On Thursday, the EUR/USD currency pair continued to rise, but the trend was already very different from what it had been the previous few days and even last Friday. Recall how the US dollar crashed like a stone last Friday based on some solid international statistics. In addition, the growth of the euro has been modest for several days. Today, however, the pair rose strongly, sank quickly, and then shot back up. Although we think that this market response was not fully rational, it has been customary in recent months. We'll discuss the fact that American inflation has decreased to 6.5% in this post, but why did the value of the dollar initially decline, then rebound, and then decline once more? Is the fact that inflation is dropping negative for the dollar, considering that it was bound to happen?

We reiterate that we believe the recent expansion of the European currency overall has not been justified. There have been factors that have occasionally supported the euro, and the overall downturn is probably coming to an end. It follows that the technical, corrective development of the euro was entirely justifiable. However, it cannot continue indefinitely, not even with the help of macroeconomics. Thus, we started to question whether the value of the European currency had increased too much during the past month. The market ignores them, as the most recent significant macroeconomic data have demonstrated. Why didn't we observe a routine downward retreat on Monday or Tuesday, even if we presume that figures from abroad on Friday were a failure? Why have we yet to see it? We continue to think that the euro should decline since its growth has been excessively rapid. We are still in long positions as there are no technical signals available for sale. Fixing below the moving average presents an excellent chance to start short trades.

What does the dollar's declining inflation mean?

Nothing positive. The Fed has fewer reasons to pursue an active monetary policy when inflation declines rapidly, as we have stated numerous times, which contributed to the robust growth of the dollar in the first three quarters of last year. Inflation will therefore revert to 2-3% in six months if it declines by 0.5-0.6% every month. Although this is an overly optimistic alternative, the US consumer price index is now showing a slowdown at this rate. As a result, the likelihood of another three tightenings of the Fed's monetary policy, of which there should have been at least one by 0.5%, dramatically decreased yesterday. No matter how much the Fed ultimately increased the rate, yesterday saw a decline in the peak value forecast. Additionally, the Fed will begin cutting the rate in 2023 if inflation, for example, returns to 2% in 8 months, as it will be ineffective to maintain it at its highest level. And this is, to put it bluntly, "bearish" for the US dollar. In general, the likelihood that the dollar will decline increases when inflation declines more quickly. The only remaining query is whether it makes sense to focus on other numbers or if inflation in the US has taken center stage. After this report, if the US dollar had fallen instead of rising for thirty minutes, we would have claimed that everything is perfectly rational. But the dollar nearly immediately reverted to its initial positions, making it difficult to establish for sure what the market's gestures exactly meant. We focus more on technical analysis because it is the one that can best depict what is occurring in the market under any ambiguous circumstances. As there is now no flat on the 4-hour TF, hints about overcoming the movement can be seen as indicators of a trend change. Therefore, you can continue to buy the pair as long as the price is above the moving average line and not worry about the macroeconomic or fundamental background. In addition, recent months have demonstrated that the market is capable of purchasing the euro even in the absence of compelling reasons.

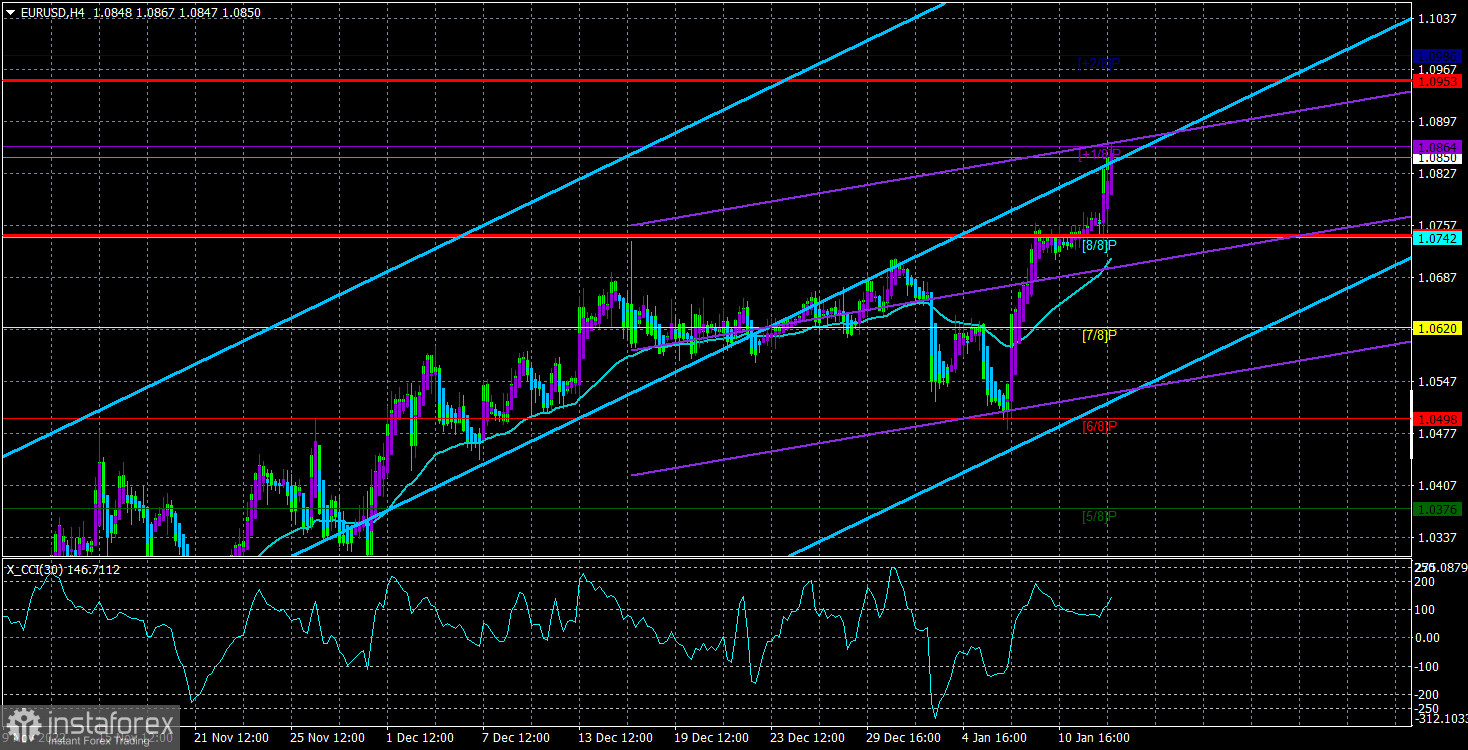

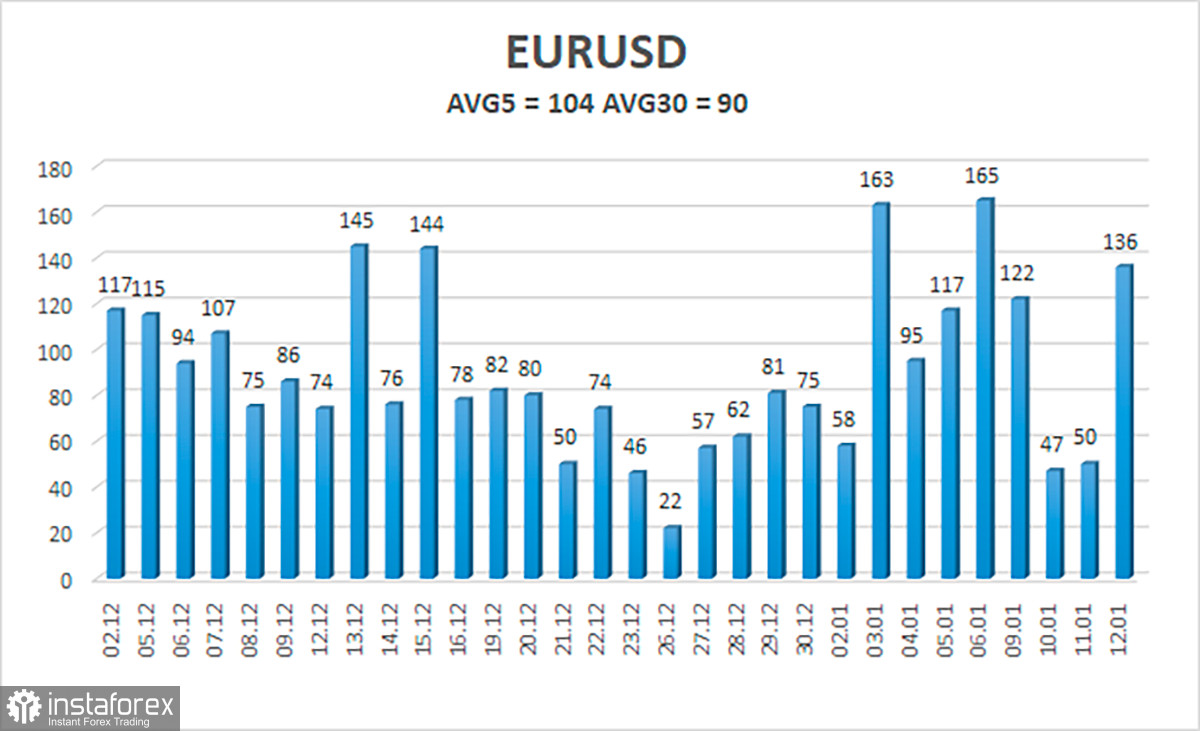

As of January 13, the euro/dollar currency pair's average volatility over the previous five trading days was 104 points, which is considered "high." As a result, we anticipate that the pair will fluctuate on Friday between 1.0744 and 1.0953. A bout of corrective movement will begin when the Heiken Ashi indicator reverses to the downside.

Nearest levels of support

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest levels of resistance

R1 – 1.0864

R2 – 1.0986

Trading Suggestions:

The EUR/USD pair is still rising. Until the Heiken Ashi indicator turns down, you can continue holding long positions with goals of 1.0953 and 1.0986. After fixing the price below the moving average, you may start opening short trades with a target of 1.0620.

Explanations for the illustrations:

Channels for linear regression allow identifying the present trend. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.