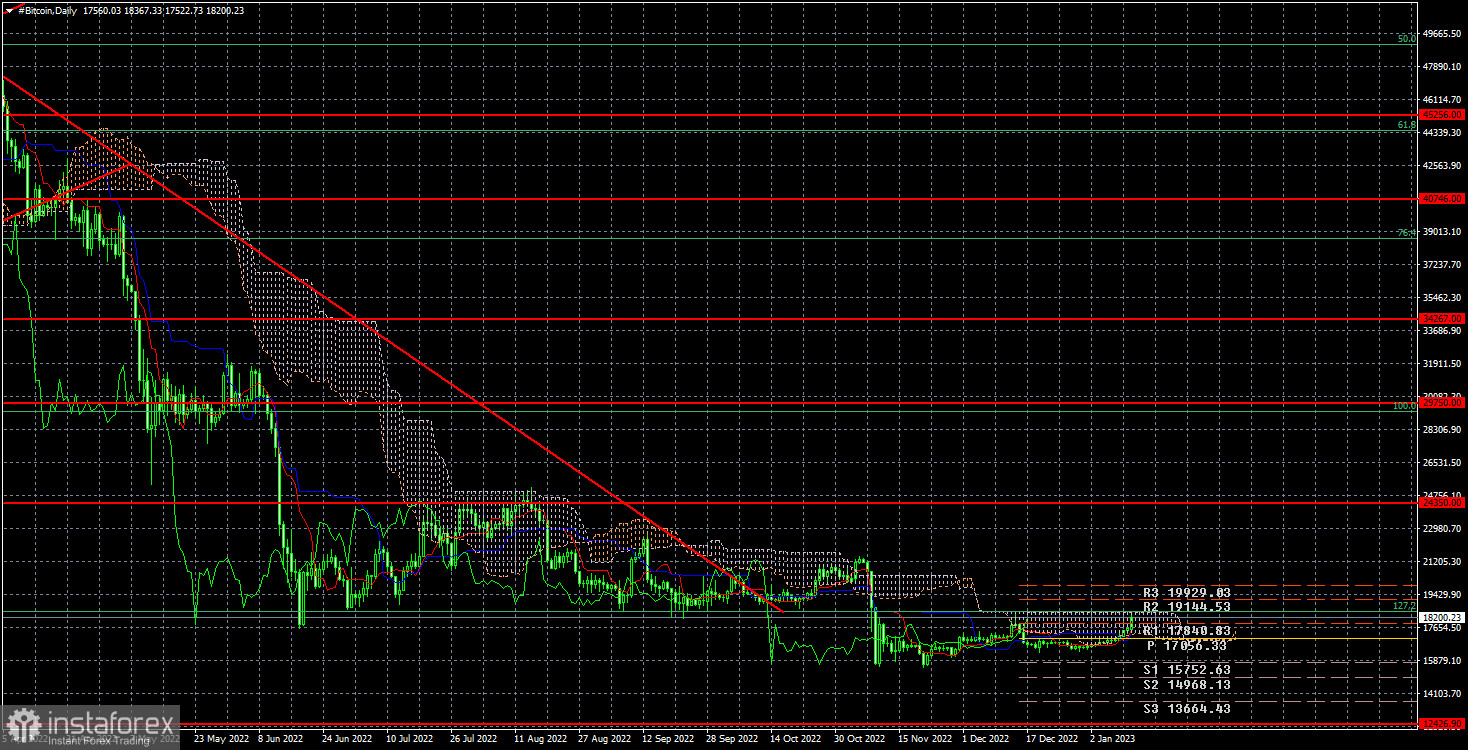

The price of the bitcoin cryptocurrency remains unchanged and is currently below the $18,500 mark. Remember that this is the precise scenario that we have discussed numerous times, therefore everything is now proceeding as expected. The "bitcoin" may currently remain in the flat position for a few more weeks or months, but eventually, we anticipate it to decline at least to the level of $12,426.

The top cryptocurrency in the world managed to gain over $1,000 during the past day. Although we don't think this gain is particularly robust, it should be highlighted that bitcoin was able to "peel off" from the $15,500 mark. However, it is already approaching the $18,500 mark, which must be overcome for very specific reasons. At the same time, quite a large number of experts continue to expect a fall from the "bitcoin," since it still correlates very well with the American stock market. And this market is also expected to fall, justified by new increases in the Fed's key rate, and then a long period of maintaining the maximum rate level. One of the most important reports for determining the future monetary policy in the United States will be released today – on inflation. We have already said that inflation is falling and may continue to do so, since rates in the US have risen very much, and the QT program continues to work, and besides this, the energy crisis in the world seems to have been avoided. Oil and gas prices have fallen, so recessions in many countries of the world may be weaker than predicted a few months ago. If inflation falls faster than expected, or just quickly, then expectations for Fed rates will decrease. It's bad for the dollar, and it's good for bitcoin, but the thing is that no matter how the rates grow, they still grow, and then they will remain high at least until the end of 2023. On the 24-hour timeframe, the quotes of the "bitcoin" remain below the level of $18,500. From our point of view, the decline may resume in the future with a target of $12,426. However, this may not happen soon enough, since after each new collapse, a flat period followed, which we are now observing. However, this does not mean that the "bearish" trend is over. Overcoming the $18,500 level can be a buy signal for the first time in a long time.

The "bitcoin" still has a strong correlation with the American stock market, therefore many experts continue to predict a decline from it. As a result of new rises in the Fed's key rate and a protracted time of maintaining the maximum rate level, this market is likewise anticipated to decline. Today's report on inflation will be one of the most crucial for establishing the future monetary policy in the United States. Inflation is declining, as we have already stated, and may continue to do so given the significant increase in US interest rates, the QT program's continued effectiveness, and the apparent avoidance of the global energy crisis. Recessions in several nations of the world may be weaker than anticipated a few months ago due to the drop in the price of oil and gas. Expectations for Fed interest rates will decline if inflation declines more quickly than anticipated or simply swiftly. It's bad for the dollar and excellent for bitcoin, but the rates will continue to rise and stay high at least through the end of 2023, regardless of how they develop.

The "bitcoin" quotes during the past 24 hours have remained below the level of $18,500. We predict that the fall will likely continue in the future, with a target price of $12,426. This might not occur quickly enough, though, as each new collapse was followed by a flat phase, which we are currently experiencing. This does not, however, indicate that the "bearish" tendency has ended. For the first time in a very long time, breaking through the $18,500 mark can be a buy signal.