Conditions for opening long positions in EUR/USD:

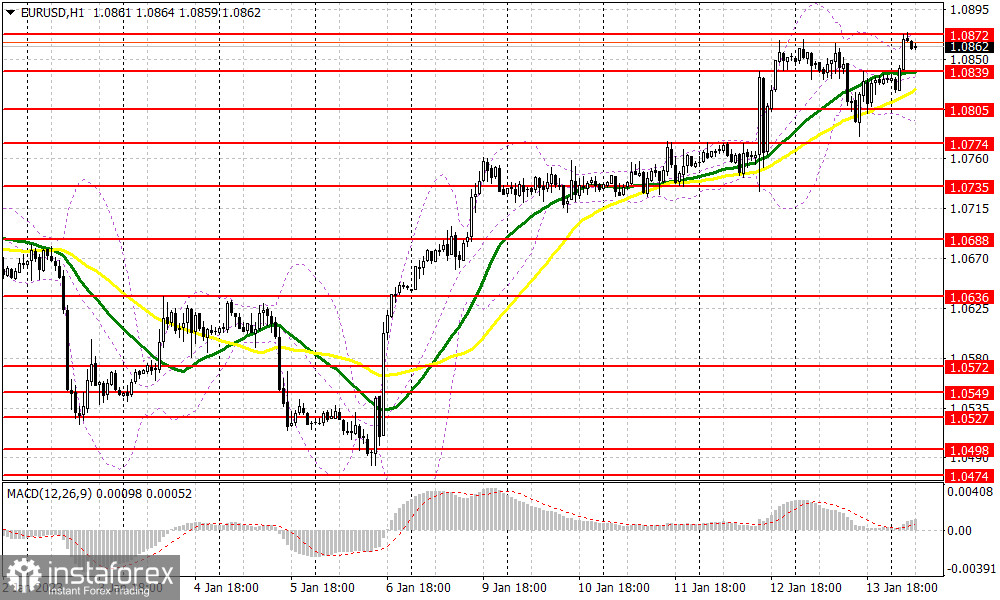

Today, the euro may have every chance to rise since the US is celebrating Martin Luther King Day and the trading volume could be lower than usual. Today, only Germany's wholesale price index and the Eurogroup meeting may have a negative effect on the sentiment of buyers of risk assets. That is why bulls are likely to be focused on the level of 1.0872, which was formed on Friday. Only a breakout of this level and consolidation above it will give a good buy signal with the targets at 1.0917 and 1.0957, where it is recommended to lock in profits. The next target is located at the resistance level of 1.0994. However, the pair will be able to reach this level only amid support from big traders. However, it will be wise not to rely on them. If pressure on the euro returns in the first part of the day and data from Germany is well below the forecast, I will avoid buying until the price declines to the middle limit of the sideways channel located at 1.0839. There, traders may go long only after a false breakout. It is also possible to open buy orders just after a bounce off 1.0805 or 1.0774, expecting a rise of 20-25 pips within the day.

Conditions for opening short positions on EUR/USD:

Bears should protect the resistance level of 1.0872. Only a false breakout of this level will give a sell signal with the target at the middle limit of the sideways channel located at 1.0839. There, we can see bullish MAs. At this level, traders should lock in profits. The farthest target is located at 1.0805. The pair may test this level only in case of weak data from the eurozone. If the price breaks this level and settles below 1.0805, it is likely to go on falling to the support level of 1.0774, thus forming a downtrend. If bears fail to be active at 1.0872 in the first part of the day, sell orders could be postponed until the price hits a new high above 1.0917. There, traders may go short after a false breakout. It is also possible to go short after a rebound from 1.0957, expecting a decline of 15-20 pips.

Signals of indicators:

Moving Averages

Trading is performed slightly above 30- and 50-day moving averages, which points to a further increase in the euro.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

Since the market volatility is very low, there are no signals to enter the market.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.