Growth in the US Consumer Price Index slowed in December from 7.1% to 6.5%, the core index declined from 6% to 5.7%. Both numbers came out exactly as projected and resulted in a brief spike in volatility on the foreign exchange market.

The slowdown in inflation follows logically from the 5-year Treasury Inflation-Protected Securities (TIPS) chart, which could well be considered a leading indicator of business inflation expectations. The Tips yield is now lower than it was on December 31, which means that businesses see the likelihood of lower inflation in January as well.

In December, the FOMC raised the Federal Funds rate by only 50 basis points. Common sense suggests that a slower rate hike is followed by a pause. Having reached the rate cap, the FOMC will take a step back and analyze the extent to which its tightening has affected the real economy. Specifically, it will analyze incoming data to assess how effective it has been in slowing wage and inflation growth and how much damage it has done to the economy (particularly the unemployment rate). Rates will peak and halt as the Fed mulls over when to start moving down.

The latest data is in favor of the FOMC raising rates by just 25 basis points in February, and that will be the last hike. The dollar is losing the initiative, and it's getting weaker against currencies where the rate peak is not so close will change the yield spread, and not in favor of the dollar. The inflation report is a bearish driver for the dollar.

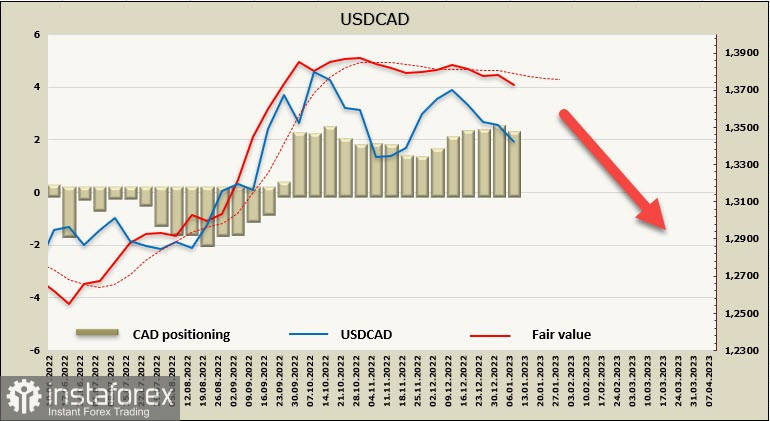

USDCAD

The Canadian dollar is stuck in a range with no good reason to start a pronounced move against the US dollar, but several factors suggest a downward move. Inflation in Canada is slowing, there has been a sharp increase in employment (+104,000 in December), lower unemployment and continued strong wage growth, indicating both a strong labor market and that Canada is a long way from recession, which further eases the pressure on the Bank of Canada.

The net short position in the CAD declined by 263 million to -1.958 billion over the reporting week, the sentiment on the loonie is still bearish, but the settlement price is increasingly turning downward, indicating that the pace of capital movements towards the CAD is strengthening.

As of Thursday evening, moving below the range seems more and more probable, as the slowdown of US inflation also means an increase in demand for risk for the markets. I assume that the USDCAD will start moving towards the nearest 1.3220/30 support area, but movement probably won't be active. The pair could settle below this area if the demand for risk gets more confirmations.

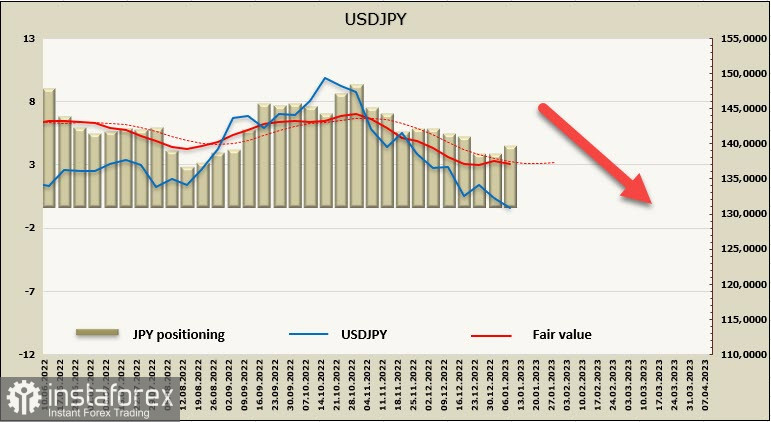

USDJPY

The USDJPY peaked at 151.94 in 2022. This is because the market is fixated on one thing: the monetary policy divergence among the US and Japan, and the yen was depreciating at an increasing rate. The exchange rate reached a point that was well above the estimated fair value of the currency based on purchasing parity, which in turn relied on inflation differentials.

The first speculation about an imminent reversal of the Bank of Japan began to be heard in December. The assumption here is that the BOJ will stop persistently pursuing Quantitative and Qualitative Monetary Easing (QQE) and begin to normalize monetary policy. No one knows when this process will start, but markets expect the Fed to start cutting rates this year and the BOJ under a new governor will begin to normalize policy.

If that happens, conditions will change to the exact opposite. Some Japanese banks are suggesting that the yen will strengthen to the 120/125 level this year, while Mizuho Bank is even more categorical and expects a move to 110.

The JPY net short position rose 938 million to -4.471 billion during the week, but that didn't stop the estimated price from staying below its long-term average.

The expected changes in the monetary policy of the BOJ led to the need to revise the forecast for the yen. Now possible resumption of growth looks unlikely, I expect an update of the recent low at 129.52 and further reduction in USDJPY. The 126.35/55 support area is the target, the probability that the yen will strengthen to this support has significantly increased.