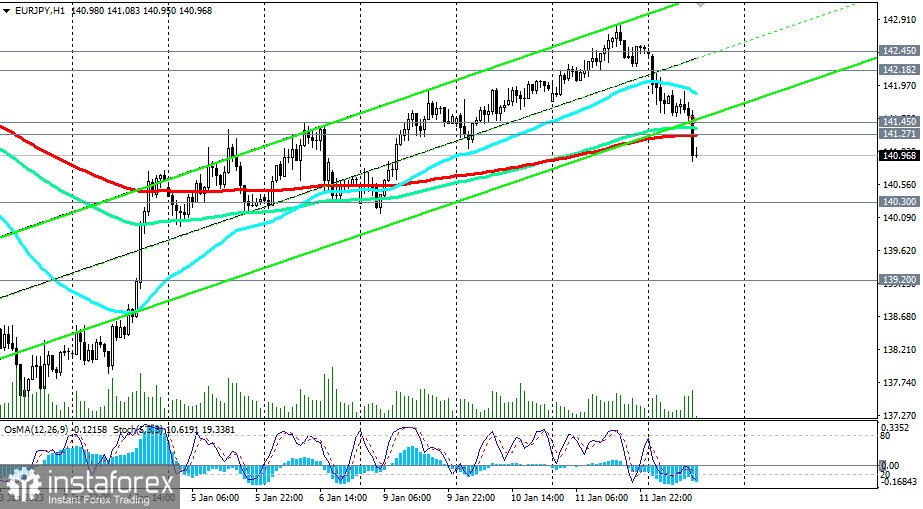

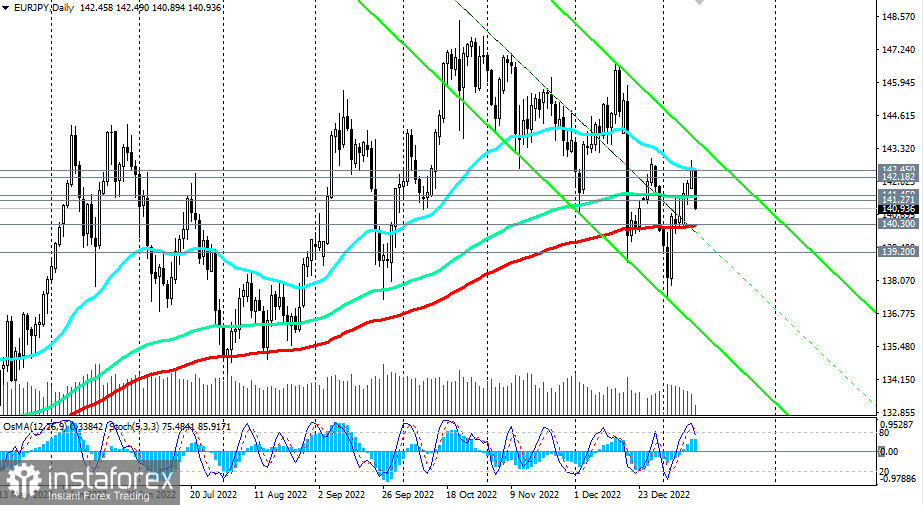

Amid demand for protective assets, the yen is strengthening today against the dollar and in cross pairs, particularly in the EUR/JPY pair. As of writing, it is trading near the level of 141.00, storming strong support levels 141.45 (144 EMA on the daily chart) and 141.27 (200 EMA on the 1-hour chart).

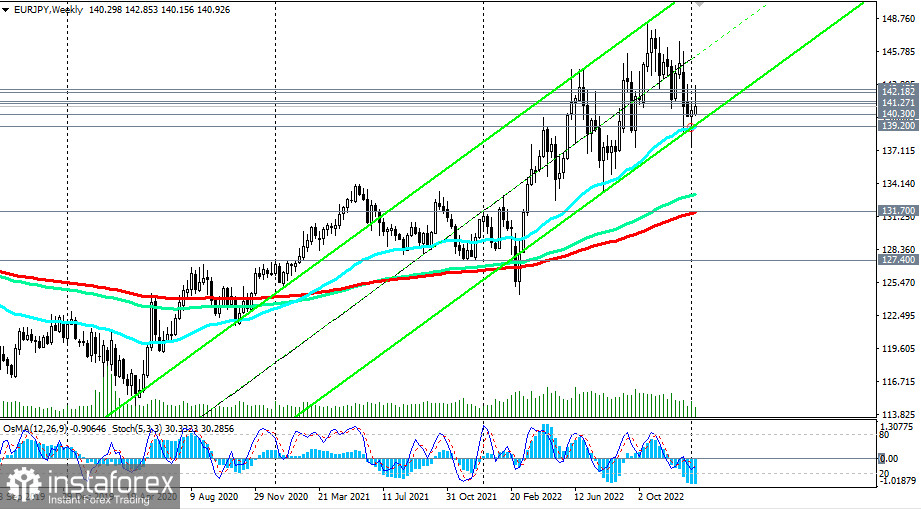

In case of further fall, the target will be the 140.30 key support level (200 EMA on the daily chart). Its breadown and breakdown of the important long-term support level 139.20 (50 EMA and the lower line of the upward trend on the weekly chart) will significantly increase the risks of EUR/JPY moving into the medium-term bear market zone, sending the pair to the 131.70 key support level (200 EMA on the weekly chart).

A breakdown of the 127.40 support level (200 EMA on the monthly chart) will complete the pair's transition to the long-term bear market zone.

In an alternative scenario, it is logical to assume that near the current round level 141.00, there will be a rebound and growth of EUR/JPY, given also the fact that the pair has already chosen its average intraday volatility of 130–150 points today.

Growth in the zone above the levels of 141. 27, 141.45 will return the pair to the long-term bull market zone. The immediate growth target in this case is the 142.45 resistance level (50 EMA on the daily chart).

Support levels: 141.00, 140.30, 140.00, 139.20, 139.00, 138.00, 137.30, 137.00

Resistance levels: 141.27, 141.45, 142.00, 142.18, 142.45, 143.00

Alternative scenarios

Sell Stop 140.80. Stop-Loss 141.50. Take-Profit 140.30, 140.00, 139.20, 139.00, 138.00, 137.30, 137.00

Buy Stop 141.50. Stop-Loss 140.80. Take-Profit 142.00, 142.18, 142.45, 143.00, 144.00, 145.00