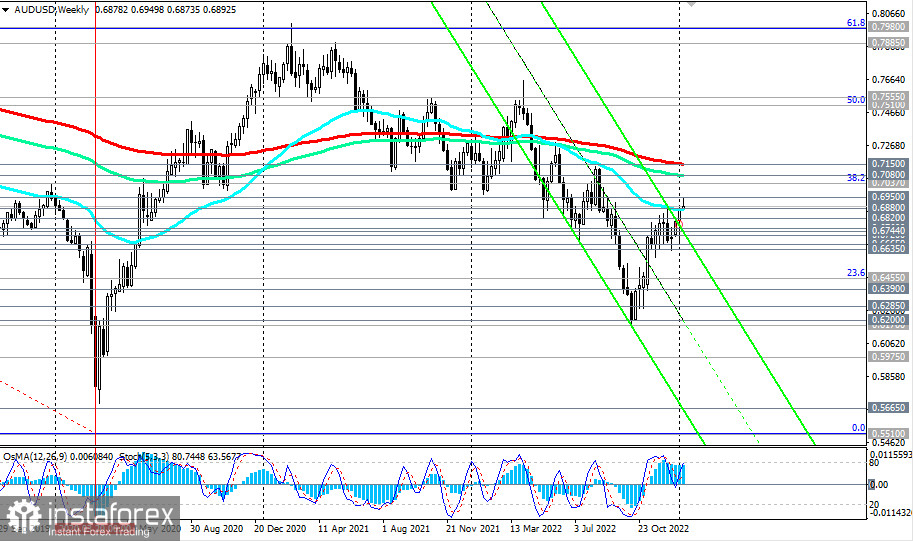

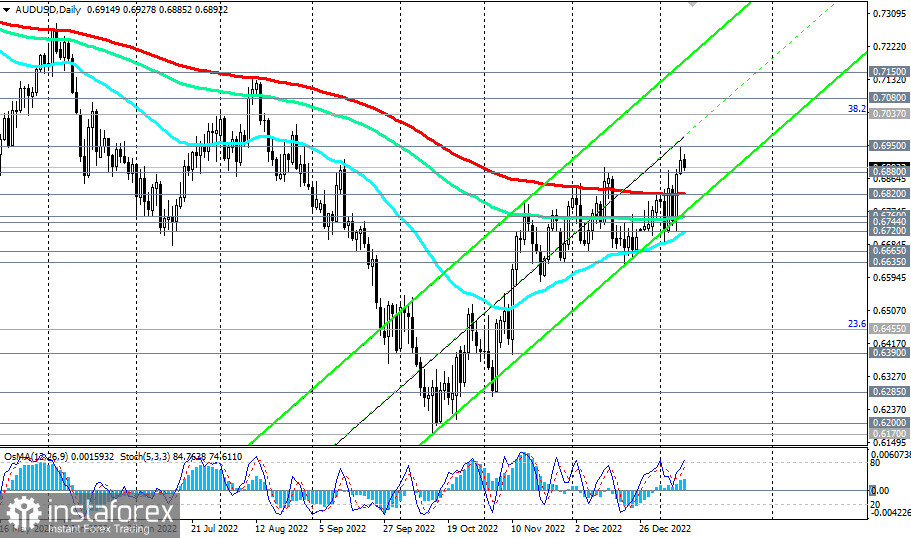

Against the background of positive news from China and the weakness of the U.S. dollar, the AUD/USD pair has grown significantly in the last two trading days. Yesterday, it reached a new 5-month high at 0.6950, breaking into the zone above the important long-term resistance level at 0.6880 (50 EMA on the weekly chart).

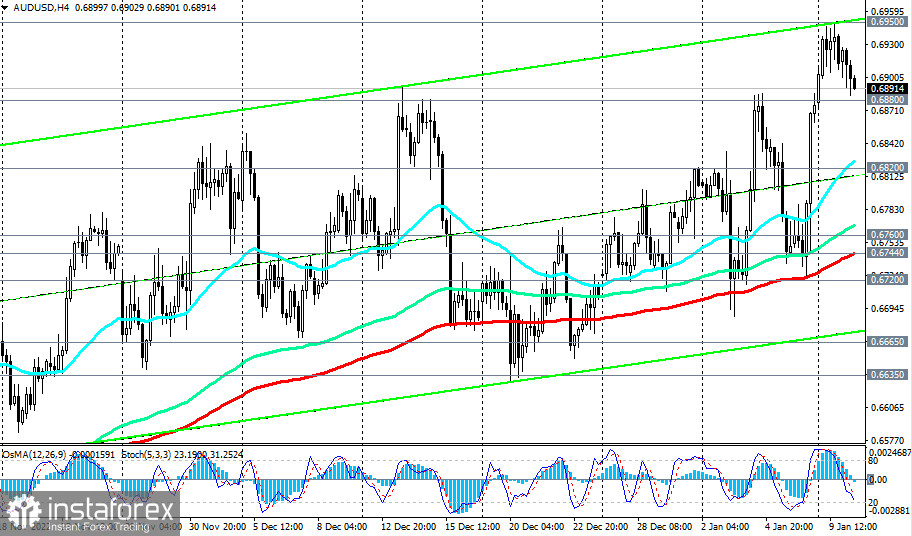

Today, the pair is falling, and as of writing, it is trading in close proximity to this level and the mark of 0.68880.

In case of its breakdown, the pair will fall again to the 0.6820 key support level (200 EMA on the daily chart). In turn, its breakdown will return the pair to the long-term bear market zone.

In an alternative scenario, AUD/USD will still break above the 0.6950 local resistance level and head towards the key resistance levels 0.7080 (144 EMA on the weekly chart), 0.7150 (200 EMA on the weekly chart).

If Fed Chairman Jerome Powell's rhetoric today regarding the Fed's monetary policy outlook turns out to be tough, the greenback may get a chance to regain its lost ground from the previous days. In this case we can expect the implementation of the main scenario and decline in AUD/USD.

The signal to open new short positions will be a breakdown of the 0.6880 support level. The immediate target of the decline is the 0.6820 support level. Further targets are the levels 0.6760, 0.6744, 0.6720 and return inside the descending channel on the weekly chart, with the lower boundary passing through 0.5665.

Support levels: 0.6880 0.6820 0.6760 0.6744 0.6720 0.6665 0.6635 0.6600 0.6500 0.6455 0.6390 0.6285 0.6200 0.6170 0.5965

Resistance levels: 0.6950, 0.7000, 0.7037, 0.7080, 0.7150

Trading Tips

Sell Stop 0.6870. Stop-Loss 0.6930. Take-Profit 0.6820, 0.6760, 0.6744, 0.6720, 0.6665, 0.6635, 0.6600, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170, 0.5975, 0.5665, 0.5510

Buy Stop 0.6930. Stop-Loss 0.6870. Take-Profit 0.6950, 0.7000, 0.7037, 0.7080, 0.7150