Should we expect a new surprise from the Bank of Japan? Less than a month ago, it doubled the target range of 10-year bond yields, which provoked turmoil in financial markets. Although Bloomberg experts don't expect BoJ to make any new moves in January, what the heck? The central bank can weaken its control over the debt market rates even more or give it up altogether. And that would be a new blow to the USDJPY bulls.

When you throw £5 trillion into the market, which is equivalent to $39 billion a day, in order to stop the growth of 10-year bond yields above the upper limit of the range of +/-0.5%, which is a record value, sooner or later you can buy up the entire debt market of Japan. The Bank of Japan is already a whale in the pond—it owns half of all bonds in circulation, so it is extremely dangerous to continue in the same spirit.

Japanese 10-year bond yield dynamics

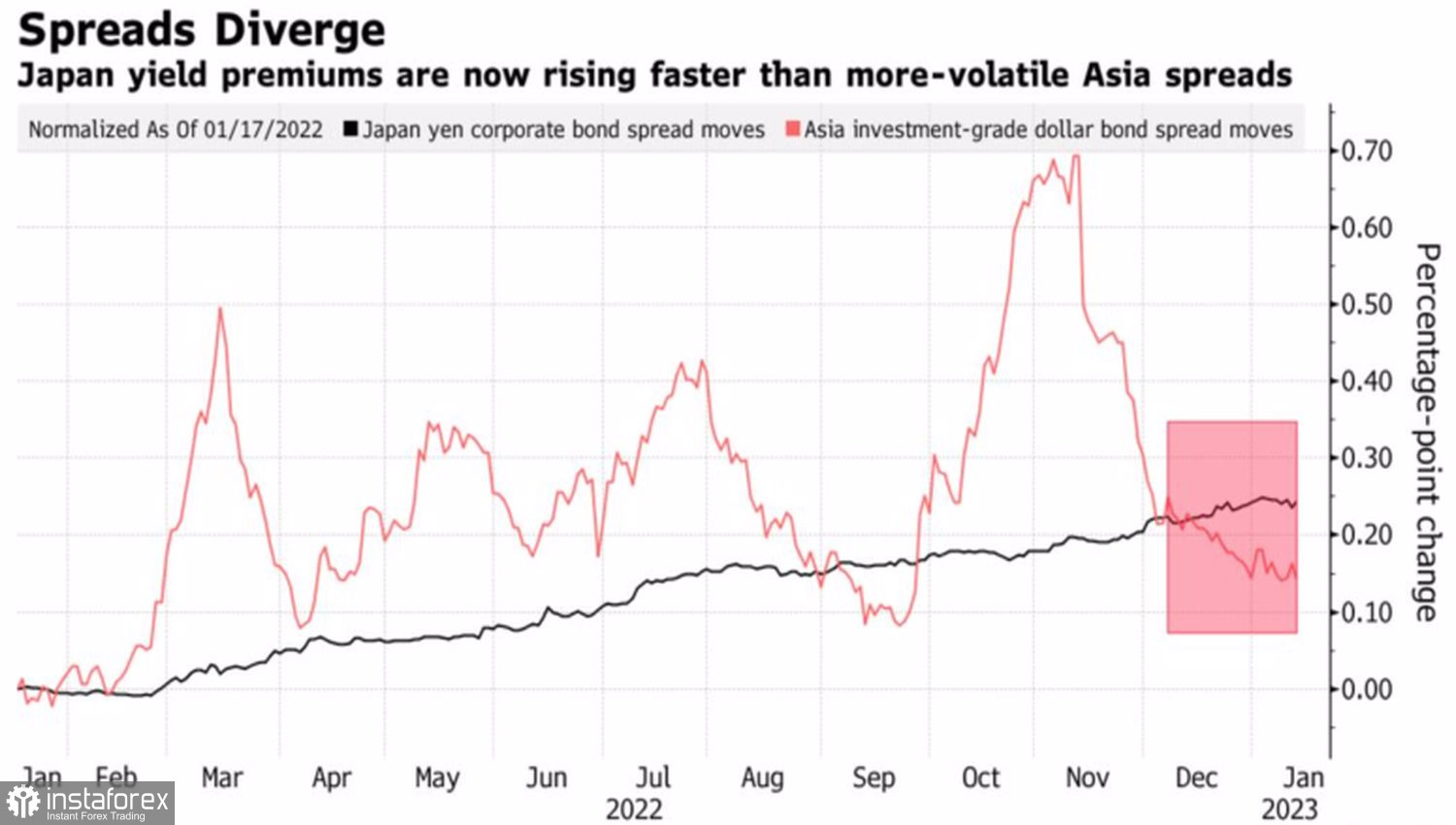

All the more so when problems are simultaneously created in the corporate debt market. As the BoJ defends 10-year rates, investors are switching to selling securities with other maturities. As a result, spreads are widening on both the government debt market and the corporate bond market. According to Bloomberg calculations, the volume of the issue of the latter in January will fall by 70% to £365 billion, which is the lowest since 2006. The lack of borrowed resources has a negative impact on the activities of companies and the functioning of the entire economy.

The Bank of Japan needs to think very carefully whether, in the face of a massive tightening of monetary policy by other regulators of the world, led by the Fed, it is worth maintaining control over Japan's bond yields?

Dynamics of yield spreads for Japanese and Asian corporate bonds

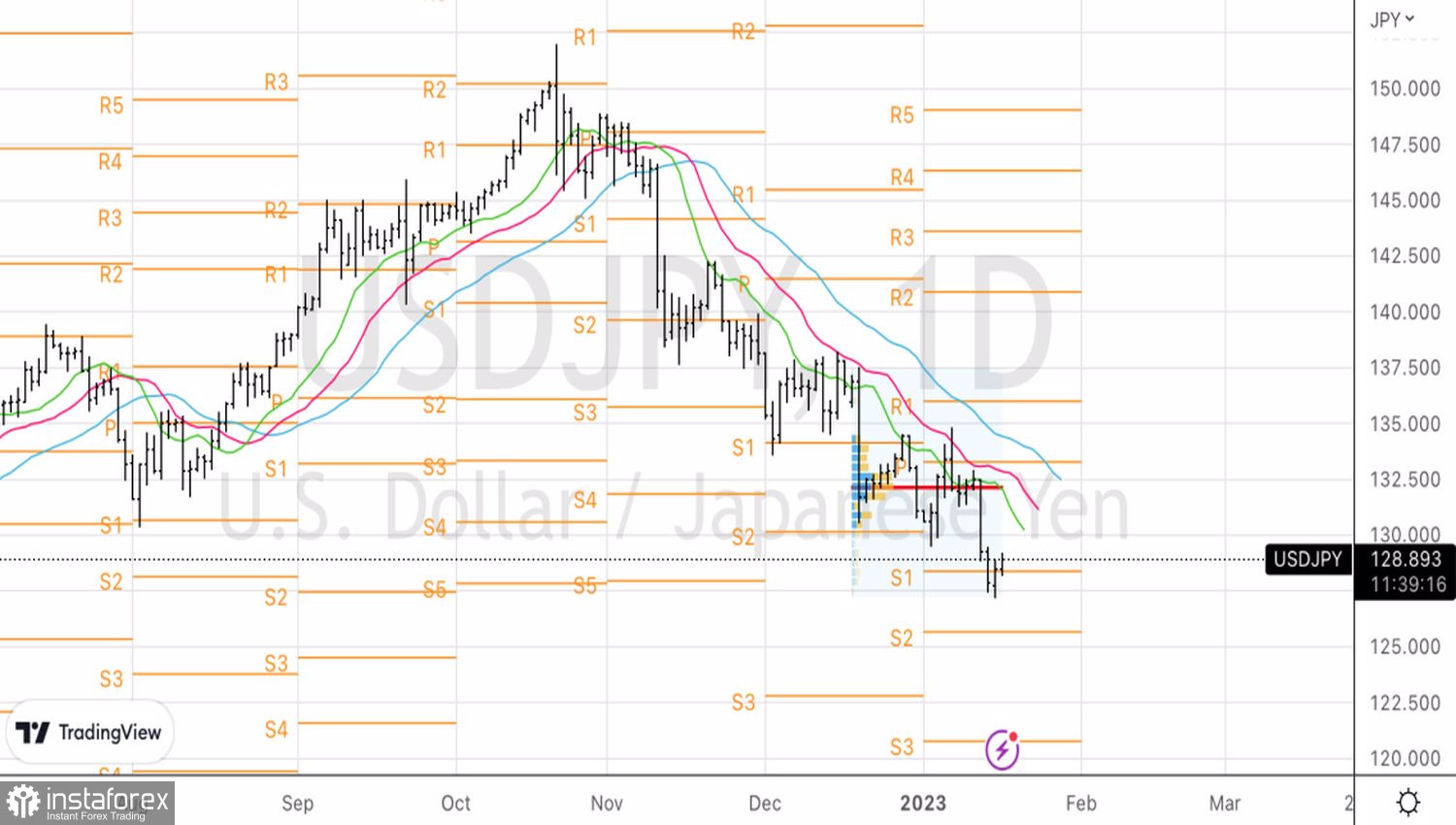

At some point, it will have to give it up, which should be interpreted as another step in the path of monetary restriction. With the Fed ending its cycle and the BoJ just starting it, the potential for a downward movement in USDJPY looks huge. The pair could fall below 120 by 2023.

The pressure on the USD is coming from the falling U.S. debt yields. Perhaps the Fed doesn't like it, as it weakens financial conditions and makes it harder to fight inflation on paper. Nevertheless, inflation expectations remain anchored at 2%, i.e., at the level of the central bank's target, so a further decline in Treasury bond rates looks logical. If investors don't believe they will rise, securities already in circulation become more popular than those yet to be issued.

Technically, there is no reason to doubt the downward trend in USDJPY. The pullbacks in the direction of the pivot points and dynamic resistances in the form of the moving averages at 130.15, 130.7 and 131.9, can be used for selling. The decline will accelerate if bulls cannot keep its quotes above 128.35.