And while ether is testing the $1,600 level and bitcoin is actively vying for the $21,150 level, the Central Bank of Georgia plans to issue a document in the near future that provides a full explanation of the idea behind the country's digital currency. We should be able to learn more about the specifics in the early spring of this year, and everyone involved in the CBDC's development will use this paper to complete their ideas for the pilot project.

Potential partners will be able to compile and improve their proposals for the project's test phase using the new document. The Central Bank's digital currency launch was originally scheduled for 2022, but it was later moved up to this year. Vice-Governor Papuna Lezhava stated in an interview that "we will publish the paper in the first half of 2023 and shortly after that, together with our partners, we will debate how long it will take to implement the project."

The official claims that several alternate strategies for evaluating the Georgian lari's digital representation have already been given the green light. It will initially be a somewhat constrained pilot version. The technological aspects of the "digital lari" will be assessed in light of this. The Central Bank's current responsibility is to guarantee price and financial stability. The development of digital technologies necessitated the construction of a digital version of the lari and a central bank's digital money, the Georgian regulator of monetary policy said. The bank made it clear that improving the efficacy of economic policy and better meeting the demands of the digital economy are both tied to the need for CBDC. He further emphasized that the coin would be considered legal money in Georgia if the state supported it.

"In both its cash and non-cash forms, the digital lari will replace the current fiat lari as a more affordable, secure, and quick method of payment. Transactions using digital lari would not require the services of middlemen, commercial banks, or payment systems," the NBG said, noting that the new platform will also be able to work offline.

I should point out that Georgia is not the first nation to implement CBDC. The Central Bank stated that the creation of its digital currency was necessary last year, and it is clear that significant progress has been made in this area. The Bank of Russia is getting ready to provide options for handling international payments utilizing CBDC in the near future, despite the sanctions and financial constraints. The Russian media covered this last week.

Regarding Bitcoin's current technical situation, the crossing of the side channel's upper barrier and the consolidation above provide a somewhat optimistic outlook for the start of the year. The $21,300 level is the immediate target for the bulls. By focusing on it, a new bullish trend can be created with a potential gain of $21,840. The $22,525 region will be the farthest objective, where significant profit-taking and a rollback of bitcoin may take place. In the case of further pressure on the trading instrument, defending the $20,300 level will take priority because a breach by sellers would be detrimental to the asset. This will put pressure back on bitcoin and create a direct path to $18,360 and $19,280. The first cryptocurrency ever created and $17,460 will "drop" when these thresholds break.

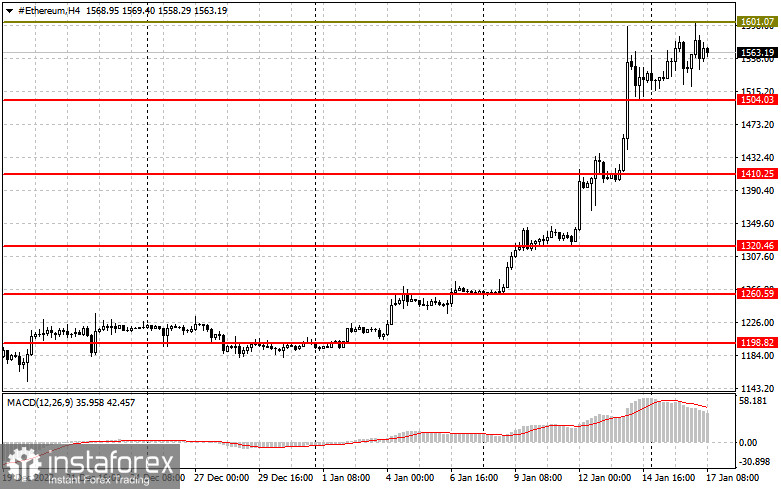

The breakdown of the nearest resistance at $1,600 is what ether buyers are concentrating on. This is going to be sufficient to establish a foothold at the current highs and keep the bullish trend going. Additionally, this will have a huge impact on the market and halt the bearish wave. The balance will be returned to the ether if the price fixes over $1,600, with a potential increase to a maximum of $1,690. The $1,780 region will be a further aim. The recent $1,410 mark will be important when the trading instrument is under new pressure and the $1,500 support is broken. If it succeeds, the trading instrument will rise to a minimum of $1,320. It will be very difficult for bitcoin owners below $1,260.