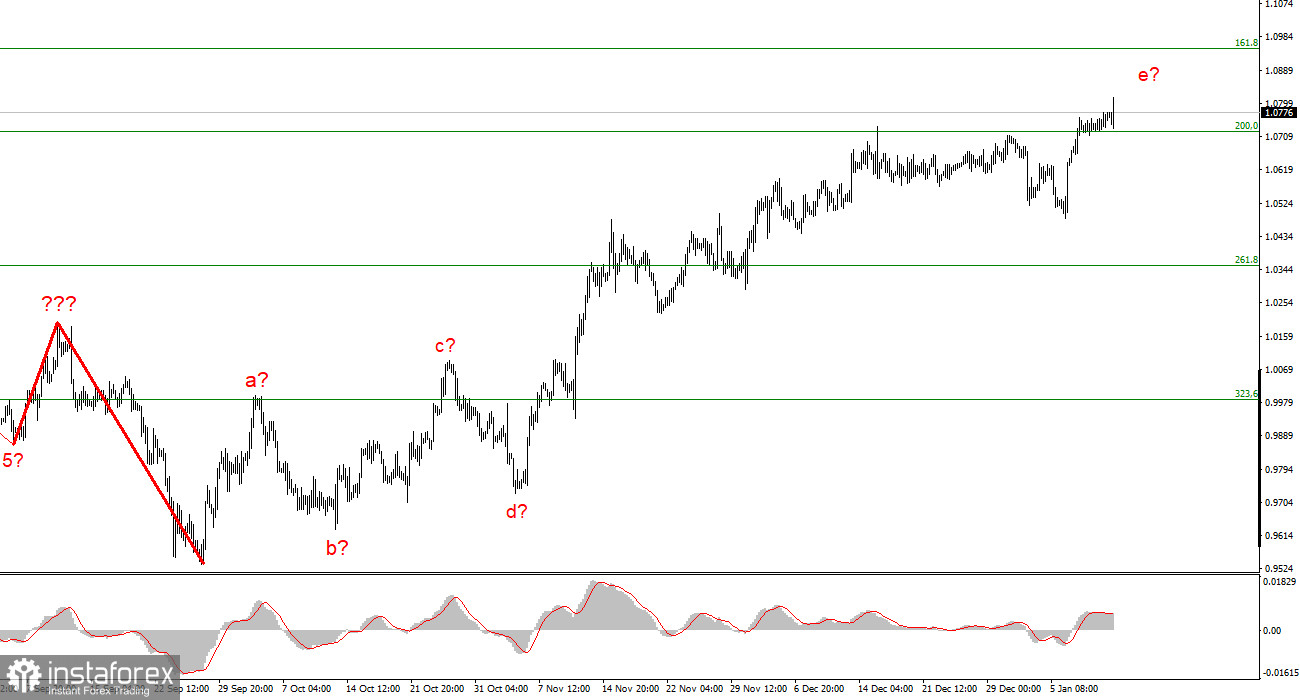

The wave marking on the euro/dollar instrument's 4-hour chart is still quite compelling and getting more intricate, and the entire upward segment of the trend is still quite convoluted. It now appears distinctly corrective and forcefully expanded. The waves a-b-c-d-e have been combined into a complicated corrective structure, with wave e having a form that is far more complex than the other waves. Since the peak of wave e is substantially higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. I'm getting ready for a decrease in the instrument because, in this scenario, we are predicted to build at least three waves down. The demand for the euro currency is increasing again in the first two weeks of the year, and the instrument has only been able to modestly deviate from its prior heights during this time. A further attempt to surpass the 1.0721 level, which corresponds to 127.2% of the Fibonacci ratio, was successful, allowing the wave e to grow even longer. Unfortunately, there is another delay in starting to build the trend correction part.

The market now expects lower Fed rates.

On Thursday, the euro/dollar instrument increased by 90 basis points. The instrument fluctuated dramatically yesterday, with a strong amplitude as it declined by 100 points and then increased by 100 points. Since the inflation report from the previous year is one of the most significant for the market, such moves did not surprise me. Additionally, inflation has been slowly falling over the past six months. This implies that the Fed will slow down the rate of an interest rate increase in early 2023, which will benefit the market and the dollar. Many analysts have already reached this conclusion. The likelihood of a rate increase of 25 basis points in February is now greater than 90%. And yesterday's decline in demand for US money was caused by this element. The second question—which I leave unanswered—is why, according to wave analysis, a corrective section of the trend is needed given that demand for the US dollar has been falling for several months in a row. If the market continues to focus solely on the "betting component," wave marking may continue to get increasingly complex for a very long time.

It is absurd to cheer the news background in the United States today in light of the events of last Friday and last Thursday. In contrast to data on inflation, the labor market, and unemployment, the University of Michigan's consumer mood index will be issued in the United States in the afternoon. The market may pause briefly today, but in terms of the wave pattern, it won't offer much. We still need to build at least three waves and generate demand for US currency. The instrument has an additional 300–400 points of growth potential if you attempt to break down the wave e into internal sub-waves. If my guess is right, wave 5-e construction started last Friday. And given the strong demand for the euro currency, wave 5 is not expected to be curtailed.

Conclusions in general

I conclude that the upward trend section's building is about finished based on the analysis. As a result, given that the MACD is indicating a "down" trend, it is now viable to contemplate sales with targets close to the predicted 0.9994 level, or 323.6% per Fibonacci. The potential for complicating and extending the upward portion of the trend remains quite strong, as does the likelihood of this happening.

The wave marking of the descending trend segment notably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this portion is complete, work on the downward trend segment can start.