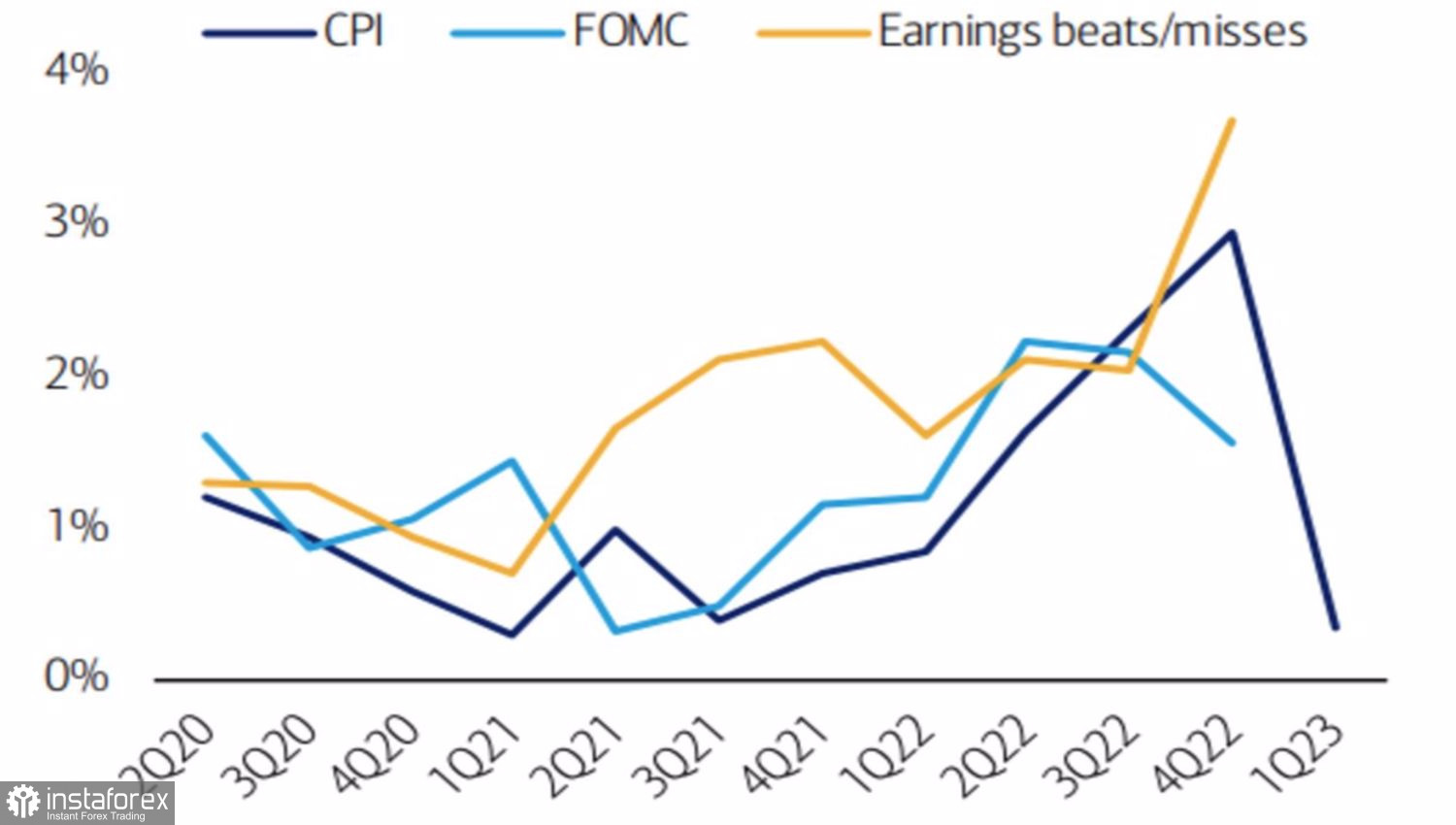

If in 2022, the struggle between the markets and the Fed took center stage on the front pages of the media, in 2023, the situation is in danger of changing. The Fed still claims that it will not cut rates this year, investors are still sure of the opposite, but the reaction of the markets convinces that interest in the topic is declining. U.S. stock indices showed more sensitivity to corporate reporting than to the comments of FOMC officials and the release of data on U.S. inflation. Is macroeconomics no longer in authority?

Market reactions to various events

The markets seem almost 100% confident in a soft landing of the U.S. economy and a rapid slowdown in inflation. The Fed is not happy with a rally in stock indices, falling Treasury bond yields and a weakening U.S. dollar as it improves financial conditions. So the central bank will continue to say that the job is not done and claim that a dovish reversal in 2023 is out of the question. Even if it is convinced otherwise. It is better to make a small mistake than to abandon the monetary restriction early and let inflation rise again.

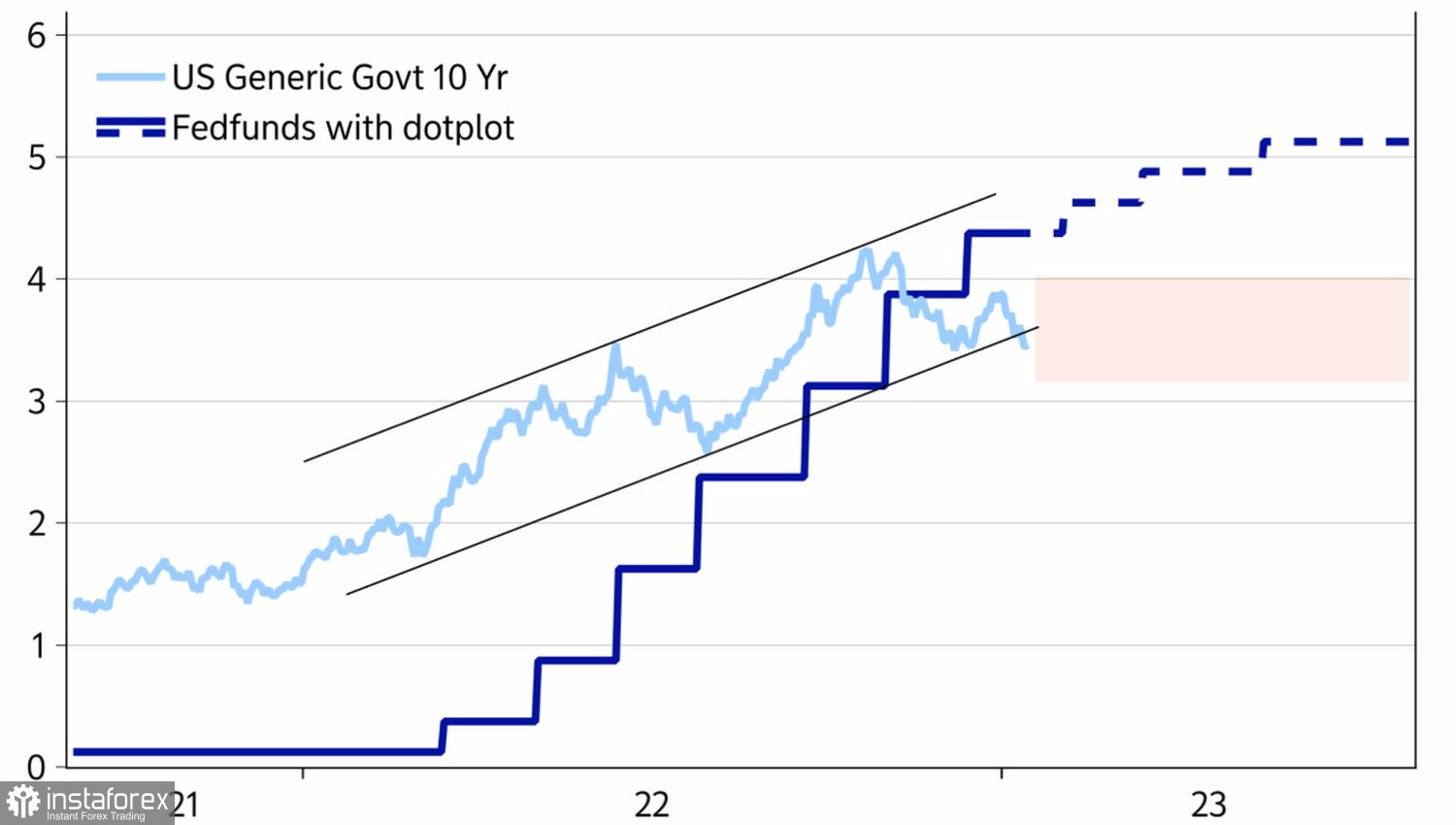

Investors are far more confident about beating the Fed than they were in the second half of 2022, partly because annual inflation expectations are anchored at 2%. In this scenario, the Fed should not be intimidated by easing financial conditions. Moreover, expectations of a dovish turn lead to lower Treasury yields, which weakens the U.S. dollar. When debt rates rise, it is the U.S. dollar that acts as the main safe-haven currency; when it falls, it goes to the yen, franc and gold.

Dynamics of the Fed rate and U.S. bond yields

Meanwhile, thanks to the warm weather and falling gas prices, the state of the eurozone economy continues to improve. European Central Bank Governing Council member Mario Centeno said that the currency bloc's GDP surprises the ECB quarter by quarter. The indicator will actually be better in September-December than expected and will certainly please in the first half of 2023.

There are plenty of reasons. The opening of China will have a positive impact on the export-oriented Eurozone. Its current account position will improve. At the same time, the influx of capital into the securities markets of the eurozone will be positive for the balance of payments. In terms of forward price-to-earnings ratio, the EuroStoxx 600 looks more attractive than the S&P 500. The former has a P/E of 12, and the latter has a P/E of 17. While U.S. stocks are expensive, European ones seem like a tidbit. Especially against the potential run-up of the related Chinese stock indices by 20% in 2023, as forecasted by Goldman Sachs.

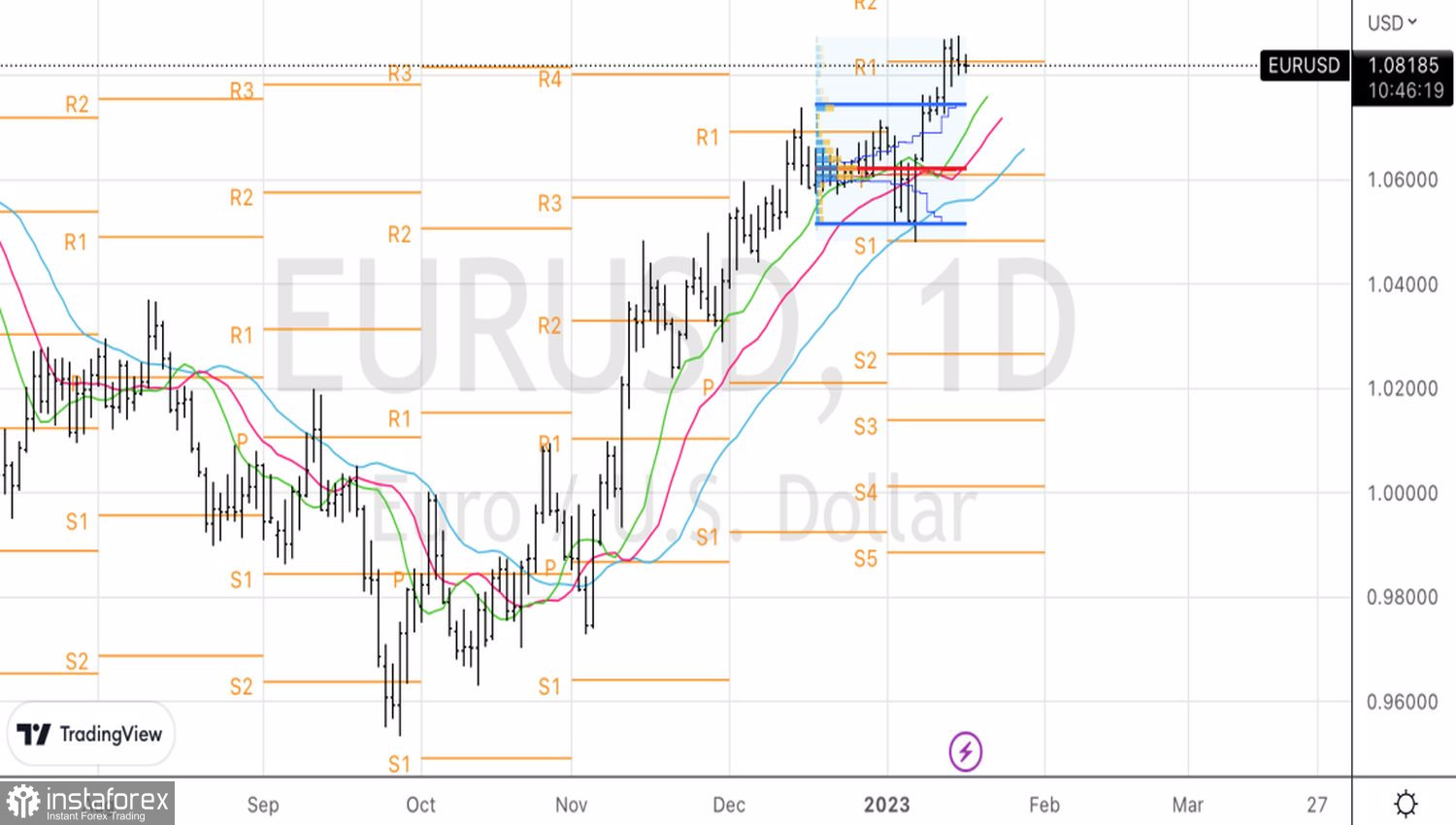

Technically, on the daily chart, the EURUSD pair decided to pause, which is quite logical after the rapid growth in the week to January 13. Failure to cling to the 1.083 pivot point will increase the risks of a pullback towards 1.075. On the contrary, bulls' victory will create prerequisites for the continuation of the rally to 1.095 and 1.104.