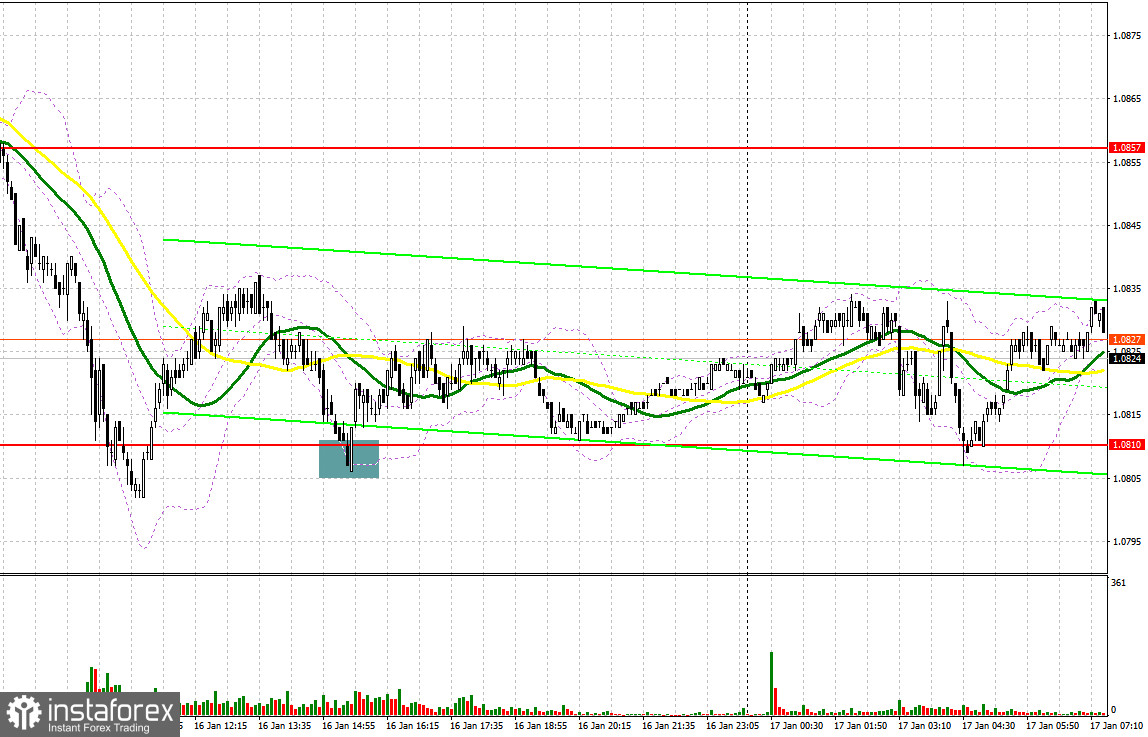

Yesterday, just one entry signal was generated. Let's take a look at the M5 chart to get a picture of what happened. A fall and a false breakout through support at 1.0810 produced a buy signal. However, due to low volatility and trading volumes in the second half of the day, the pair was able to rise by just 20 pips.

When to go long on EUR/USD:

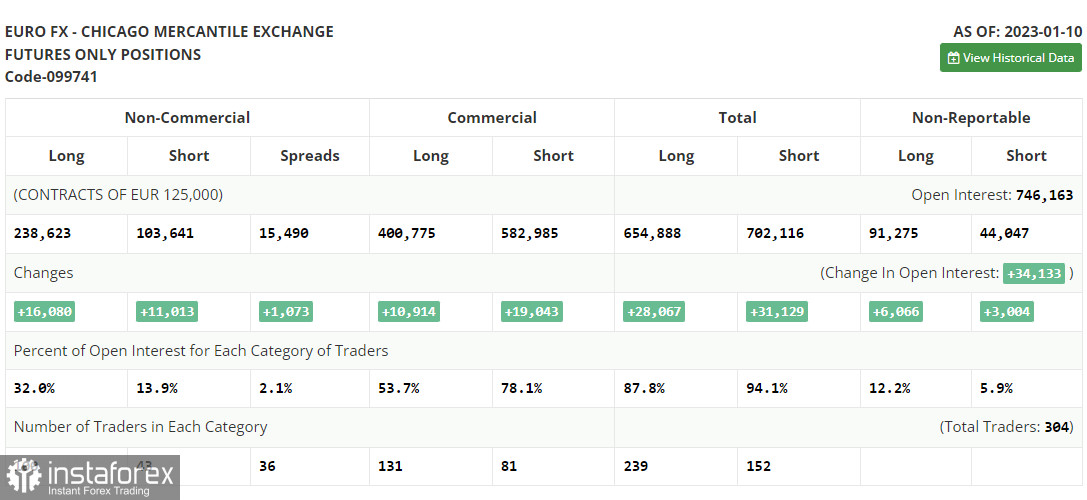

Before we analyze the prospects of EUR/USD, let's see how the Commitments of Traders have changed. The COT report for January 10 illustrates a steep rise in long and short positions. Trading activity is clearly on the rise after the winter holiday season and the release of US inflation statistics for December. A fall in inflation allows the Federal Reserve to reduce the pace of rate hikes at the February meeting. If the central bank announces a 0.25% rate increase, this will inevitably lead to a weaker dollar against the euro. Demand for risk assets is also growing. Indeed, a less hawkish stance of the American regulator brings back risk appetite, which decreased significantly last year. According to the latest COT report, long non-commercial positions grew by 16,080 to 238,623 and short non-commercial positions rose by 11,013 to 103,641. Consequently, the non-commercial net position came in at 134,982 versus 129,915 a week ago. Investors are now betting on the euro on expectations of a less aggressive stance of world central banks this year. Still, for a surge in price, new fundamental factors are needed. The weekly closing price ascended to 1.0787 versus 1.0617.

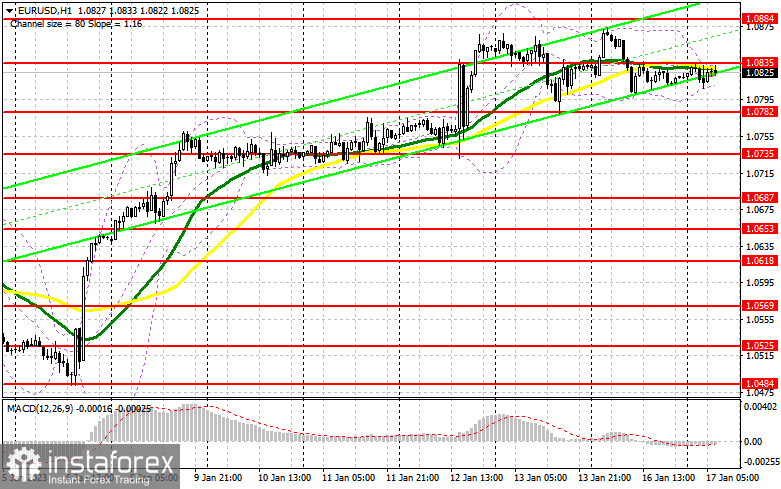

A series of macro reports will be delivered in Germany and the eurozone today. The bull trend will continue if data comes better than expected. A rise in figures will confirm economists' expectations that the European economy may land softly and avoid a prolonged recession this year. In such a case, the euro will definitely strengthen. However, if results are pessimistic, the bulls should not allow the pair to go below the support level of 1.0782 that formed on Friday. A false breakout through the barrier will make a buy signal with the target at the resistance level of 1.0835, which is also the middle of the sideways channel. A breakout and a downside retest will push the pair to 1.0884. More distant targets are seen at 1.0931 and 1.0970 (new monthly high). If the quote reaches the most distant target, the bullish trend will go on. It is wiser to lock in profits there as well. If EUR/USD goes down and there is a lack of bullish activity at 1.0782, the pair will face tremendous pressure although the bulls are likely to remain in control of the market. Therefore, a buy signal will only be generated after a false breakout through support at 1.0735. It will also become possible to go long on a rebound from the low of 1.0687 or 1.0653, allowing a bullish correction of 30 to 35 pips intraday.

When to go short on EUR/USD:

Yesterday, the bulls failed to touch 1.0835. So far, the pair has been trading below 1.0835. Therefore, the bears are now anticipating a correction. That is why they should protect the area of 1.0835. If bullish activity increases following the release of macro data in the eurozone, the pair may test the mark. So, a false breakout through the level will push the quote to the support level of 1.0782. A breakout and consolidation below the barrier as well as an upside retest will produce an additional sell signal and trigger a row of bullish stop orders. The pair will drop to 1.0735. This will be the first corrective move that may actually threaten the bullish continuation. The price may go beyond this level only after the publication of US macro data in the second half of the day. If EUR/USD goes up in the course of the European session and there is a lack of bullish activity at 1.0835, the bulls will remain in control of the market. Therefore, it will become possible to go short after a false breakout through 1.0884. EUR/USD could be sold on a rebound from 1.0931 or 1.0970, allowing a bearish correction of 30 to 35 pips intraday.

Indicator signals:

Moving averages

Trading is carried out near the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.0835, in line with the upper band. Support stands at 1.0810, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.