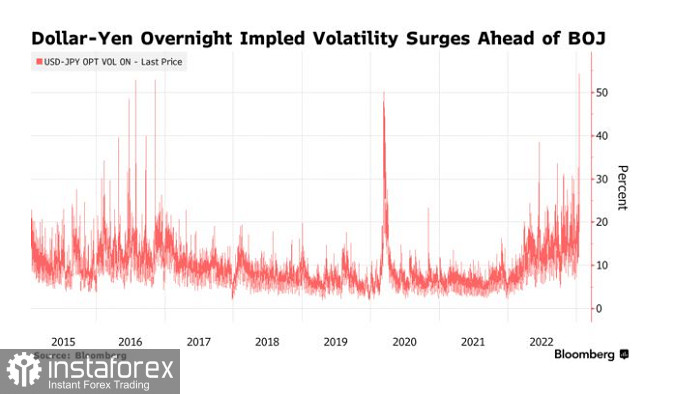

The Bank of Japan's monetary policy decision on Wednesday could be the biggest risk for USD/JPY since the global financial crisis. As such, implied volatility in the pair has jumped to 54.4 overnight, the highest level since November 2008. This indicates that market players are preparing for another policy adjustment after a surprising move in December.

The impact of another policy change will be felt around the world, with the move likely triggering a jump in yen and global bond yields. But if the bank maintains its current policy, USD/JPY will rise as players will look to cover their short positions.

The pair is down 25,000 pips since last October.

Analysis suggests that there is a 70% chance that USD/JPY will trade around 125.12-132.29 on Wednesday. It was at 129 on Tuesday.