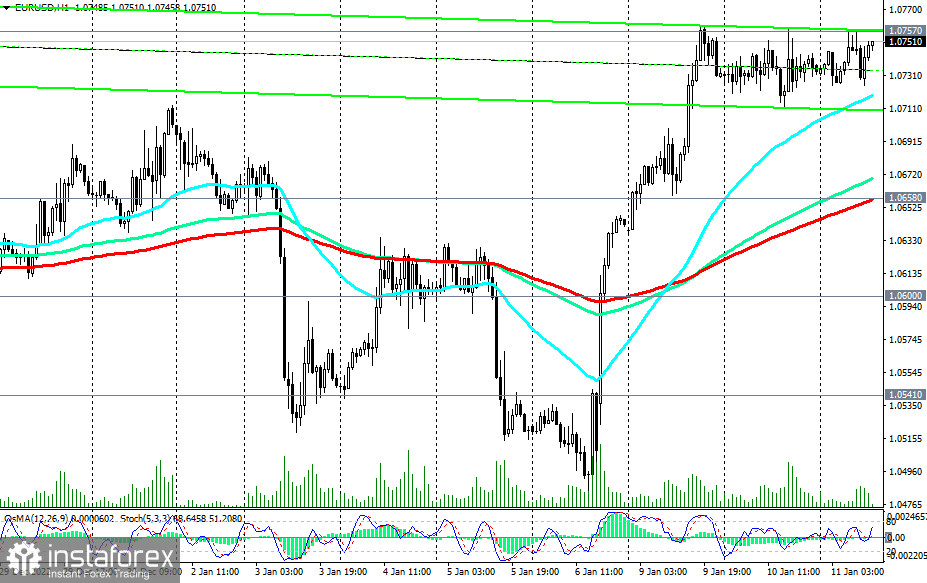

The euro is strengthening today, including in pair with the dollar. EUR/USD rose strongly on Friday and Monday after the release of weak PMIs in the services sector of the U.S. economy, as a result of which the dollar fell into a wave of sell-offs.

The growth of EUR/USD at the moment and for the last four partial trading days amounted to more than 2%.

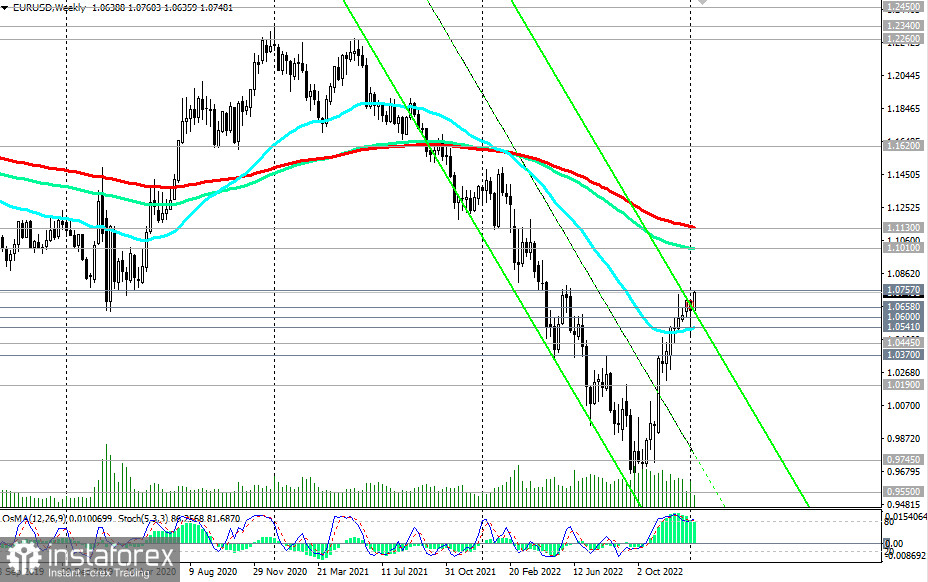

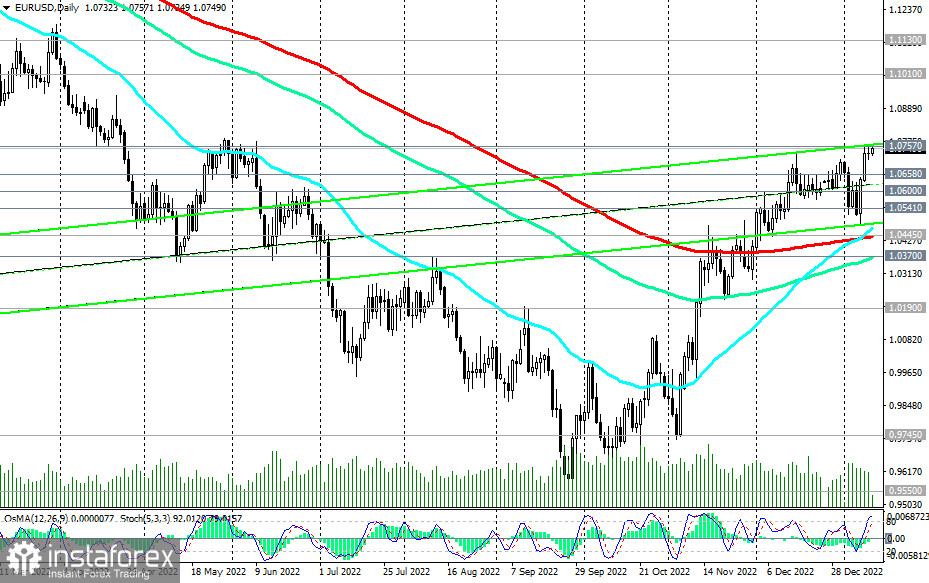

As of writing, EUR/USD was trading near the 1.0750 mark, moving in the medium-term bull market zone, above the support levels 1.0540 (50 EMA on the weekly chart), 1.0445 (200 EMA on the daily chart) towards the key resistance levels 1.1010 (144 EMA on the weekly chart), 1.1130 (200 EMA on the weekly chart), separating the long-term bullish trend in the pair from the bearish one. Thus, above the support levels 1.0540, 1.0445, long positions remain preferable.

In an alternative scenario, the EUR/USD pair will not be able to break above the 1.0757 local resistance level, which it has touched four times in the last four partial trading days.

The first signal for the resumption of sales may be a breakdown of the 1.0710 local support level, and a confirming one will be a breakdown of the important short-term support level 1.0658 (200 EMA on the 1-hour chart). The downside target is the 1.0445 key support level.

A breakdown of the 1.0370 support level (144 EMA on the daily chart) will increase the risks of EUR/USD returning to the global downward trend.

Support levels: 1.0710, 1.0658, 1.0600, 1.0540, 1.0500, 1.0445, 1.0370, 1.0190

Resistance levels: 1.0757, 1.0800, 1.0900, 1.1010, 1.1130

Trading scenarios

Sell Stop 1.0685. Stop-Loss 1.0765. Take-Profit 1.0658, 1.0600, 1.0540, 1.0500, 1.0445, 1.0370, 1.0190

Buy Stop 1.0765. Stop-Loss 1.0685. Take-Profit 1.0800, 1.0900, 1.1010, 1.1100