The different speeds of monetary tightening by the Fed and the ECB, as well as narrowing divergence in U.S. and eurozone economic growth pushed EURUSD to the region of 9-month highs. The pair posted its best weekly rally in two months, but the updated forecasts from Bloomberg experts made the bulls doubt their own rightness. It turns out that not only the Fed, but also the European Central Bank may begin to reduce the cost of borrowing this year.

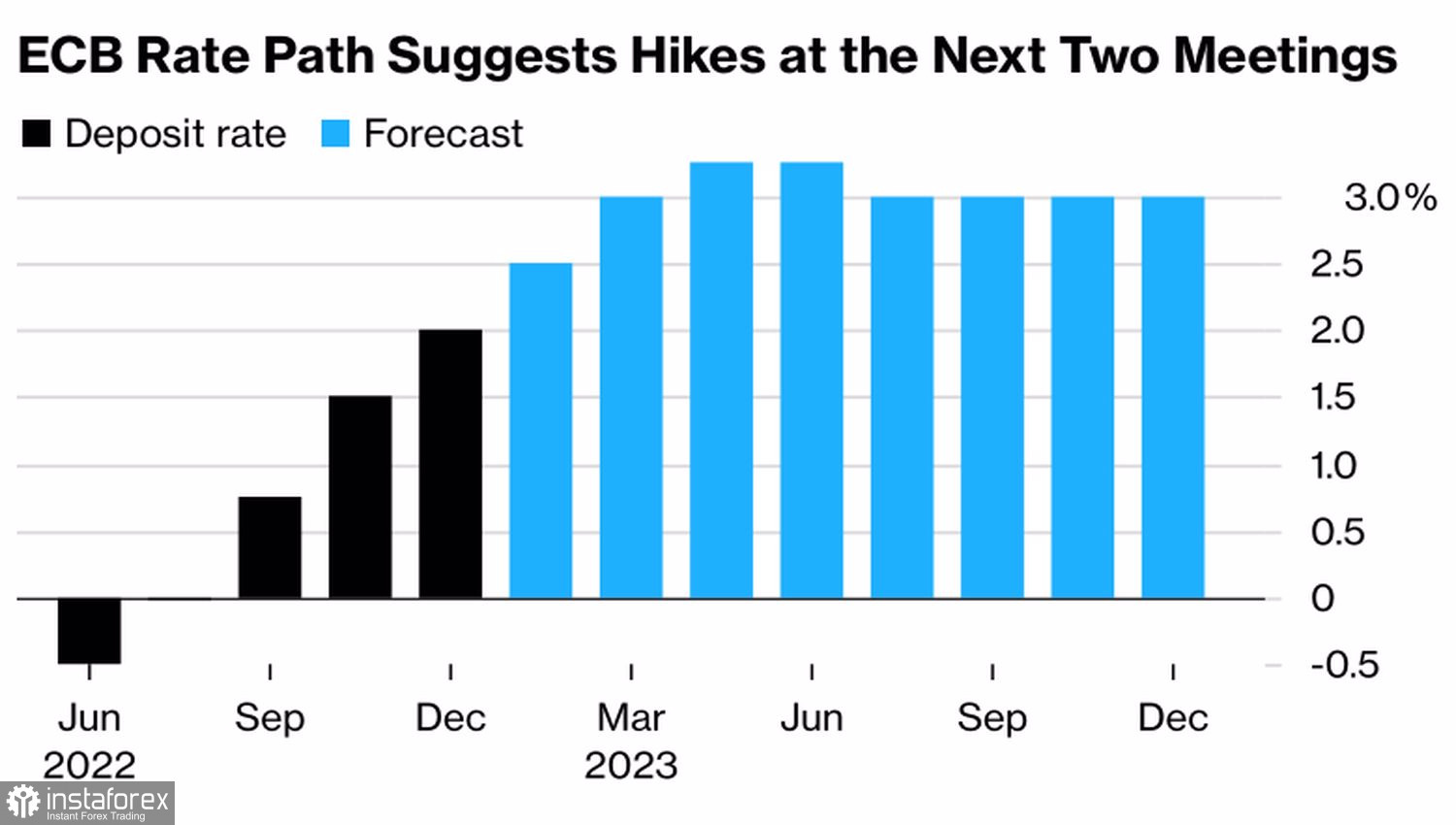

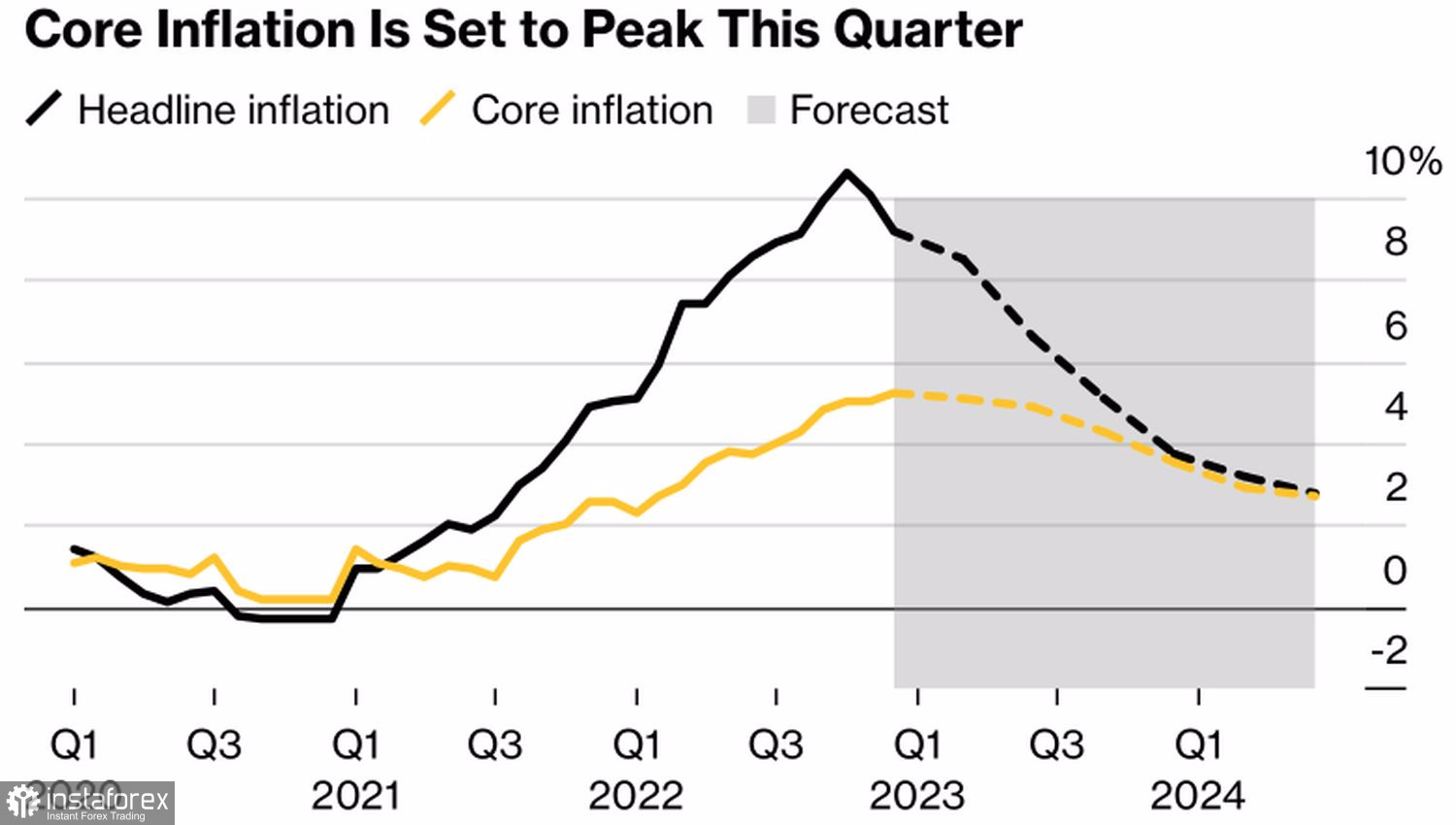

Indeed, if the Fed makes a dovish reversal in 2023, why wouldn't the ECB do the same? According to a consensus forecast by Bloomberg experts, core inflation in the eurozone will peak at 5.1% in the first quarter and then its growth rate will fall to 3.5% by the end of the year. As a result, the deposit rate will rise by 50 bps in February and March, then by 25 bps in May or June to 3.25%, before starting to decline in September.

ECB deposit rate forecasts

The opinion of experts contradicts the position of investors participating in the MLIV Pulse survey. According to the majority of 201 respondents, the cost of borrowing in the eurozone will jump above 3.5%. 15% predict an increase to a record high of 4%. 60% of respondents believe that Europe will avoid the energy crisis, and the greatest benefits from the opening of the Chinese economy will benefit luxury goods, tourism and the euro. In the latter case, we are talking about strengthening the regional currency due to the improvement of the current account.

In my opinion, inflation will continue to be the main driver of the main currency pair quotes. There is a view that eurozone consumer prices will drop so fast that many people will be surprised and the ECB will be forced to do a dovish reversal. Where the Fed will be by then is a big question, but if the federal funds rate plateaus, EURUSD risks weakening by the end of the year.

Dynamics of European inflation

Currently, the market is ruled by Greed and the principle of buying on pullbacks, however, if something starts to fail, closing longs on U.S. stock indices and the major currency pair could turn into a serious pullback. The main fears are related to the arrival of cold weather in Europe and the problems of the Chinese economy. Indeed, a sharp increase in deaths will increase the likelihood of a return to lockdowns, and the celebration of the Lunar New Year suggests a delayed start of recovery.

Let's not discount the many speeches from FOMC officials, which fill the week of January 20. Sure enough they will be saying that the Fed's work is not done yet, and that the markets are running ahead of themselves. Won't that scare the EURUSD bulls?

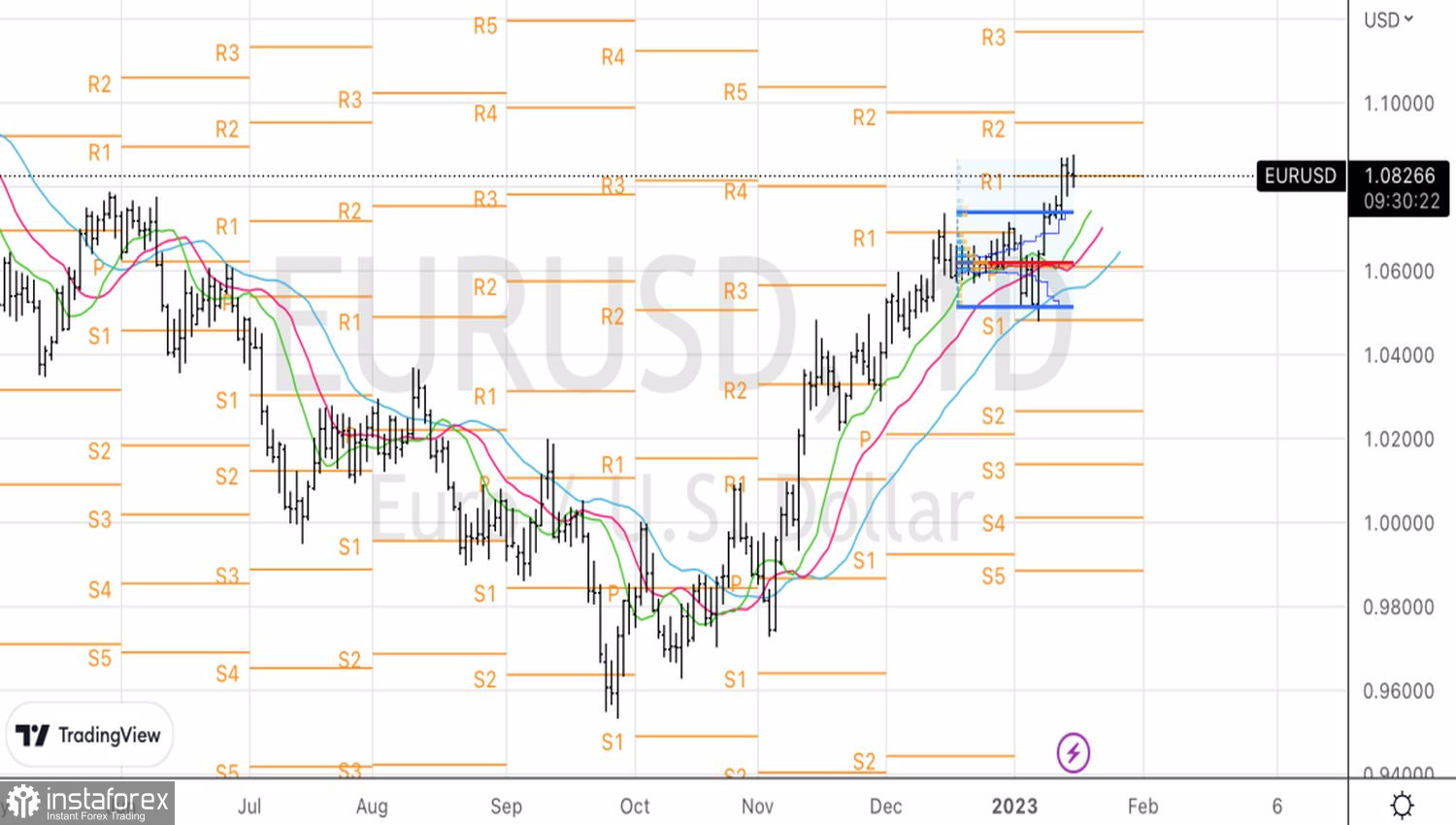

Technically, on the daily chart of the major currency pair, the strength of the upward trend is undeniable. However, the formation of an inside bar followed by an unsuccessful test of its upper border increases the risks of a pullback. Selling from 1.079 may bear fruit, but the subsequent pullback from 1.0745 and 1.072 makes sense to use for a reversal.