Despite the lack of any compelling explanations, the GBP/USD currency pair once again displayed an upward trend on Tuesday. In the UK, data on unemployment and earnings were released early in the morning. These numbers cannot be characterized as "strong" or "failed," but it is very tough to call them either. Simply put, the unemployment rate remained at 3.7% in November, while earnings climbed by 6.4%, which was basically in line with expectations. Remember that the UK has been experiencing a severe cost of living problem for several months. The country's population's salaries are devalued by the fast-falling value of the pound in 2022 and a strong rise in inflation. Naturally, the least socially protected groups experience the most severe pound devaluation. Simply described as low-paid, everyday laborers. They can tell that the value of the pound has decreased by 10%. 10% inflation is a lot to them. Therefore, it is difficult to describe the 6.4% growth in earnings during a time of inflation that is higher than 10%. However, traders hurried to repurchase the pound after discovering a teaspoon of honey in a barrel of tar.

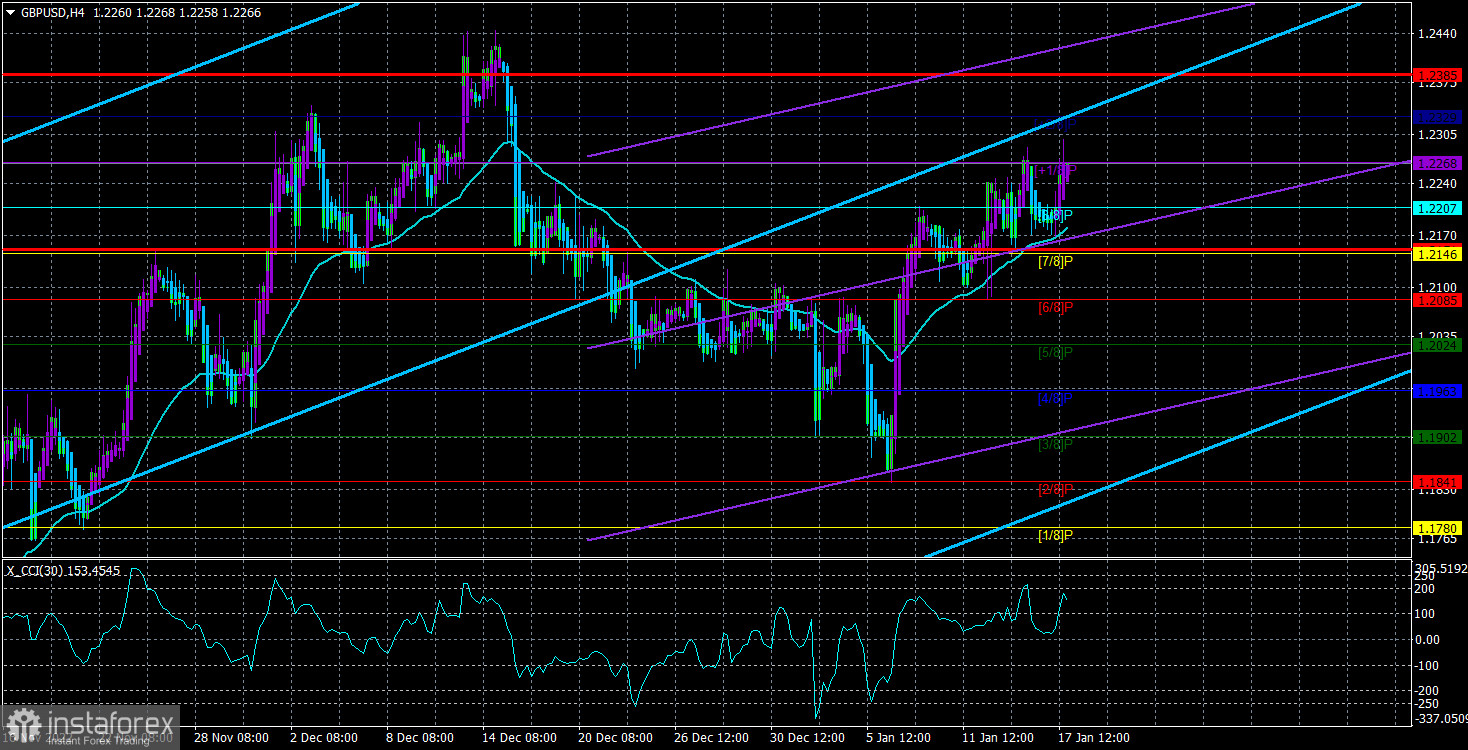

They are completely correct from a technical standpoint because there isn't even one sell signal at the moment. The pair is still above the moving average line on the 4-hour TF, and both linear regression channels point upward. The price is above all of the Ichimoku indicator's lines on the 24-hour TF. Therefore, anything is possible based on fundamental research, but the pound will gain in value if the market buys more of it. Since many currently anticipate that the Bank of England will reduce the "monetary pressure" on the economy, the pound can, of course, halt this process at any point. Simply put, the BA may again pause the pace of tightening monetary policy in February to prevent a serious recession. If so, one of the strongest pillars of the pound's support may be lost.

The Bank of England's governor is overjoyed with confidence.

On Tuesday, Andrew Bailey testified before the House of Commons Treasury Committee. It had been a while since he had spoken in public because the head of BA rarely does so. He expressed his optimism for a significant drop in inflation in 2023 as a result of reducing energy prices in his address. He thinks that the military confrontation between Ukraine and Russia in 2022 caused the sharp rise in energy prices, but gas prices have dropped by almost four times since then, suggesting that inflation can be slowed down even without the regulator's help. Additionally, Mr. Bailey informed the Committee that the financial markets had calmed following the Liz Truss board issue, which saw a dramatic devaluation of the pound and an increase in government bond yields. The BA chairman added, "However, it will take some time to convince people that the worst is over."

The markets continue to anticipate a further increase in rates in early February despite Mr. Bailey's silence on the subject. Since the anticipation of lower inflation naturally entails that the regulator may slow down the pace of tightening monetary policy more, we think Bailey's comments can be viewed as a "dovish" element. And give it a total break with the possibility of several months. The pound is still increasing, though. The result is the following image: The pound is growing regardless of how quickly or slowly rates are rising; rates may even cease rising altogether. Therefore, we continue to think that the more crucial element is the slowing of the US rate rise. Based on this reason, the British pound may continue to increase for some time, but its prospects may suffer if the rate is lowered to 0.25%. In any case, you shouldn't anticipate a significant decline in the value of the pound until the price is locked below the moving average. When that occurs, it will be possible to guess whether this is just a little reversal or the start of a new, lengthy decline in the value of the pound.

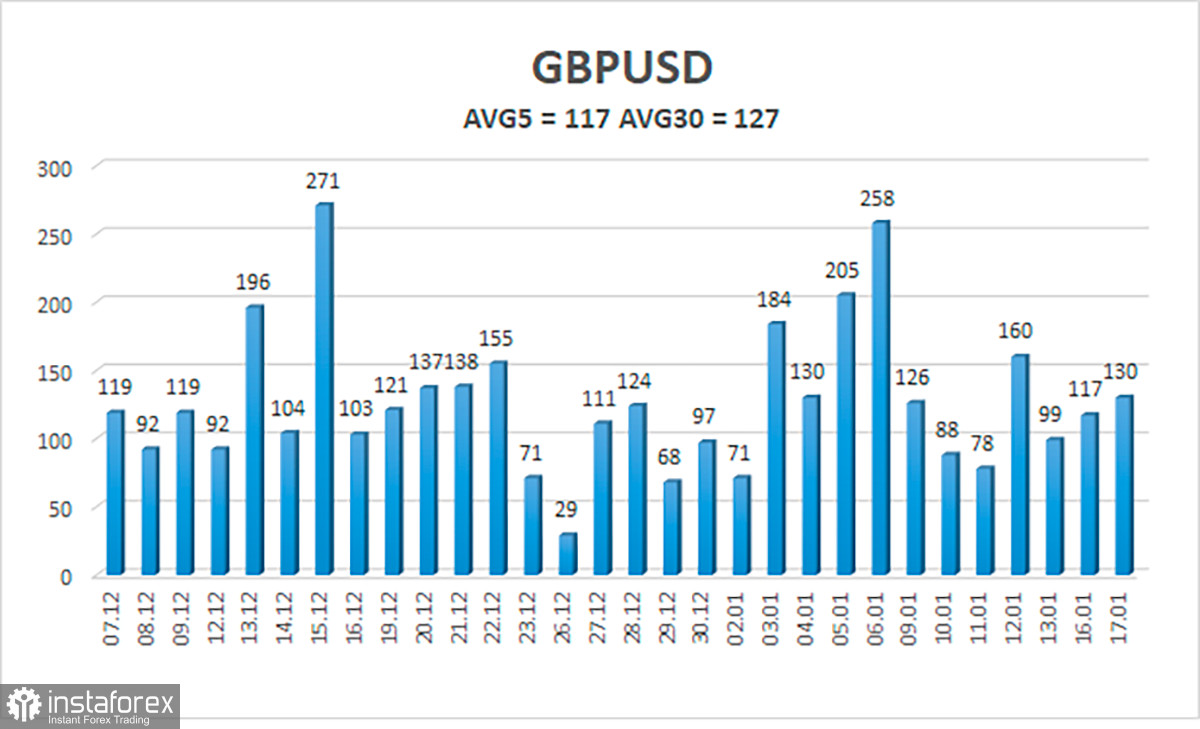

Over the previous five trading days, the GBP/USD pair has averaged 117 points of volatility. This figure is "high" for the dollar/pound exchange rate. Therefore, on January 18, we anticipate movement that is contained inside the channel and is constrained by the levels of 1.2151 and 1.2385. A new bout of corrective action will begin when the Heiken Ashi indicator reverses direction and moves back down.

Nearest levels of support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest levels of resistance

R1 – 1.2268

R2 – 1.2329

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is attempting to advance further. Therefore, until the Heiken Ashi indicator swings down, it is still possible to hold long positions with goals of 1.2329 and 1.2385. If the price is set below the moving average, short trades can be opened with goals of 1.2085 and 1.2024.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.