Analysts at Deutsche Bank AG and Morgan Stanley believe that the euro could rise as high as 1.15 against the US dollar from the current 7-month lows at 1.07. In another forecast, Nomura International Plc foresees the euro's growth to 1.10 by the end of January. Besides, a portfolio manager at Aegon Asset Management plans to increase long positions in EUR/USD.

"We got the miracle weather," said Mark McCormick, an FX strategist at TD Securities. It was a superb cushion which enabled the Eurozone to overcome a recession.

The euro is enjoying a sharp change in market sentiment compared to 2022 when the euro slumped to the parity level with the US dollar. Mild winter temperatures across the continent nullified the worst-case scenario with catastrophic economic fallout. Nevertheless, investors admit that such a scenario might resurface afterwards.

Trends beyond Europe also confirm the bullish sentiment on the euro. A lot of investors expect the US dollar to weaken, especially on the condition of easing inflation in the US. If so, the Federal Reserve will approach the end of its cycle of aggressive rate hikes. The European economy benefits from reopening China's economy because it mitigates disruption in supply chains.

"The downside risks to the euro are diminishing with lower gas prices," said Gettinby, a portfolio manager at Aegon. "European economic bottlenecks are still escalating while they are ebbing away in the US."

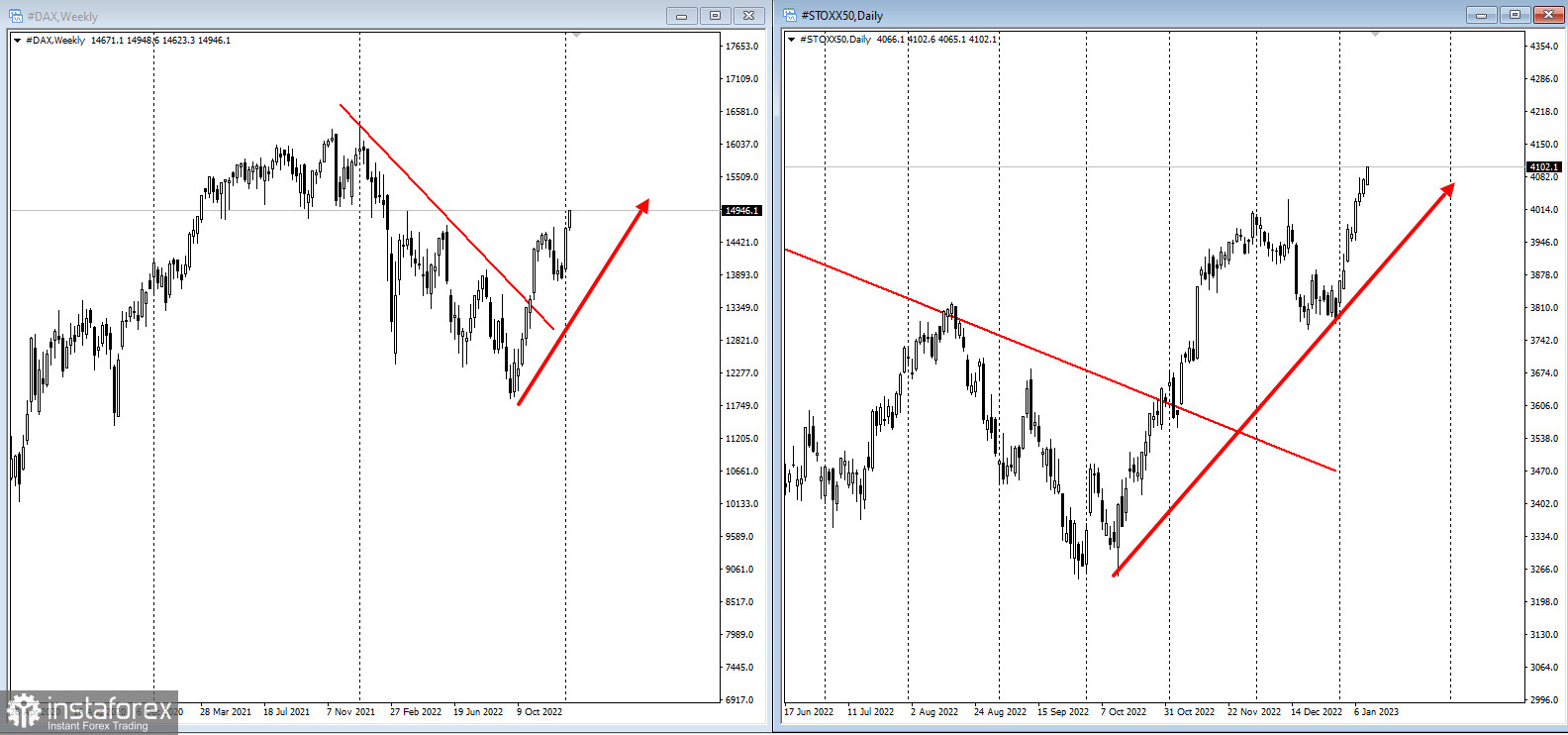

The Stoxx 600 index has surged by 5% this year. The extra yield that investors need to hold on to riskier European debt has been declining since mid-October.

The bears still voice concerns that Russia might escalate its broader advance in Ukraine. Energy prices which have been stuck at elevated levels for a long time could derail economic growth. A new jump in US inflation and stronger-than-expected macroeconomic data may also encourage a new rally in the US dollar at the euro's expense if the Federal Reserve goes ahead with aggressive rhetoric.

Analysts at JPMorgan Chase & Co. are still worried about a recession scenario. At the same time, they say that the hawkish ECB is likely to prop up the euro. Recently, the ECB has revised its stance from hawkish to neutral for the first time in a few months.

Market participants expect the ECB to raise interest rates by almost 150 basis points this year whereas the Federal Reserve is anticipated to moderate the pace of rate hikes and increase the funds rate by 60 basis points. Traders will closely monitor fresh inflation data for the US which is due on Thursday. They will look for new evidence that inflationary pressure has been waning.

"Everything is falling into place for a more sustained decline in the dollar," George Saravelos, head of currency research at Deutsche Bank, wrote in a note, specifying his bullish outlook for the euro.

"Two key factors in the dollar's safe haven appeal — the energy shock in Europe and China's zero-Covid policy — have changed," he added. "Ultimately, the Fed's policy revision is the last missing link."