Gas prices have fallen from nearly $4,000 per 1,000 cubic meters to $600-700 in recent months. Of course, such a drop in prices for one of the world's primary energy carriers benefits the economy. Energy prices are falling, the European population is less concerned, and inflation is decreasing. I believe that the European Union is currently in a favorable period for itself, as the ECB raises interest rates while gas prices fall. Let me remind you that last year the situation was the opposite. Gas prices were rising at an incredible rate, and the rate remained low for the majority of the year. Inflation was rising rapidly at the time, but it is now expected to fall.

However, this favorable period will not last long. Winter was kind to the European Union this year. Because it turned out to be quite warm, gas storage facilities were nearly full on the eve of winter. As a result, the EU has been very well prepared for the cold season, and it is not currently experiencing energy problems. However, I'd like to remind you that Russian gas supplies have been cut off, and gas storage facilities are not rubber. You can't put gas in them for another 5 years. The EU is currently attempting to increase energy production at the expense of other sources, but only time will tell whether it will be possible to completely replace the volumes of gas imported from the Russian Federation. I believe that gas shortages will continue to plague the European Union in the future. As a result, natural gas prices may begin to rise again, putting pressure on the European budget and consumers' pockets.

The European currency continues to react positively to the news backdrop, but this backdrop may deteriorate over time. To begin with, the energy crisis may resurface and begin to accelerate inflation. The ECB rate will rise to 3.75%, but its future growth is uncertain. Inflation has begun to slow, but no one can guarantee that this will continue. So far, the euro is rising on expectations that the Fed will soon abandon tightening monetary policy. The spread between ECB and Fed rates will narrow, but it is unlikely to disappear entirely by 2023. As a result, I can conclude that the euro is fully exploiting the opportunity to rise. It will worsen and become more difficult.

The usual statistics don't mean much to the market right now because of the larger factors I mentioned earlier. There will be a few significant reports this week, and the market is already anticipating upcoming ECB and Fed meetings. I believe that demand for the euro currency will remain high for some time, but a decline is unavoidable.

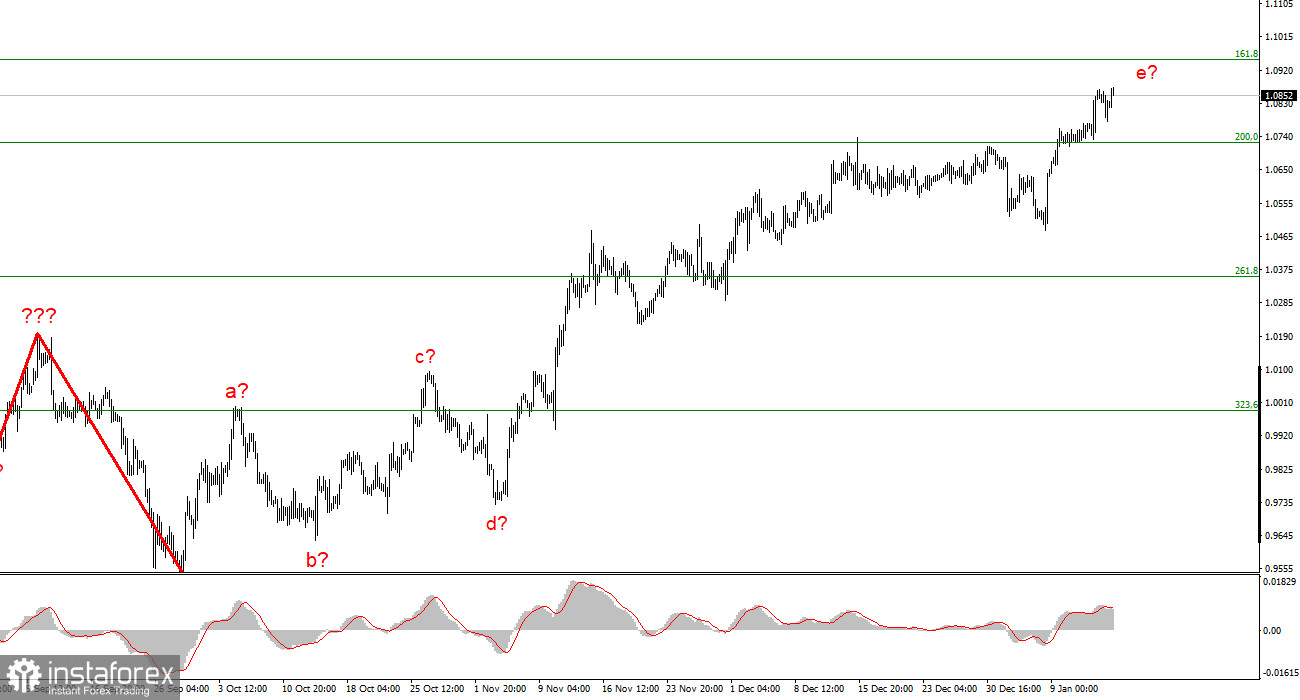

Based on the analysis, I conclude that the upward trend section's construction is nearing completion. As a result, according to the MACD signals "down," it is now possible to consider sales with targets near the estimated 0.9994 mark, which corresponds to 323.6% by Fibonacci. The possibility exists of complicating and extending the upward section of the trend, and the probability of this scenario remains quite high. If the market fails to break through the 1.0950 level, it will indicate that it is ready to complete wave e.

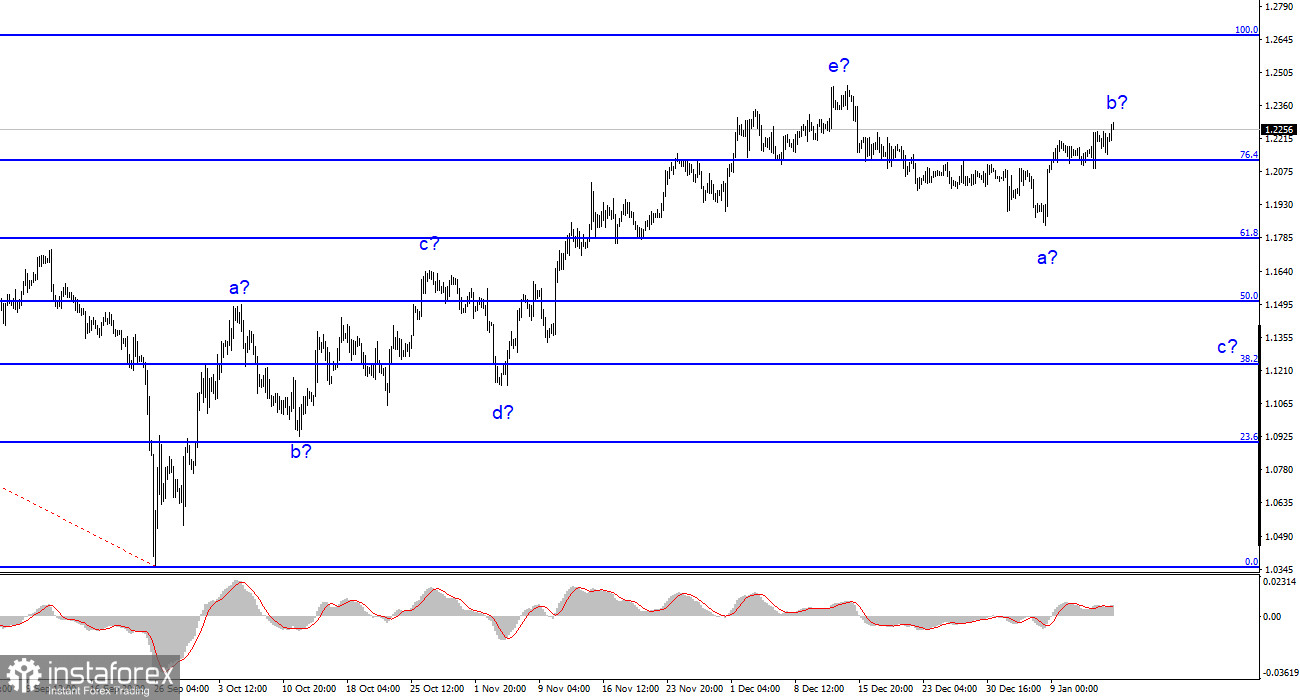

The pound/dollar instrument's wave pattern continues to assume the formation of a downward trend section. At this time, sales with targets located around the level of 1.1508, which is equivalent to 50.0% by Fibonacci, according to the reversals of the MACD indicator "down," can be considered. The upward section of the trend may continue to take a longer form than it does now, but it is almost certainly over. However, you should exercise caution when selling because the pound tends to rise at this time of year.