Dollar buyers may get some respite today if short dollar positions start taking profits amid the release (at 15:00 GMT) of the preliminary University of Michigan consumer sentiment survey.

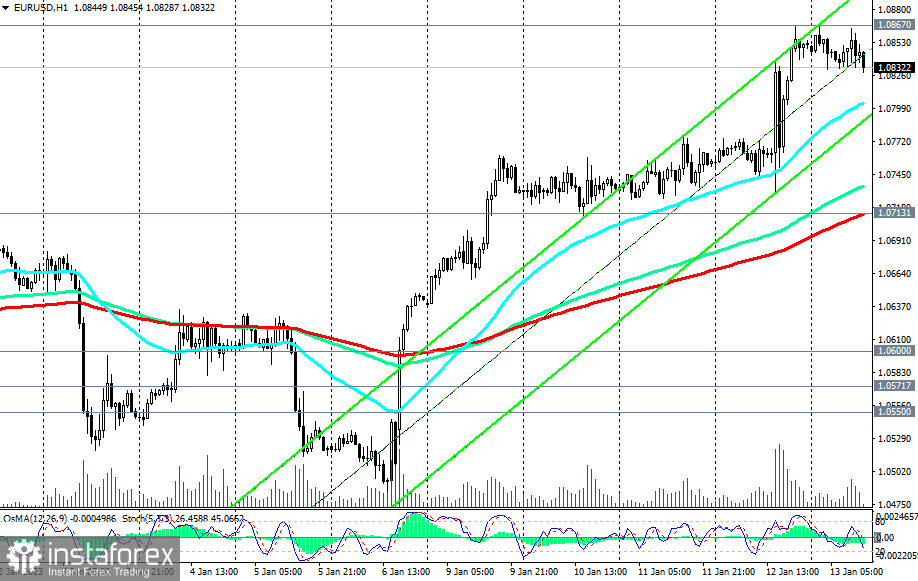

As a matter of fact, it looks like it has already begun. Despite the fall at the very beginning of today's European session, during its course and as of this writing, the dollar is strengthening, and the EUR/USD pair, respectively, is declining.

So far, we expect two targets for this decline—the 1.0802 support level (200 EMA on the 15-minute chart) and 1.0713 (200 EMA on the 1-hour chart), unless there is a rebound from the 1.0802 support level and resumption of growth.

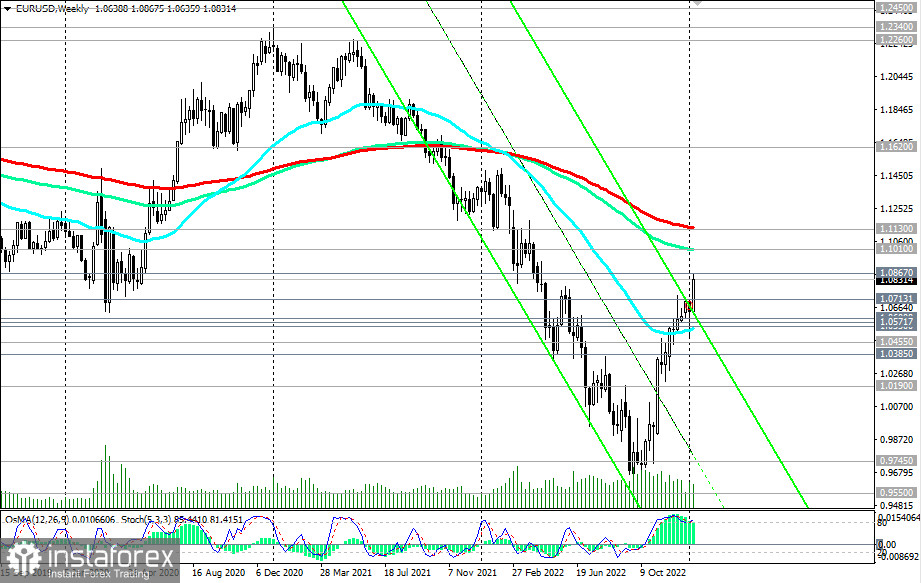

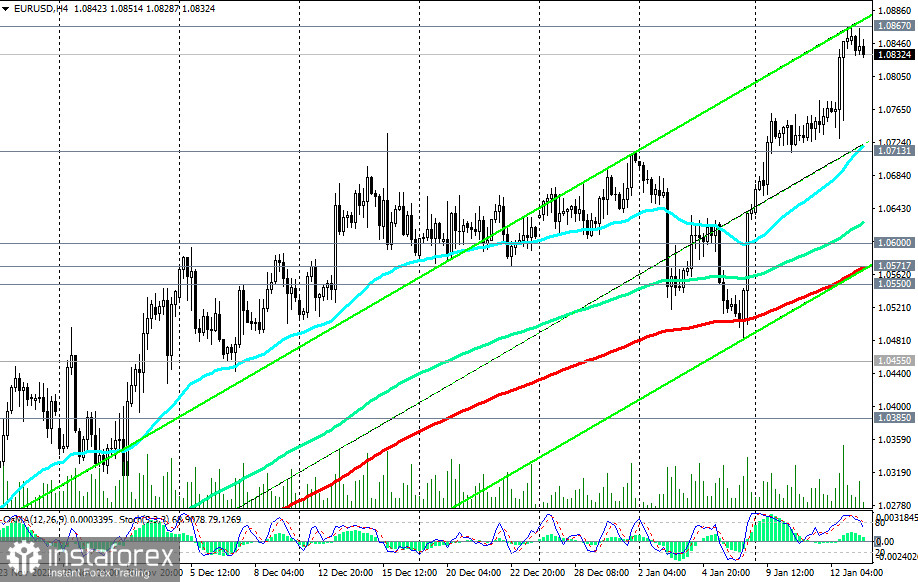

A breakdown of the 1.0713 support level may provoke a further decline to the zone of strong support levels 1.0600, 1.0572 (200 EMA and the lower line of the upward channel on the 4-hour chart), 1.0550 (50 EMA on the weekly chart).

In case of a rebound from the 1.0802 support level, the growth of EUR/USD will resume. Despite the current decline, a strong bullish momentum remains, pushing the pair towards the key resistance levels 1.1000, 1.1130 (200 EMA on the weekly chart), separating the pair's long-term bullish trend from the bearish one.

The breakdown of today's and the local high of 1.0867 will be a signal for the implementation of this scenario.

Support levels: 1.0802, 1.0713, 1.0600, 1.0572, 1.0550, 1.0500, 1.0455, 1.0370, 1.0190

Resistance levels: 1.0867, 1.0900, 1.1000, 1.1130

Alternative Scenarios

Sell Stop 1.0785. Stop-Loss 1.0875. Take-Profit 1.0713, 1.0600, 1.0572, 1.0550, 1.0500, 1.0455, 1.0370, 1.0190

Buy Stop 1.0875. Stop-Loss 1.0785. Take-Profit 1.0900, 1.1000, 1.1130