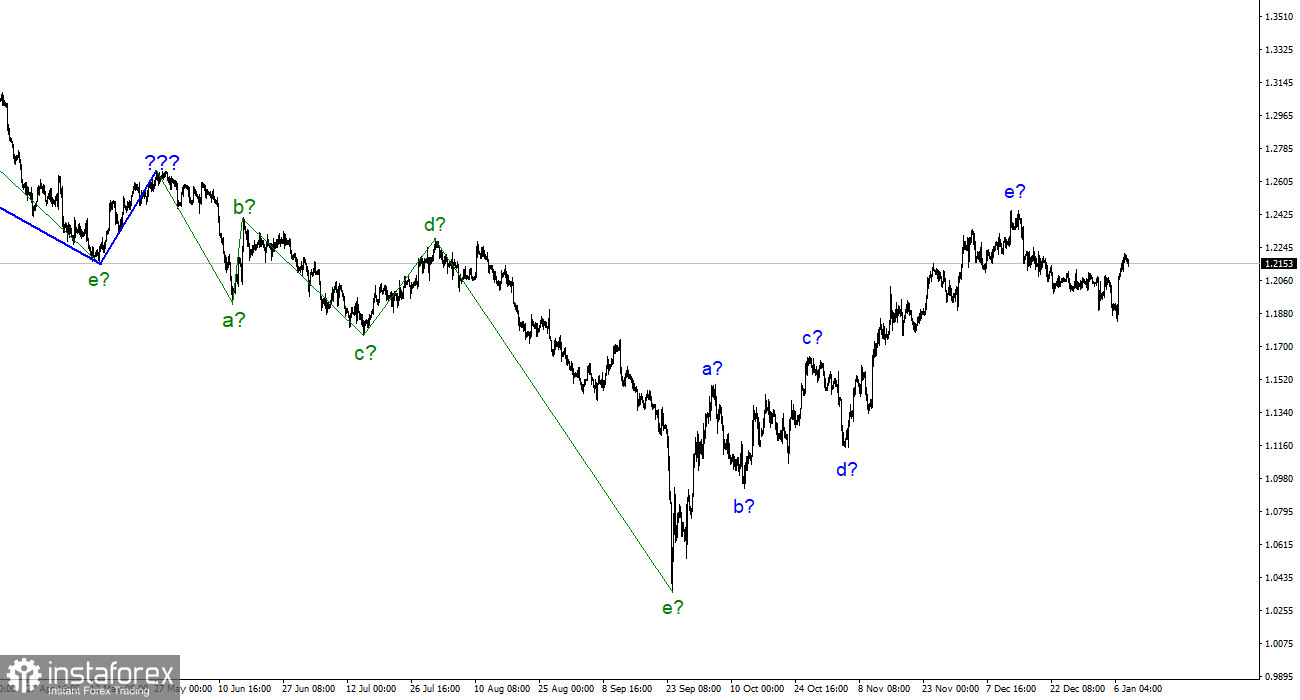

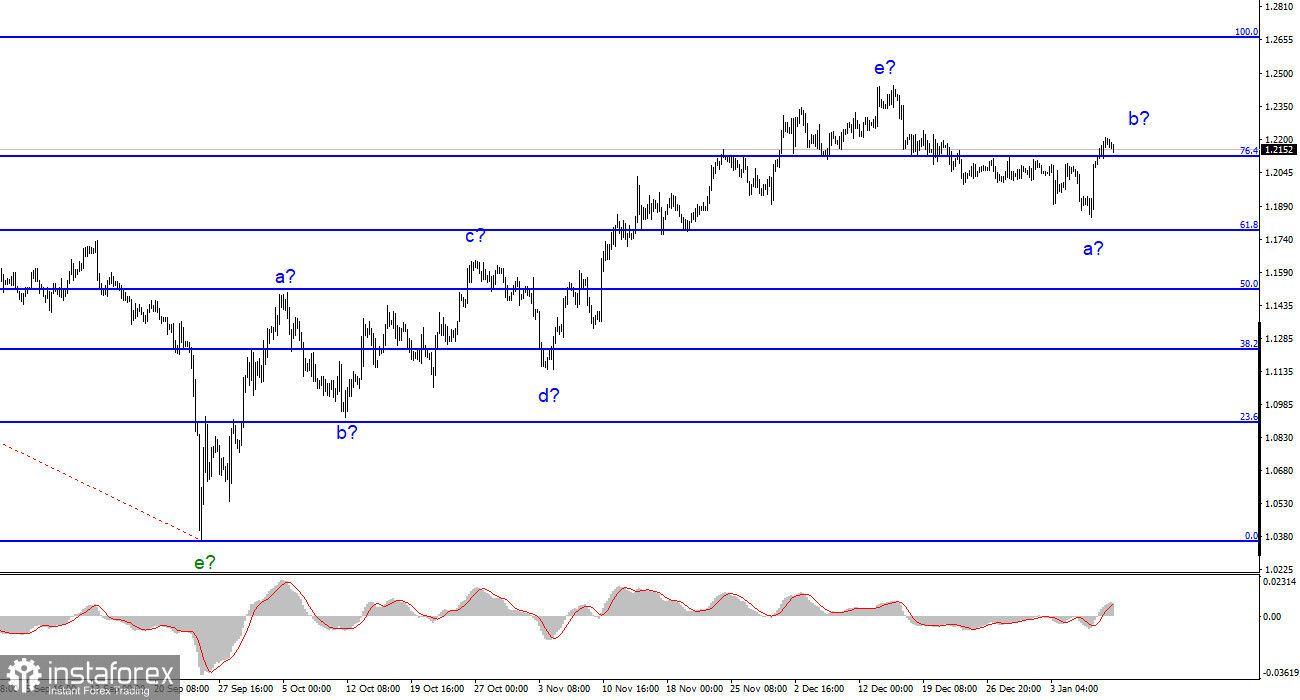

The wave markup for the pound/dollar instrument currently appears rather complex, but it also doesn't call for any explanations and starts to diverge dramatically from the markup of the euro/dollar instrument. Our five-wave rising trend segment has the form a-b-c-d-e and is most likely already finished. Since the quotes have been actively moving away from previously reached highs in recent weeks, the likelihood of the British currency completing the upward trend segment has increased noticeably. As a result, I can say that the downward part of the trend has started to take shape and will include at least three waves. Additionally, the recent increase in the instrument's quotes could represent wave B of this trend segment, which can take either a five-wave or a five-wave impulse form. However, the drop of the British should continue because there has only been one downward wave created thus far, and it has not been in the strongest or most compelling shape. Naturally, the rising portion of the trend can continue for an indefinite amount of time and have any duration. However, because it is not a typical scenario, it can be challenging to predict. I continue to attempt to expand upon the conventional wave structures, which can be utilized for both work and prediction.

Although the US labor market is robust, there is too much suspicion in the foreign exchange market.

On Friday and Monday, the pound/dollar exchange rate increased by 280 basis points. Similar to the euro/dollar instrument, there are no evident reasons for any of the instrument's increases. Let me remind you that, while the American data were not the best, they were still adequate, but the market interpreted them negatively. The current negative portion of the pattern is still there in the case of the pound, despite this gain. However, it will be broken if British quotes continue to rise, which is also a possibility. The creation of a new downward wave with targets near the calculated mark of 1.1514, which corresponds to 50.0% Fibonacci, will start from the current positions, and I, therefore, hope that the increase will terminate there.

This week, there will only be two noteworthy days when the market may be keen to see active swings. The days are Tuesday and Thursday. The Bank of Sweden is hosting an international summit today, and Fed President Jerome Powell will speak at it. Additionally, the US inflation report for December will be made public on Thursday. As they directly affect monetary policy and the economy, these two events are of utmost significance. Let me remind you that the Fed has already slowed down the rate at which it raises interest rates and that the sooner inflation declines, the sooner the Fed will stop tightening generally and slow down much more. The consumer price index is predicted by the markets to slow down to 6.5–6.7%, which you will agree is already very near 2%. The sixth consecutive fall in inflation may occur. Because no one knows what Jerome Powell will say in advance, his speech is always "a cat in a poke." The market's attitude this week will therefore be influenced by these two developments.

Conclusions in general

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. Right now, I still suggest sales targets near the level of 1.1508, which corresponds to a 50.0% Fibonacci. The upward portion of the trend is probably over; however, it might yet take a longer form than it does right now.

The euro/dollar instrument and the picture seem extremely similar at the larger wave scale, which is fortunate because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished. If this is the case, a downward portion will likely be built for at least three waves, with the possibility of a dip in the region of figure 15.