The start of the new week was quite calm. If there was a residual reaction from the US reports from Friday on Monday, then both instruments slowly deviated from their earlier highs on Tuesday and Wednesday. It was conceivable to focus solely on Fed President Jerome Powell's address for the first three days of the week, but once he started speaking, it became evident that monetary policy problems would not be covered. Therefore, as of right now, there hasn't been a single significant incident this week.

It will be a little more fascinating in the second half of the week. First, the US inflation report for December will be revealed tomorrow. The value of 6.5% is being placed at the current 7.1% y/y by the markets, which are anticipating a new downturn. It is impossible to say for sure right now if these expectations will come true, but if they do, the response might not be that strong. The demand for US money may drop significantly if inflation falls below 6.5%. Conversely, if it is less than 6.7%, it will increase. Let me remind you that the market now anticipates a hike in the Fed's interest rate to 5.5% but acknowledges that it could increase to 5.75–6.00%. The primary choice is the first one. The likelihood of using the second, dollar-beneficial alternative decreases as inflation declines more quickly.

There will be reports on the UK's GDP on Friday, but the market can simply ignore them. Only monthly values will exist, and they won't be of much significance. In addition, I can mention that Goldman Sachs revoked its prediction of a 2023 Eurozone recession. They now predict that the European economy will expand by 0.6% as opposed to GDP declining by 0.1%. The energy crisis, according to Goldman Sachs economists, will make this winter's growth extremely poor, although the worst-case scenario was averted. Recent weeks have seen a substantial decline in gas prices, which are presently under $750 for every 1,000 cubic meters. Due to the Nord Stream's sabotage, Europe is still experiencing significant supply issues because it is almost entirely without Russian gas. However, having limited gas for $750 is preferable to having limited gas for $2,500.

Goldman Sachs analysts anticipate a quicker drop in inflation as a result of the decline in the price of energy resources. It might decrease to 3.25% by the end of 2023. The bank also thinks that the ECB will increase the interest rate by 50 basis points more frequently in the upcoming months. In general, they anticipate an increase in the ECB rate to a minimum of 3.25–3.5%. This value, in my opinion, is too low, and it won't be able to sustain the strong demand for the euro currency in 2023. For both instruments, I continue to anticipate the creation of corrective trend sections, which may ultimately develop into fresh impulse sections.

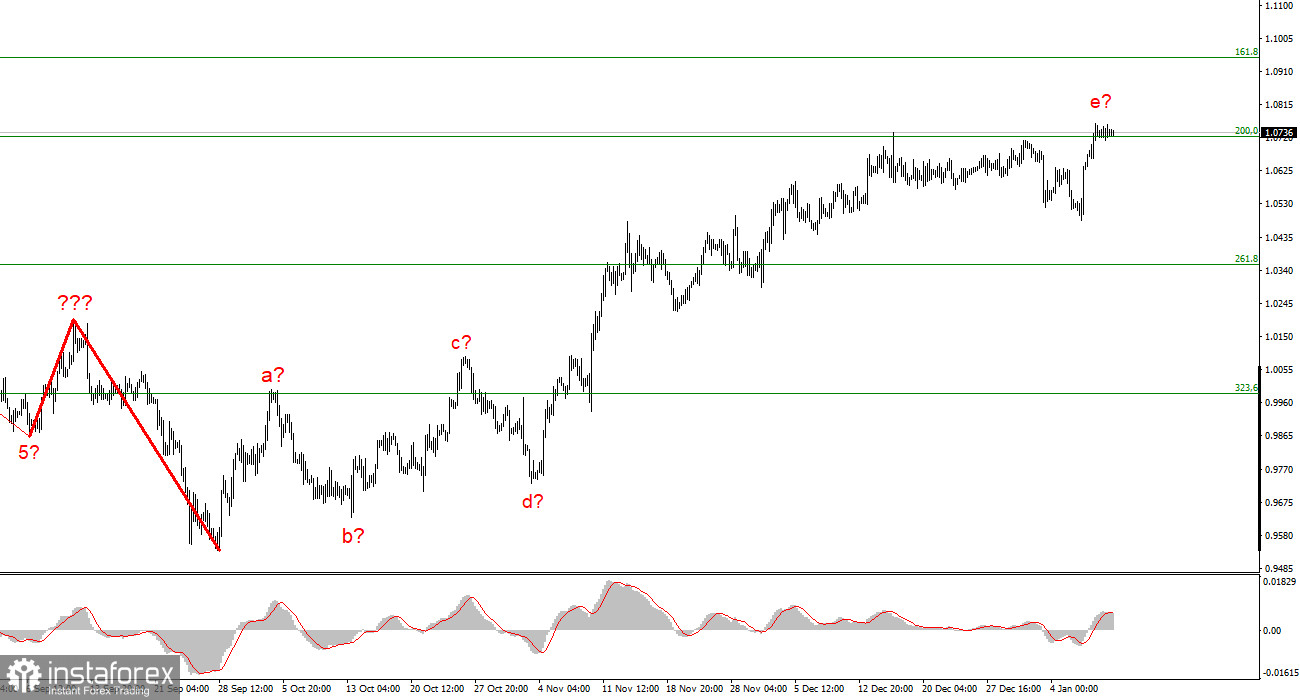

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, sales with goals close to the anticipated 0.9994 level, or 323.6% Fibonacci, can now be taken into account. A failed attempt to break through the 1.0726 level suggests that the instrument may decrease in the upcoming weeks, however, it is possible to complicate and lengthen the rising portion of the trend. The likelihood of this scenario is still relatively strong.

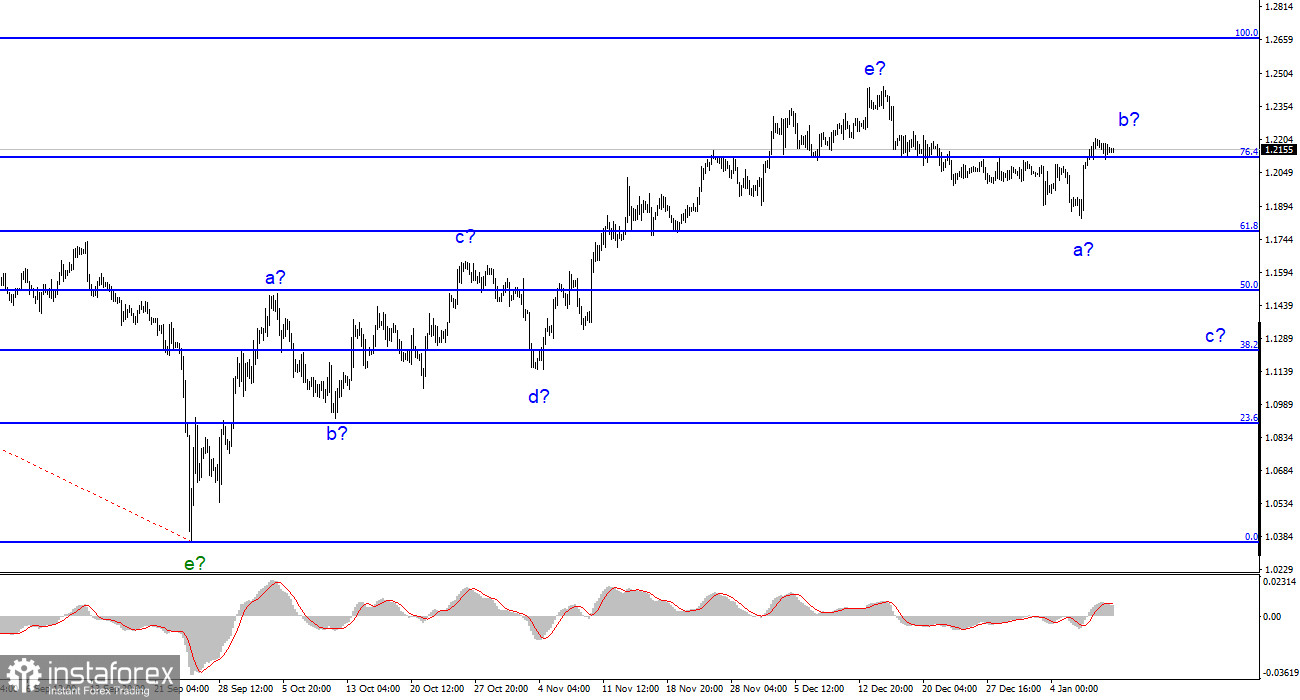

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. Currently, sales with objectives at the Fibonacci level of 1.1508 (50.0%) might be taken into account. The upward portion of the trend is probably over, however, it might yet take a longer form than it does right now.