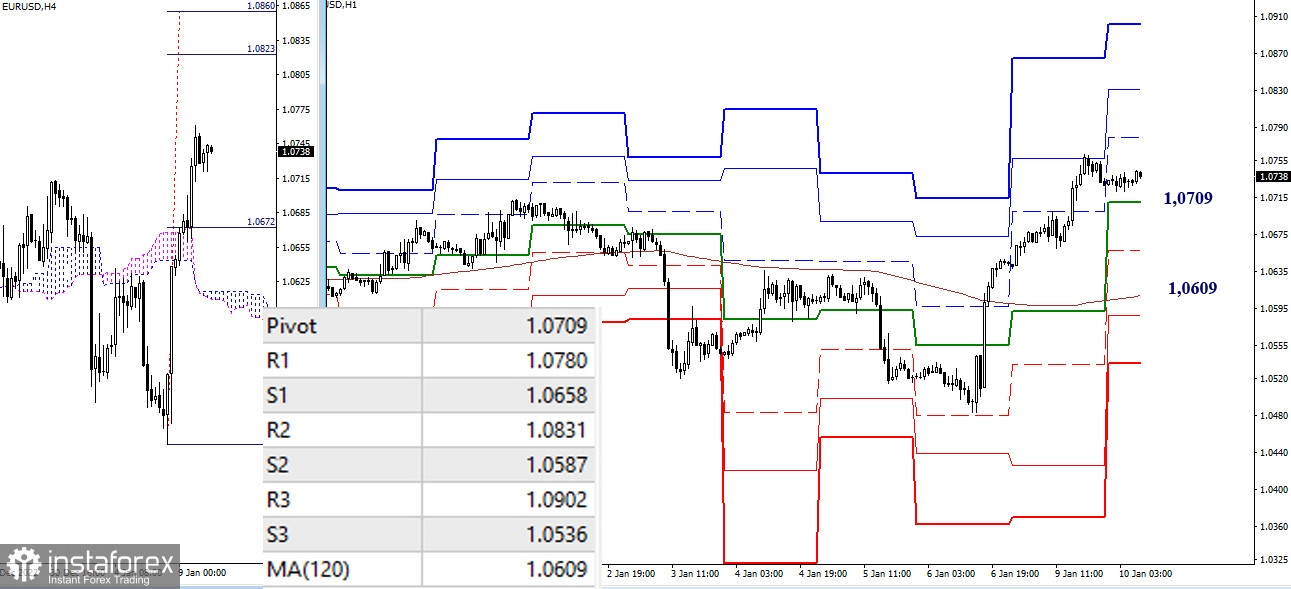

H4 – H1

On lower time frames, bulls are also in control of the market. If the price continues to rise today, it may face intraday resistance at the standard pivot levels of 1.0780 – 1.0831 – 1.0902. The key levels are acting as support and forming an extended support zone. The nearest support is found at the central pivot level of 1.0709. Then, it is followed by interim support at 1.0658. The key level is where a weekly long-term trend is found (1.0609). Consolidation below this level and a reversal of the moving average may change the market balance.

***

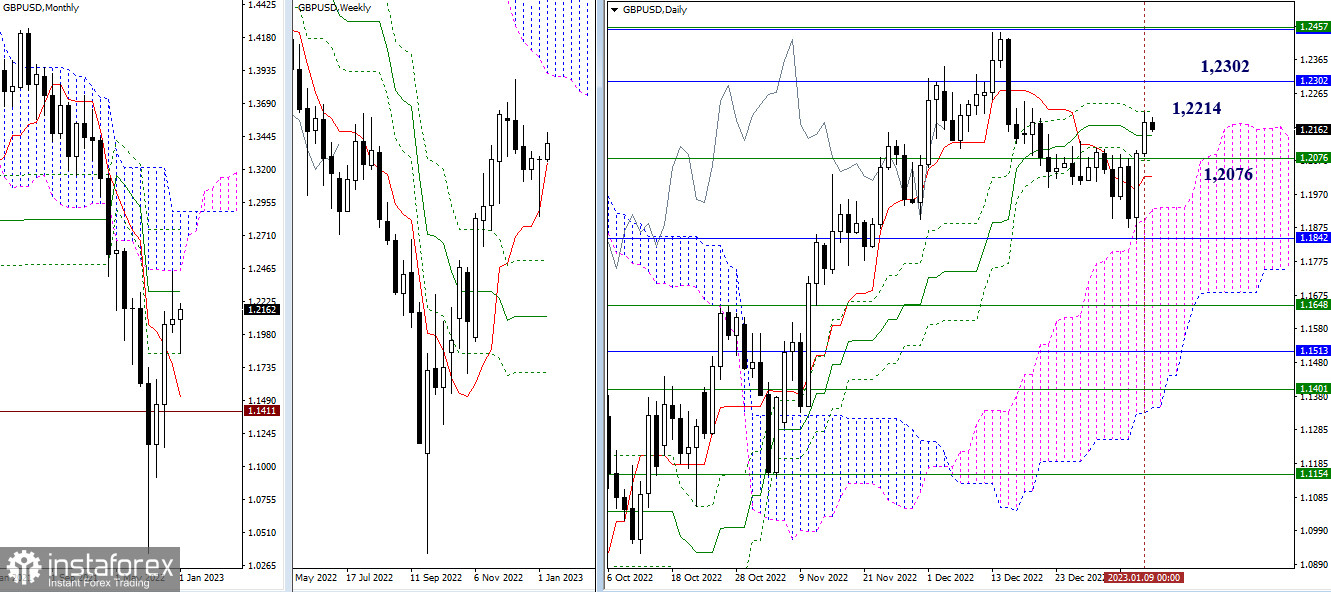

GBP/USD

Higher time frames

Yesterday, the pair continued its uptrend. Our previous conclusions and expectations are still relevant today. The main task for the bulls is to cancel the Ichimoku Death Cross pattern at 1.2214. Then, the price may face resistance at the monthly medium-term trend at 1.2302. Also, the highest point of the correction at 1.2445 may coincide with resistance levels located at the lower boundaries of weekly (1.2457) and monthly (1.2454) Ichimoku Clouds. In this case, the pair will have the nearest support at the daily Ichimoku Cross pattern at 1.2142 – 1.2071 – 1.2025), confirmed by a weekly short-term trend at 1.2076.

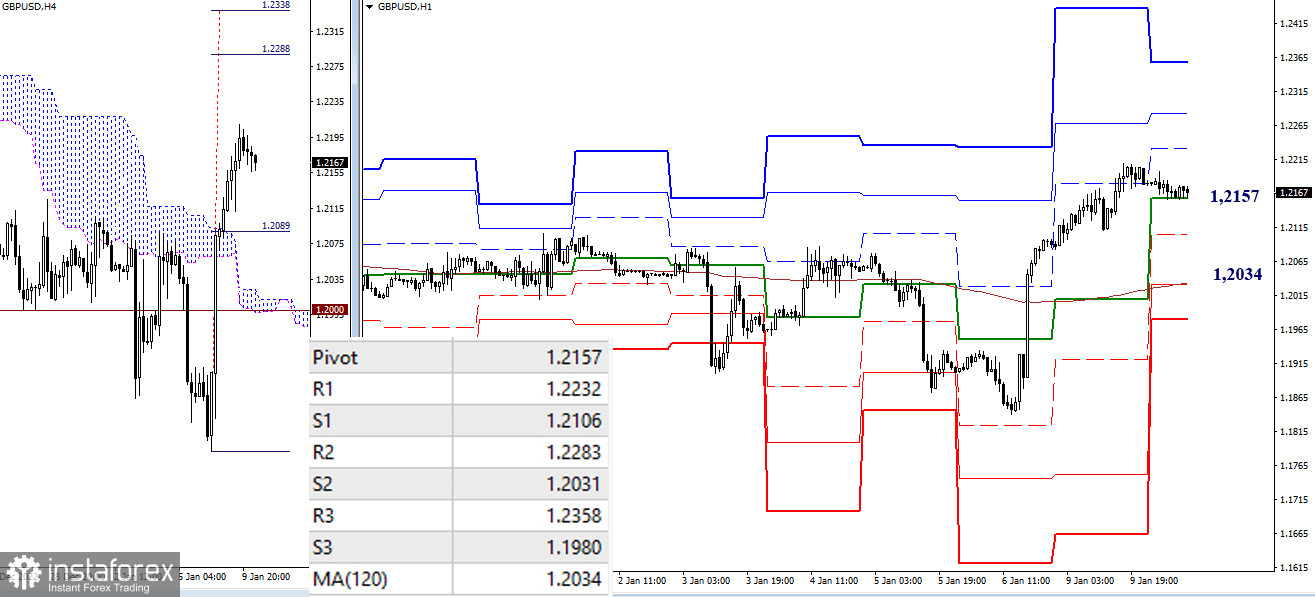

H4 – H1

On lower time frames, buyers alos prevail. Their intraday upper targets are located at standard pivot levels at 1.2232 – 1.2283 – 1.2358. The price may even break through the Ichimoku Cloud on H4 (1.2288 – 1.2338). Currently, the pair is declining as the price is testing the central pivot level of 1.2157. Then the pair may hit interim support at S1 (1.2106) and the weekly long-term trend at 1.2034. Consolidation below this range and a reversal of the moving average may change the market balance on lower time frames.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)