In just a couple of days, the pound gained almost 350 points, and a local correction was justified. However, despite a completely empty macroeconomic calendar, which usually promotes all sorts of bounces, the British currency lost only 50 points. And it proves that investors don't really believe in the dollar's growth potential right now. At least, in the short-term perspective. Moving forward, I don't think the dollar is going to strengthen. Most likely, the market will continue to stand still. And it's been staying in the same place since the middle of yesterday. In fact, the macroeconomic calendar is also absolutely empty today. The market obviously needs a good reason for it to move in any direction. The pound can't grow because it's overbought, and there's no particular reason for it to fall.

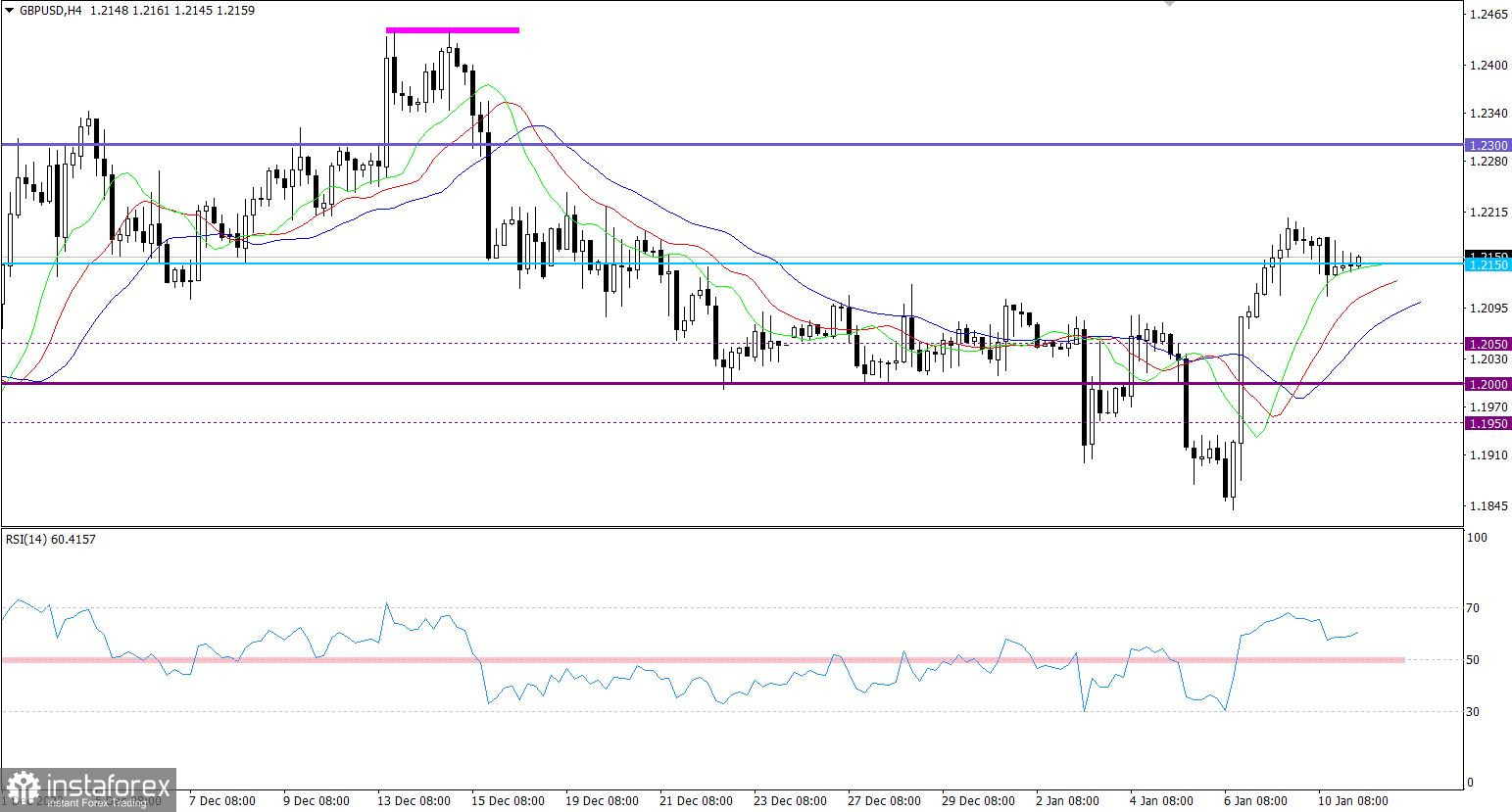

The pair's upward momentum has slowed down around 1.2200. As a result, there was a pullback of about 90 pips, which is considered as a process of regrouping trading forces.

On the four-hour chart, the RSI technical indicator is moving in the upper area of 50/70, which reflects traders' interest in long positions on the euro.

On the four-hour chart, the Alligator's MAs are headed upwards, which corresponds to the upward cycle.

Outlook

The current pullback has smoothly turned into stagnation along 1.2150, which may support new price surges. Using technical analysis, I expect long positions on the pound to grow even more once the price stays above 1.2200. In this case, the subsequent upward movement will resume.

As for the bearish scenario within the corrective move, the price should stay below 1.2130 over the four-hour period.

Based on complex indicator analysis, there is a variable signal for short-term and intraday trading due to a flat. In the medium term, there is still a buy signal.