Despite the fact that the precious metal can be considered overbought, market sentiment suggests that prices will rise in the near future.

The first weekly review of gold shows that sentiment from both Wall Street analysts and Main Street investors is overwhelmingly bullish, with many analysts suggesting it is only a matter of time before reaching the $2,000 an ounce target.

"There is a gravitational pull to $2,000 and will only build as prices continue to move higher," said Phillip Streible, chief market strategist at Blue Line Futures.

While momentum favors higher prices, analysts advise investors not to chase the market.

Streible believes that gold will rise and plans to buy from the pullback.

Daniel Pavilonis, senior commodities broker with RJO Futures, said he is also bullish on gold but advised investors not to buy at current levels.

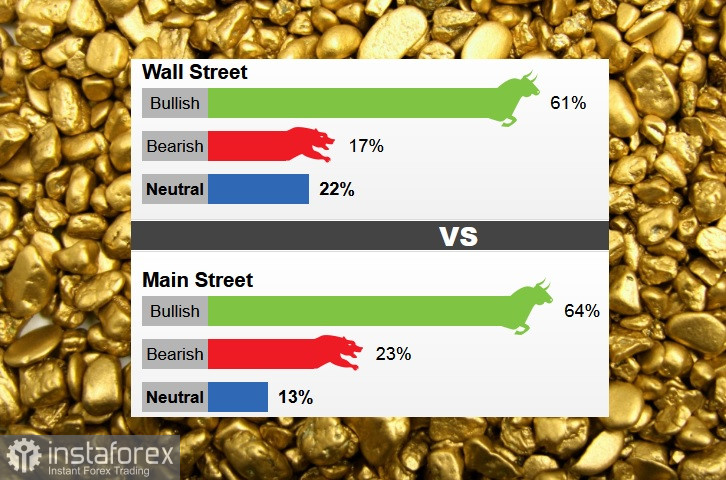

Last week, 18 Wall Street analysts took part in the gold survey. Among the participants, 11 analysts, or 61%, were bullish in the short term. At the same time, three analysts, or 17%, are bearish, and four analysts, or 22%, believe prices are trading sideways.

Meanwhile, 825 votes were cast in online polls. Of these, 524 respondents, or 64%, expected gold prices to rise this week. Another 190 voters, or 23%, said the price would go down, and 111 voters, or 13%, were neutral.

Some analysts say the change in expectations for the Federal Reserve's aggressive monetary policy remains the biggest bullish factor for gold. Those analysts say that lower inflationary pressures have given the Federal Reserve room to further slow its pace of rate hikes next month, with bond yields and the U.S. dollar somewhat reversing last year's massive upward trend.

Kevin Grady, president of Phoenix Futures and Options, said the momentum of the U.S. dollar is turning bearish as market expectations change. He added that while gold could reach excessive levels, it still has upside potential.

According to Grady, the bond market will decline and that is beneficial for gold.

However, not all analysts are convinced that gold will be able to maintain the current momentum. Ole Hansen, head of commodity strategy at Saxo Bank, said that despite his optimism for gold, there are growing risks of price consolidation at current levels.

And Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is neutral on gold in the near term.