Speaking at the Riksbank International Symposium on Central Bank Independence on Tuesday, Fed Chairman Jerome Powell refrained from making any comments on the prospects for the U.S. central bank's monetary policy. The dollar as a whole also reacted neutrally to this performance: neither the bulls nor the bears found any hints or signals in it to take active actions ahead of the release (Thursday) of key inflation data in the United States.

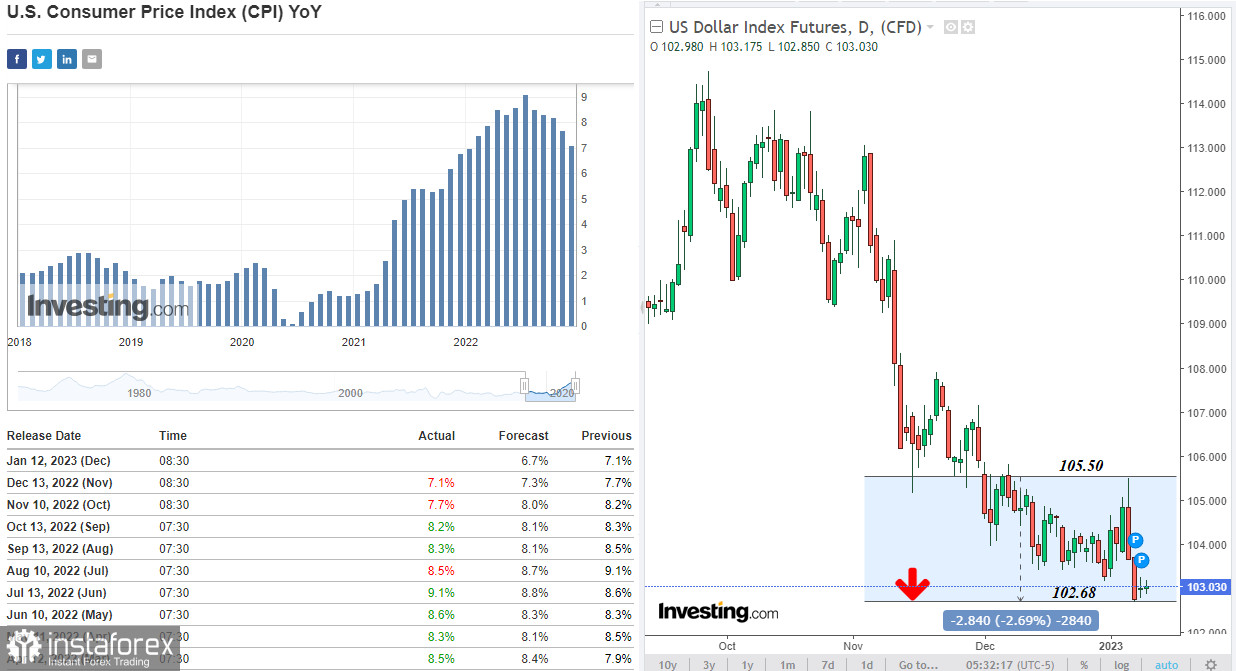

Since the opening of today's trading day, the dollar is also mostly traded neutrally, and the dollar index (DXY) is currently close to 103.03 and yesterday's closing price and today's open.

Today's economic calendar does not contain any significant publications, and, most likely, the same dynamics of the market and the dollar will continue in the American trading session.

Tomorrow, market volatility, especially in quotes of Asian and commodity currencies, will increase immediately at the beginning of the trading day on the release of important macro data on Australia and China at 00:30 and 01:30 (GMT).

And at 13:30, an update on the U.S. inflation data (December) will be released. Again we expect numbers to decline, which might be taken as a signal for action by the market participants and dollar sellers.

However, the data may be higher than forecast. If they also turn out to be higher than the previous values, then the strengthening of the dollar will likely not be avoided tomorrow.

As follows from the minutes of the December meeting of the U.S. central bank published last week, its leaders, so far, adhere to a tough position, expressing readiness for further tightening of monetary policy. Fed officials believe that disruptions in the global supply chain and increased inflationary risks, will persist for at least another year, which means that the interest rate will be raised again at the next meeting (January 31–February 1) with a high probability. The question so far, is how strong this increase will be, and the inflation data expected tomorrow will allow market participants to draw certain conclusions on this matter.

Atlanta Fed President Raphael Bostic said Tuesday that the Fed is prepared to keep rates high through 2024, and San Francisco Fed President Mary Daly told the media that the Fed could decide to raise rates by either 50 or 25 basis points at its next meeting.

"Our decisions will depend on the totality of incoming data," Powell said after the December meeting of the central bank, adding that the Fed "has not yet reached a level that could be justified as sufficiently restrictive," considering "risks to inflation as upward" and "go through a certain path of raising rates."

If, as we have already noted, tomorrow's inflation data exceeds market expectations, then the Fed will have more arguments to follow the intended course, i.e. raise the interest rate this year to 5.0%–5.1%, and maybe even higher if inflation continues to rise in the coming months. At least the state of the U.S. labor market allows this: according to Powell, "the unemployment rate of 4.7% is still a strong labor market" (recall that, according to a recent report by the U.S. Department of Labor, the unemployment rate in the country in December was at 3.5%, also being better than the forecast and the previous value).

As for the euro—it remains stable in the market, strengthening today both in cross-pairs and against the dollar.

European Central Bank Governing Council member Robert Holzmann said on Wednesday that "rates will need to rise significantly to reach levels sufficiently restrictive to ensure inflation returns to target in a timely manner," adding that "there are no signs of weakening market expectations for inflation."

And today, Governing Council member and French Central Bank Governor Francois Villeroy de Galhau supported his colleague, saying that "we will have to raise rates even more in the coming months."

Last week, Bundesbank President Joachim Nagel also said that further action is needed to contain inflation expectations, i.e. continue to tighten monetary policy.

Thus, the expectations of another interest rate hike by the European Central Bank and verbal interventions of its representatives are pushing the euro quotes up, pushing the EUR/USD pair in the same direction, given that the ECB has more room for maneuver than the Fed in terms of the monetary policy outlook.

As of writing, EUR/USD was trading near 1.0750, moving in the middle-term bull market zone (above the support levels 1.0540 and 1.0445) towards the key resistance levels 1.1010 and 1.1130, separating the long-term bullish trend of the pair from the bearish one. Thus, above the support levels of 1.0540, 1.0445 long positions are preferable.