Talks of the Fed taking a pause in raising rates are spreading in markets, causing a cautiously positive sentiment among investors. But even though more and more people are speculating about such a situation, there are still those who remain firm with the idea that the central bank will increase rates by another 0.25% in February.

The discussion may end once the US publishes its December data on inflation. The figures will certainly set the tone for markets, as well as influence the Fed's stance on rates and the monetary policy as a whole. Forecasts have said that CPI will remain unchanged in terms of month-over-month data, while on year-on-year it will show a slow down from 7.1% to 6.5%. If the figures display as expected, market players will rush to buy stocks, while dollar and Treasury yields will continue to decline. This setup will push gold prices up as the Fed is likely to raise rates by 0.25% in February, then take a pause for the next three months to monitor the behavior of inflation.

A second possible development, in which US CPI shows even a slight increase, will strike a strong blow to risk appetite and support both dollar and Treasury yields. It could also put pressure on commodities and force the Fed to raise the rate again by 0.50%. Such a scenario will be disastrous for markets as it will cause a new strong wave of sell-offs.

The first scenario is more realistic because recent data points to such a development. This means that global markets are likely to enter a new bullish era.

Forecasts for today:

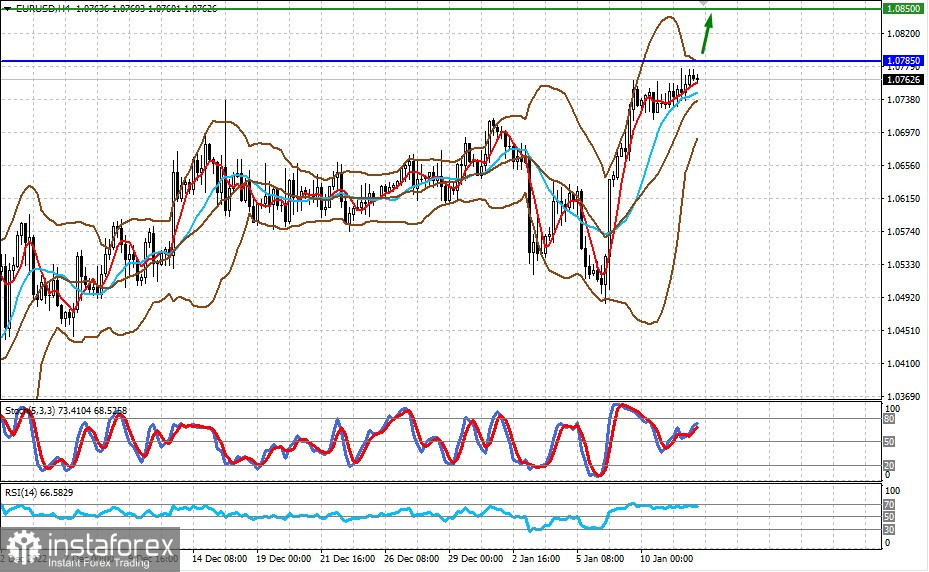

EUR/USD

The pair is trading below the resistance level of 1.0785. If US data shows a decline in inflation, it will rise to 1.0850.

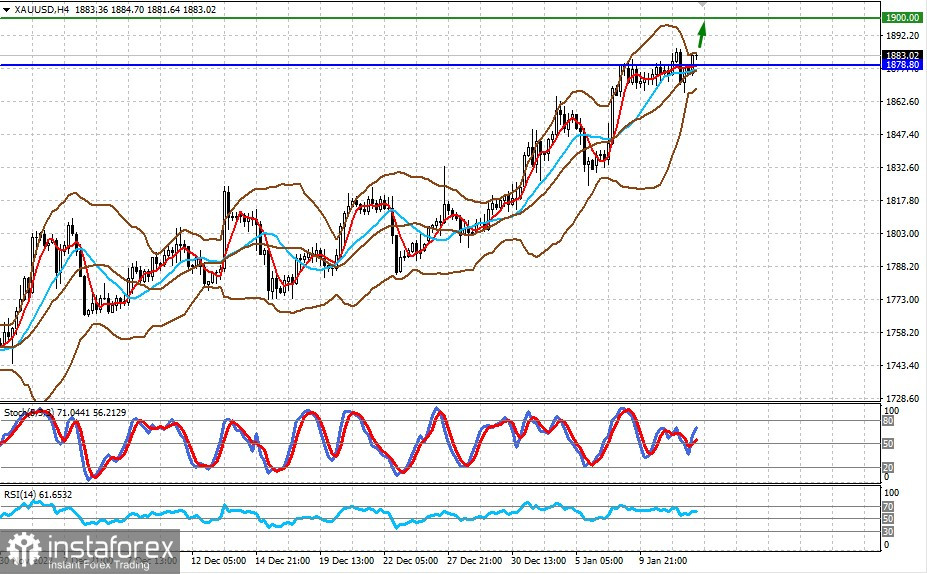

XAU/USD

Gold is consolidating near the level of 1878.80. News of a decline in the US consumer price index could be a reason for a renewed rise in the price to 1900.00 per ounce.