The first two weeks of January proved to be quite challenging for the US dollar. The euro and the pound were able to dramatically improve their positions on the eve of the Old New Year, although economic indicators didn't start to surface until the end of last week and the end of this week. For these two weeks, only a small number of reports may be allocated. The extensive American data, of which there were many, is a separate pillar. Remember nonfarm payrolls, which, in my opinion, were not a failure. Let's not forget that the jobless rate has reached its lowest level in 50 years. Let's go back to the time when wage growth matched expectations. These reports might stimulate demand for US money rather than cause it to decline.

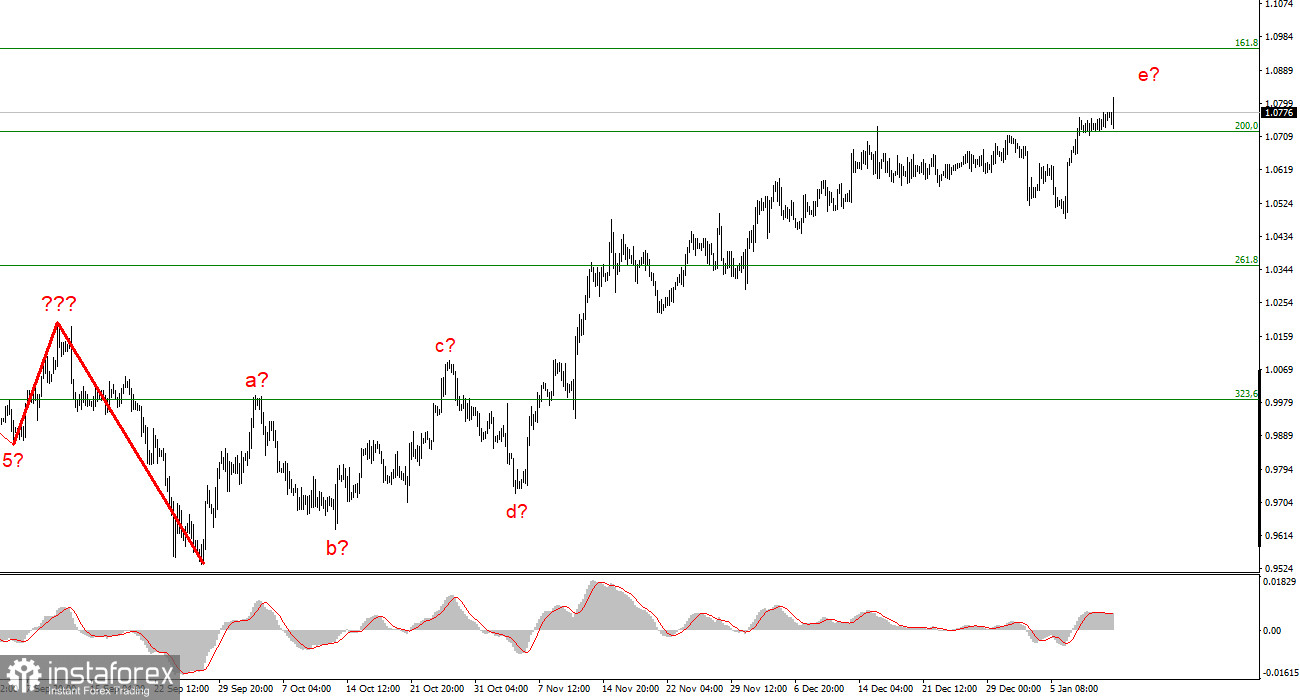

Reports on business activity and inflation were also available, though. The market suffered a very painful decline in company activity in the American non-manufacturing sector below the critical level of 50.0. Even more severely, it took the report on inflation, which dropped to 6.5% in December. Therefore, although wave analysis has long indicated the need to construct a corrective set of waves and wave e has evolved into a highly prolonged shape, both instruments continue to increase in the first weeks of 2023.

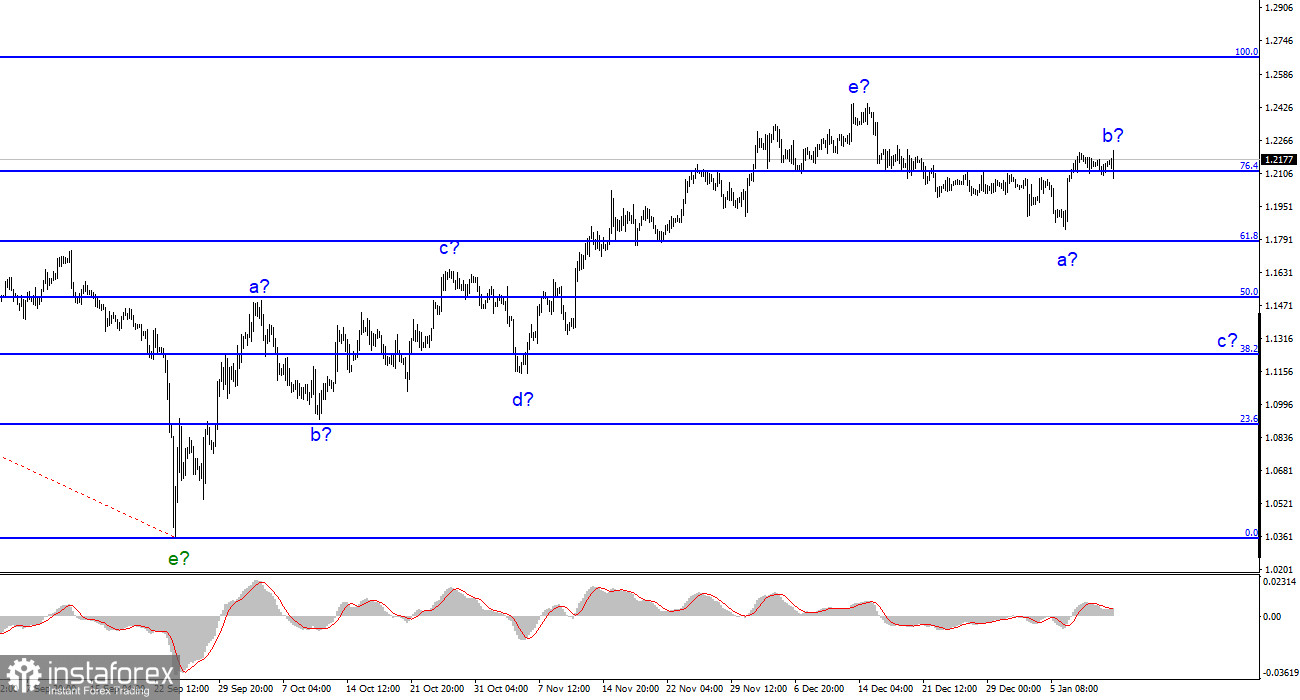

I lean toward the belief that the euro and the pound will still see the start of the construction of a corrective part of the trend. If the value of the first currency increased by 1300 basis points in 3.5 months and the value of the second by 2100, it is very difficult to anticipate that trend continuing. I have nothing against these currencies continuing to appreciate, but I think it should wait until after the traditional downturn. After then, nobody will object to the trend's new impulse parts being built.

Given these considerations and justifications, the upcoming Fed meeting will be crucial since the market occasionally demonstrates that it is more interested in the American central bank and its judgments. A 50 basis point rate increase was more likely than 50% at the start of this year. Indicators of economic activity, payrolls, unemployment, and other reports, in my opinion, should only have confirmed to the Fed that this strategy was appropriate. Why alter the rate of policy tightening when the labor market is still strong and shining? While inflation has been slowly declining over the past six months, it is important to remember that the cost of gas and oil has also decreased recently. For instance, since the beginning of September, the price of gas has decreased three times. Since mid-summer, the price of oil has decreased by $45. What if the cost of energy resources starts to increase once more? Because rates have been rising quickly and the cost of energy resources has been down during the past three to four months, the inflation pressure has been rapidly lessening. Rates will now progressively increase, and gas and oil prices may start to increase once more. Because of this, in my opinion, US inflation may slow, and the Fed will seriously explore the possibility of acting proactively by hiking the interest rate by 50 basis points in February.

I conclude that the upward trend section's building is about finished based on the analysis. As a result, given that the MACD is indicating a "down" trend, it is now viable to contemplate sales with targets close to the predicted 0.9994 level, or 323.6% per Fibonacci. The potential for complicating and extending the upward portion of the trend remains quite strong, as does the likelihood of this happening.

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1.1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over, however, it might yet take a lengthier shape than it does right now.