The fundamental background for the EUR/USD pair remains ambiguous. On the one hand, the dollar is under pressure amid growing confidence in the slowdown of the Fed rate hike to 25 points. On the other hand, traders need additional information impulse for the upward movement. The pair consolidated within the 8th figure (for the first time since last April), but to conquer the 9th price level, not to mention the 10th figure, they need a powerful informational trigger.

Chinese anti-records

Experts pinned certain hopes on China, which today published key data on its economic growth. However, these hopes were not justified. The data turned out to be negative, but for the most part they came out in the green zone. Neither the dollar nor the euro were the beneficiaries of today's release.

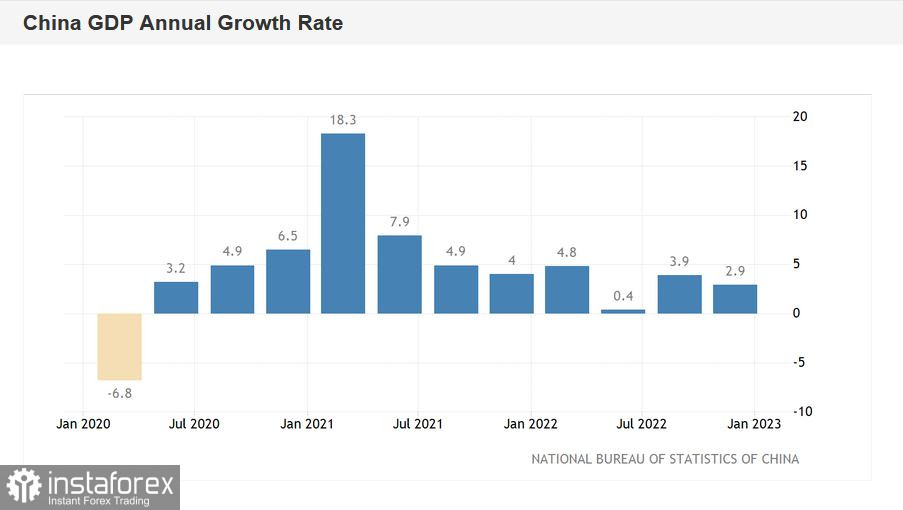

In terms of figures, the situation is as follows. China's GDP grew 3.0% last year, down from 8.4% in 2021. If we exclude the 2.2% growth after the first blow of the coronavirus crisis in 2020, this is the worst performance since 1976. Clearly, this result reflected the effects of the "zero tolerance" policy on COVID, which Beijing abandoned only at the end of last year. A sharp 180-degree turn suggests that in 2023 there will be conditions for economic growth in China. In addition, according to The Wall Street Journal, the Chinese authorities have significantly eased pressure on technology companies, relaxed strict regulation of real estate and recently lifted the ban on coal imports from Australia (which was in effect for more than two years). However, another question remains regarding the overall global demand for Chinese goods, given the global economic slowdown and the threat of recession in the world's largest economies.

In addition, another alarming signal was published today: it became known that the population of the People's Republic of China decreased last year for the first time in more than 60 years. According to a number of analysts, this is a historic shift, which in the future will have long-term consequences for both the Chinese and the global economy. According to data, Chinese population decreased by 850,000 people last year to 1.41 billion.

The reverse side of a coin

However, despite the set anti-records, the safe dollar could not benefit from the situation, including in pair with the euro. Several factors acted as a counterbalance.

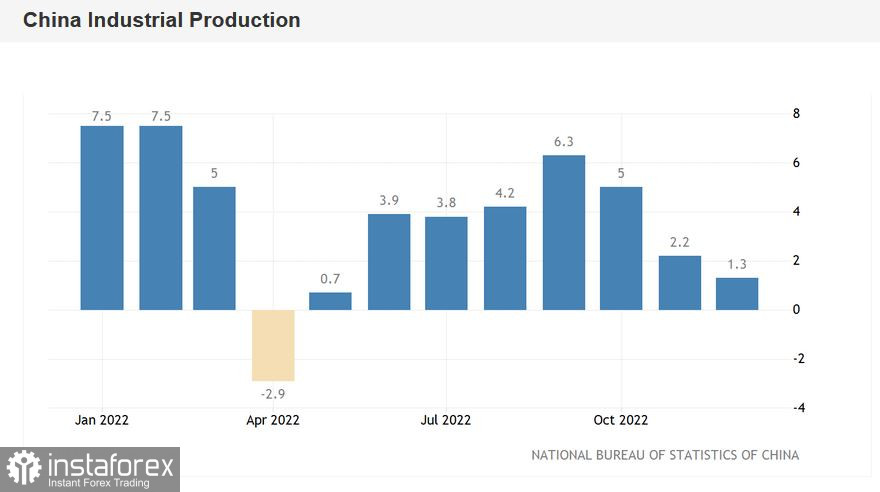

First, almost all the components of today's release came out in the green zone. China's fourth-quarter GDP beat forecasts despite growth at the slowest pace since the 1970s, with China's economy expanding 2.9% (slowing down from 3.9% growth in the third quarter), while the consensus forecast was 1.8%. As mentioned above, in 2022, the Chinese economy grew by 3.0%, while the forecast was at 2.7%. Other indicators are also green: for example, retail sales in December fell by 1.8%, while experts were more pessimistic in their estimates, expecting a decline of 9.5%. In turn, the volume of industrial production grew by 1.3% (in annual terms), with a weak growth forecast of 0.5%. The official unemployment rate fell to 5.5% (forecast was 5.8%).

The second support factor that somewhat smoothed over the negative emotions on the market from today's release was the fact that Beijing still abandoned the frankly destructive policy of zero-COVID policy.

Thus, contradictory signals from China could not tip the scales—neither in the direction of buyers nor in the direction of sellers of EUR/USD.

Moreover, some support for the euro is provided by the ECB representatives, who voiced hawkish comments. In particular, European Central Bank chief economist Philip Lane said in an interview with the Financial Times that "interest rates should be much higher than they are now." Earlier similar messages were voiced by other representatives of the European regulator, in particular Martins Kazaks, Isabel Schnabel, Robert Holzmann, Olli Rehn and Francois Villeroy de Galhau.

Conclusions

The pair is holding within the 8th figure, against the background of the general weakness of the greenback and the 90% probability of the implementation of the 25-point scenario at the February meeting of the Fed. The hawkish comments of the ECB only fuel interest in buying EUR/USD, but do not allow the pair's bulls to organize a large-scale counterattack.

In my opinion, short positions on the pair are too risky and fundamentally unreasonable. Whereas it is advisable to consider longs only after overcoming the 1.0860 resistance level, which corresponds to the upper line of the Bollinger Bands indicator on the D1 timeframe. It is likely that the price turbulence (which may not be in favor of the dollar) will be provoked by representatives of the Fed, many of whom will voice their position in the second half of the week. The market is expecting speeches by Lorie Logan, Susan Collins, Lael Brainard, Patrick Harker, Christopher Waller and John Williams. Perhaps they will shift the balance of power towards EUR/USD buyers. However, in the current, rather shaky situation, it is best to take a wait-and-see attitude.