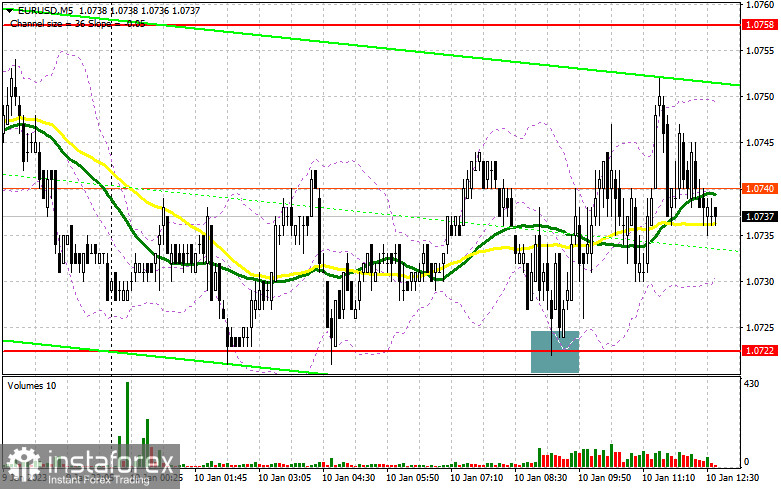

In the morning article, I turned your attention to 1.0722 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A decline and a false breakout of 1.0722 as well as the lack of economic reports and the limited upward potential of the pair created a good buy signal for the euro. At the time of writing the article, the pair rose by about 25 pips. The technical outlook remained unchanged as well as the trading strategy.

When to open long positions on EUR/USD:

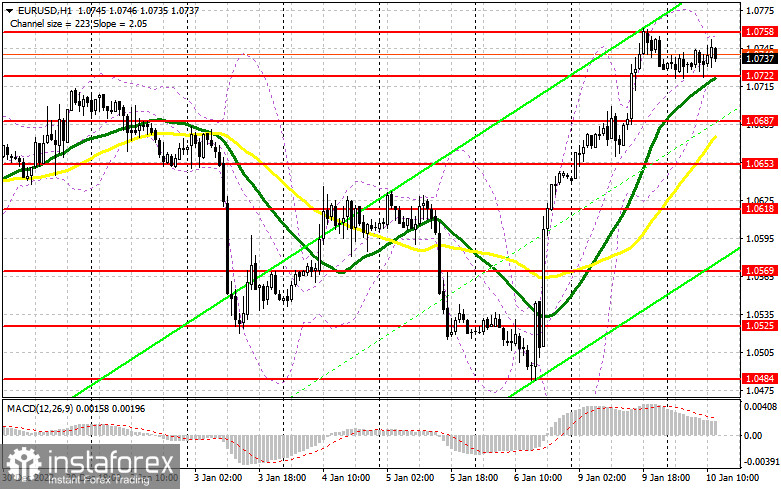

In the American session, there will be no crucial economic reports. Traders are now anticipating Jerome Powell's speech. He is projected to touch upon such topics as stubbornly high inflation and the labor market. He may also stress the need for further monetary tightening to achieve the goals set by the central bank at the start of last year. Inflation is still far from the 2% target. This is why a policy reversal looks unlikely. If Powell provides hawkish remarks about keeping the interest rate at a restrictive level for a longer time, demand for the US dollar is sure to increase. The pressure on the pair could escalate. For this reason, I would stick to the following scenario. A drop and a false breakout of the support level of 1.0722, similar to the one I discussed above, could give a buy signal. If so, the pair may return to the weekly high of 1.0758. The pair failed to settle above this level in the morning. A breakout and a downward retest of this level will provide new buying opportunities. The pair could jump to 1.0791, boosting the bullish trend. A breakout of this level will occur only amid Powell's dovish statements. Bears will have to close Strop Loss orders. It will give a new buy signal with the prospect of a rise to 1.0820 where I recommend locking in profits. If EUR/USD declines and bulls show no activity at 1.0722 in the afternoon, which is quite likely, the pressure on the pair will increase significantly. Therefore, it would be better to focus on the support level of 1.0687 where only a false breakout will generate a new buy signal. You could buy the instrument at a bounce from a high of 1.0653 or lower at 1.0618, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Traders ignored the morning speeches of ECB policymakers. This is why the market sentiment remained unchanged. It is very important for bears to maintain control over 1.0758. As long as trading is carried out below this level, there is a chance of a larger downward correction. If EUR/USD grows during the American session, it is better to open short positions after a failure to consolidate above 1.0758. It will provide new entry points in short positions. The pair could decline to 1.0722. It has already tested this level several times today during the Asian and European sessions. A breakout and an upward retest of this level could significantly undermine short-term bullish prospects, increasing pressure on the euro. if so, a new sell signal may appear. The price is likely to decrease to 1.0687 where the moving averages are benefiting the bulls. Bears are sure to retreat after the first test of this level. A drop below this level could lead to a sharper downward movement to 1.0653. If so, bears will take the upper hand. A more distant target will be the 1.0618 level where I recommend locking in profits. If EUR/USD rises during the American session and bears show no energy at 1.0758, I would advise you to postpone short positions until a false breakout of 1.0791. You could sell EUR/USD at a bounce from a high of 1.0820, keeping in mind a downward intraday correction of 30-35 pips.

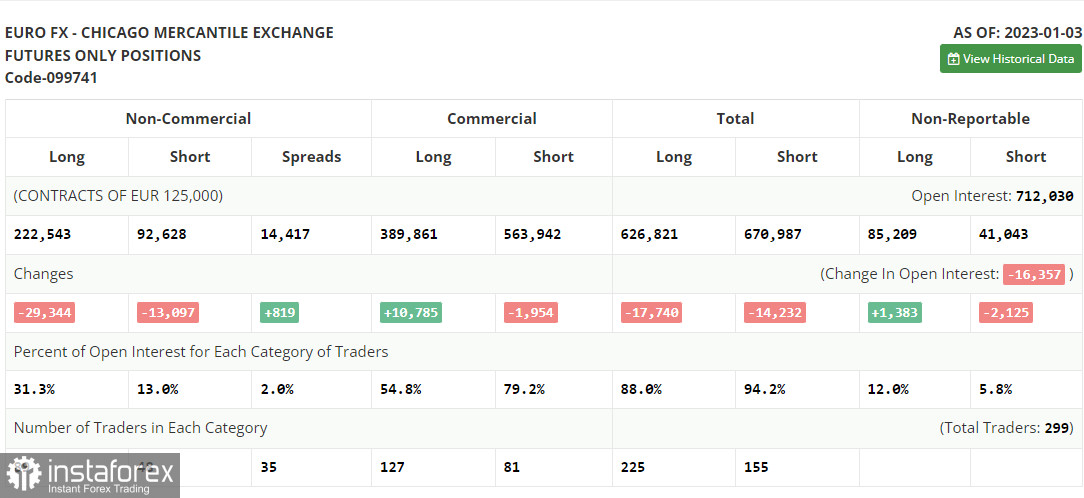

COT report

The COT report (Commitment of Traders) for January 3 logged a sharp drop in both long and short positions. Traders preferred to lock in profits at the start of the year due to uncertainty over the further policy decisions of the Fed and the ECB. Inflation is starting to slow down. This is why it is high time to abandon aggressive tightening. However, the Fed will hardly do that. Traders are concerned that monetary tightening could trigger a recession in the global economy this year. For this reason, demand for risky assets is limited. Apart from that, traders are now anticipating the US inflation report. It is likely to provide more clues about the Fed's future plans for monetary policy. Fed Chairman Jerome Powell's speech this week is likely to be devoted to this problem. The COT report revealed that long non-commercial positions decreased by 29,344 to 222,543, while short non-commercial positions fell by 13,097 to 92,628. At the end of the week, the total non-commercial net position declined sharply and amounted to 129,915 against 142,279. It appears investors are still opening long positions on the euro despite uncertainty over the ECB's steps on monetary policy. They are betting on a policy reversal this year. However, the euro needs new drivers for further growth. The weekly closing price slid to 1.0617 against 1.0690.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages. It indicates strong bullish momentum.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD climbs, the indicator's upper border at 1.0758 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.