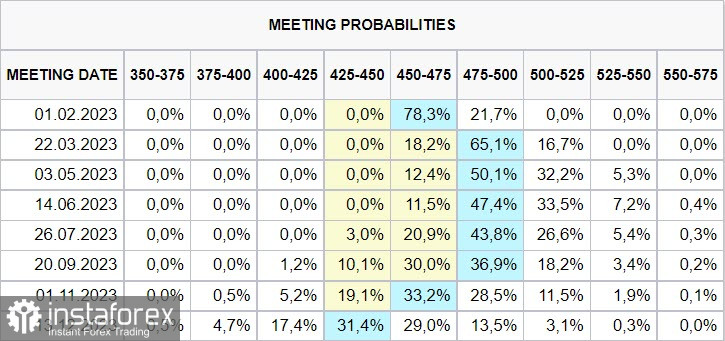

In anticipation of the release on Thursday of the important US inflation report for December, which will be significant for the Fed's rate estimates in February, there is still little movement on the markets. The markets are currently leaning toward the possibility that the rate will only be lifted by 0.25% after the rate was increased by 50p on December 14 to a range of 4.25–4.50%.

The possibility that the rate will be hiked above 5% this year is not seen by the futures market. There will probably be one final increase in February, followed by a respite until the Fed resumes rate reductions in November. This indicates that the key factor that supported the dollar's strength in 2022 has run its course.

The head of the Fed Powell was present at the event yesterday that the Swedish Riksbank organized, but Powell did not make any remarks that could have upset the markets. At the same time, Schnabel from the ECB warned that to fight inflation, the rate (ECB) should still rise sharply and the policy should tighten. As a result, the euro is expected to outperform the dollar in the yield spread, which benefits both the growth of EUR/USD and the majority of other major currencies.

The NFIB Small Business Optimism survey dropped from 91.9 to 89.8, below the predicted 91.5, while wholesale sales decreased by 0.6% vs an increase of 0.2%. This is negative news for the US economy but advantageous for market stability because it lessens the chance of a more aggressive Fed stance.

According to a report on commodity prices issued by ANZ Bank, the composite price index declined by just 0.1% in December, indicating that there are no indications of a sharp decline in demand for raw materials in light of the impending global recession. On Wednesday morning, the price of Brent crude oil surpassed $ 80 per barrel once more. Gold is also approaching the price of $ 1,900 per ounce, which weakens the US currency.

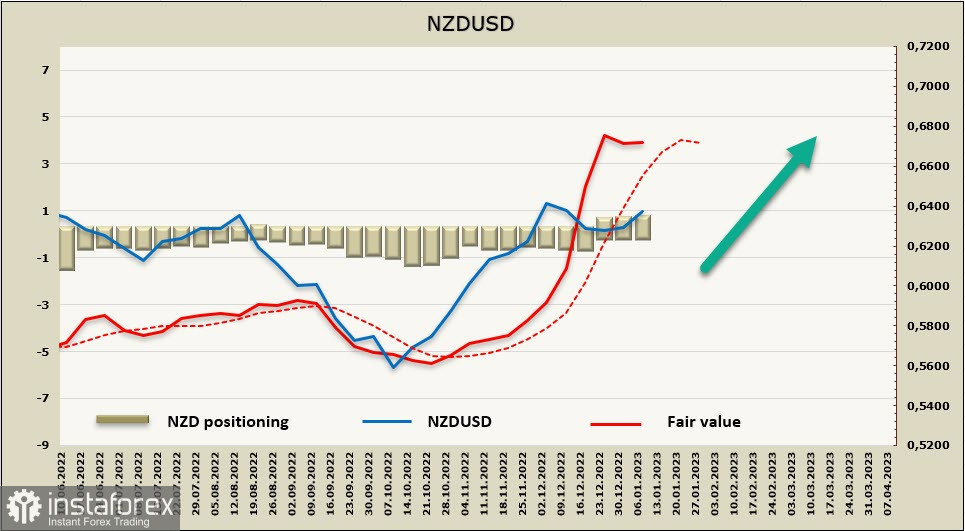

NZD/USD

Since there haven't been any significant macroeconomic or political developments in New Zealand, external rather than internal causes dominate the movements of the NZD. One benefit is the opening of China, which will enhance demand. Additionally, raw material and logistical prices globally are rapidly falling and are already close to pre-pandemic levels. At the same time, given that China is getting ready to celebrate the New Year, a rapid increase in demand shouldn't be anticipated.

The absence of news and the concurrent decline in expectations for the Fed rate lay the groundwork for the current expansion of risky assets. The growth of commodity currencies presents an opportunity for the kiwi to profit from favorable circumstances.

During the reporting week, the net long position on the New Zealand dollar climbed by 34 million to 468 million. The posture is optimistic, and the expected price is still significantly higher than the long-term average.

After the consolidation is over, we anticipate that the NZD/USD will begin growing this week, testing the local maximum of 0.6507 before aiming for 0.6570. There aren't many conditions for a bearish turn, but with a potential drop to the 0.6193 support level, we anticipate a restart of purchases.

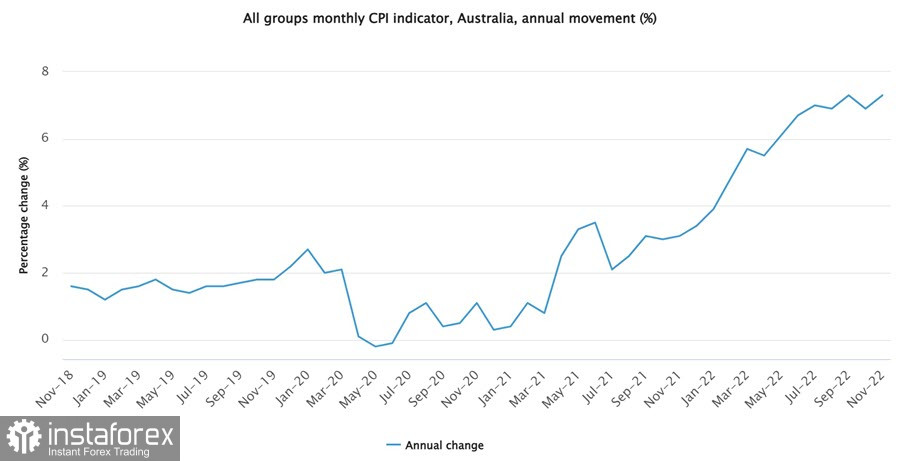

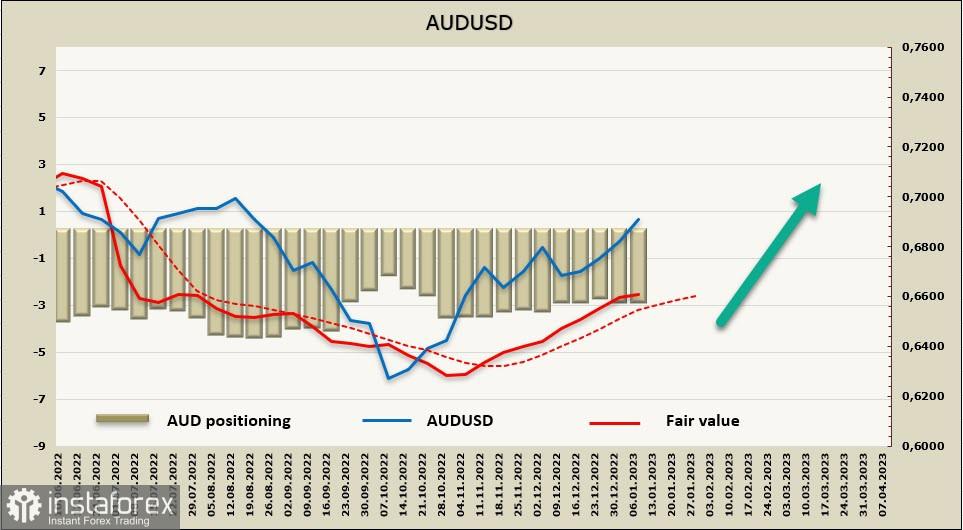

AUD/USD

In Australia, the consumer price index increased to 7.3% in November, with housing, food, and transportation contributing the most to growth. As a result, raw material growth is not now the primary driver of price growth, though NAB bank anticipates that prices will increase in December.

Because rising inflation will put pressure on the RBA and prevent it from finishing the cycle of rate growth, the Aussie, unlike the US dollar, has internal room for expansion. The report on retail sales for November, which showed growth of +1.4% with a prediction of 0.6%, is in favor of rising inflation.

There are getting to be fewer and fewer things that may stop the demand for AUD from increasing further as expectations for commodity prices are growing once again.

According to the CFTC data, the weekly movement in AUD was a symbolic +34 million, and the total short position is -2.44 billion. However, although a bearish advantage still exists, the dynamics of the settlement price are in favor of the Aussie continuing to rise.

There are a few reasons for a reversal to the south, and the local maximum of 0.6895 has been updated. We are now watching for movement toward the closest resistance area of 0.7100/40.