Following yesterday's sharp increase in volatility following the release of US inflation data, US stock index futures opened Friday with a slight flat tone. Additionally, the European and Asian indices increased due to the easing of inflationary pressure.

The European stock indices surged, posting the greatest numbers for the first two weeks of January ever recorded. S&P500 futures contracts increased by 0.1%, while those on the NASDAQ for technology increased by 0.2%. The Dow Jones industrial average did not exhibit any dynamism. Investors anticipate the release of company results for the fourth quarter of last year today, which might trigger a significant sell-off in the stock markets.

The key Asian index increased to its highest point since June. Investors believed rumors that China planned to purchase "golden shares" in the local operations of Alibaba Group Holdings Ltd. and Tencent Holdings Ltd., which may give the government more control over the strategic sector. As a result, technology businesses registered in Hong Kong closed for the day.

As a result of reports that the Bank of Japan is taking into account the negative repercussions of its ultra-accommodative monetary policy, the yield on Japan's 10-year bonds went above the 0.5% cap set by the institution. Most recently, the Central Bank made an unexpected second round of debt purchase announcements.

Regarding the United States inflation report from yesterday, it is clear that the Federal Reserve System had the chance to raise interest rates in February of this year as a result of the indicator's drop. If the inflation outlook improves, the Fed may be able to increase rates by 25 basis points next month as opposed to the 0.5% that the public has been anticipating recently. Many Fed analysts are confident that it is too early for a reversal and relaxation of conditions, notwithstanding the good impact of reduced inflation.

For the two upcoming meetings, the swap market now anticipates a tightening of less than 50 basis points. It is also quite unlikely that March will see no gains at all. Some Fed members declared their preparedness to raise the rate by 25 basis points at their upcoming meeting immediately after the inflation report while highlighting the fact that the Fed still has a lot of work to do to keep prices under control.

Regarding other markets, oil is still expanding. After surpassing $1,900 for an ounce, gold is also expected to gain for a fourth consecutive week.

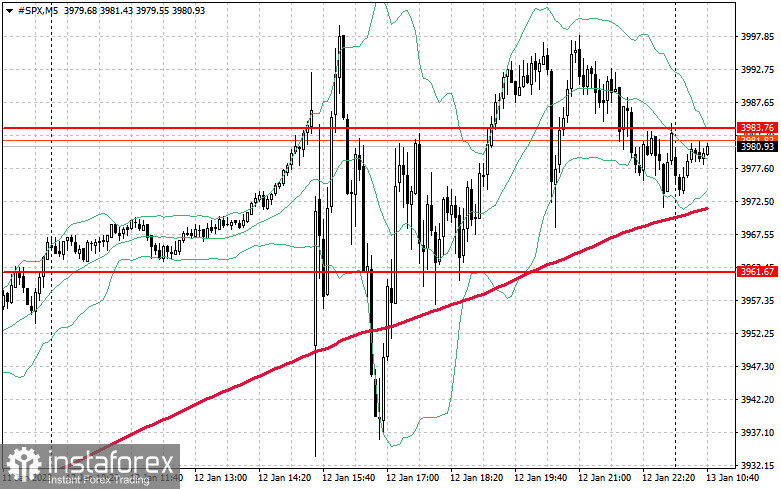

According to the S&P 500's technical picture, the index might keep expanding. Protecting the $3,960 nearest level will be a priority for today to achieve this. The trading instrument is expected to strengthen to $3,983 just after that, at which point we can anticipate a more confident upward move. The $4,010 level is a little higher; it will be challenging to surpass it. Buyers are only required to declare themselves in the vicinity of $3,866 in the event of a downward trend and a lack of support at $3,960 and $3,920. The trading instrument's breakdown will swiftly push it to $3,839, and the $3,806 region will be the furthest goal.